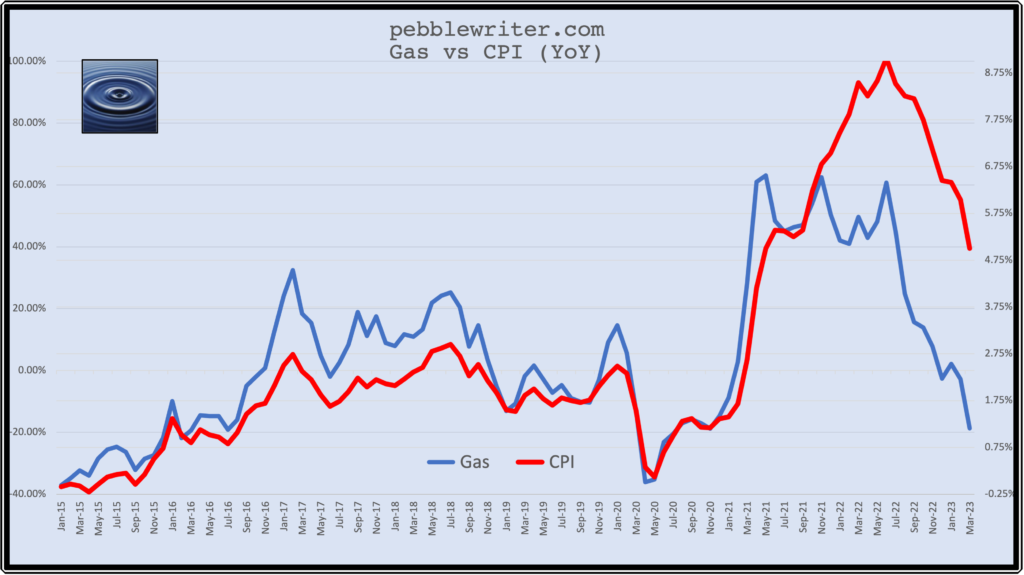

For the first time in over two years, core CPI topped headline. Core, which ignores food and gas prices, climbed 0.4% MoM and 5.6% YoY, while headline came in at 0.1% MoM and 5.0% YoY.

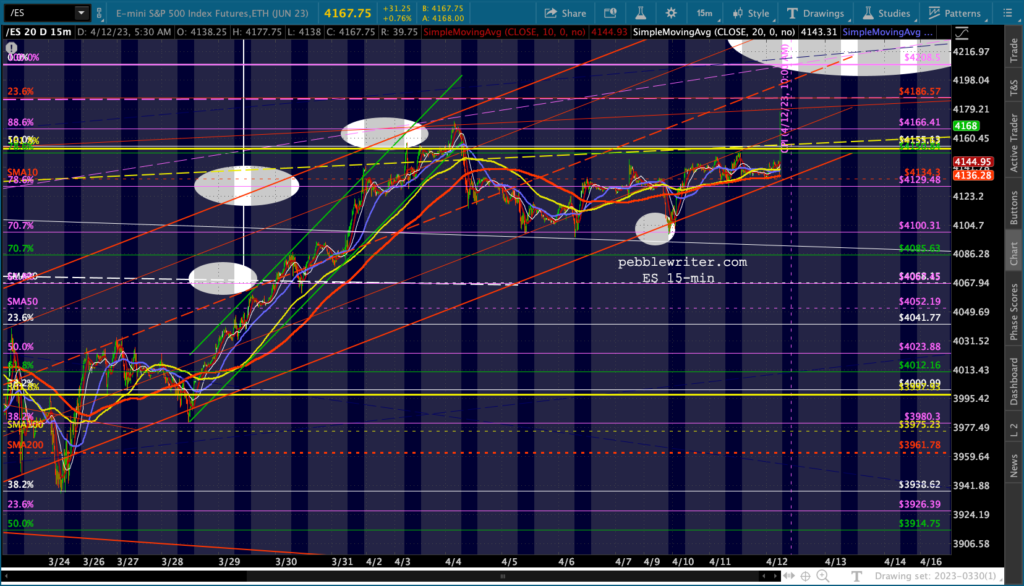

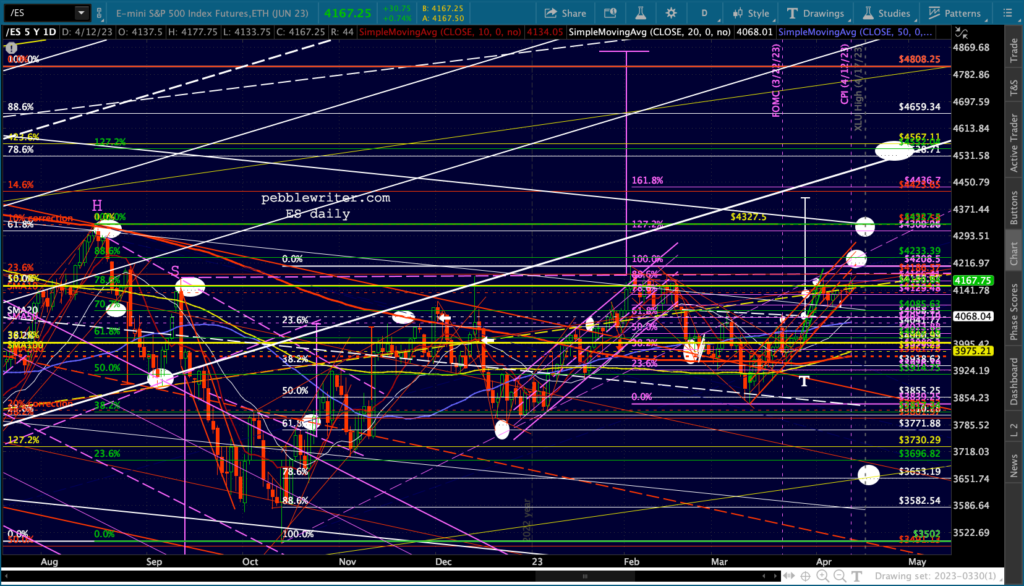

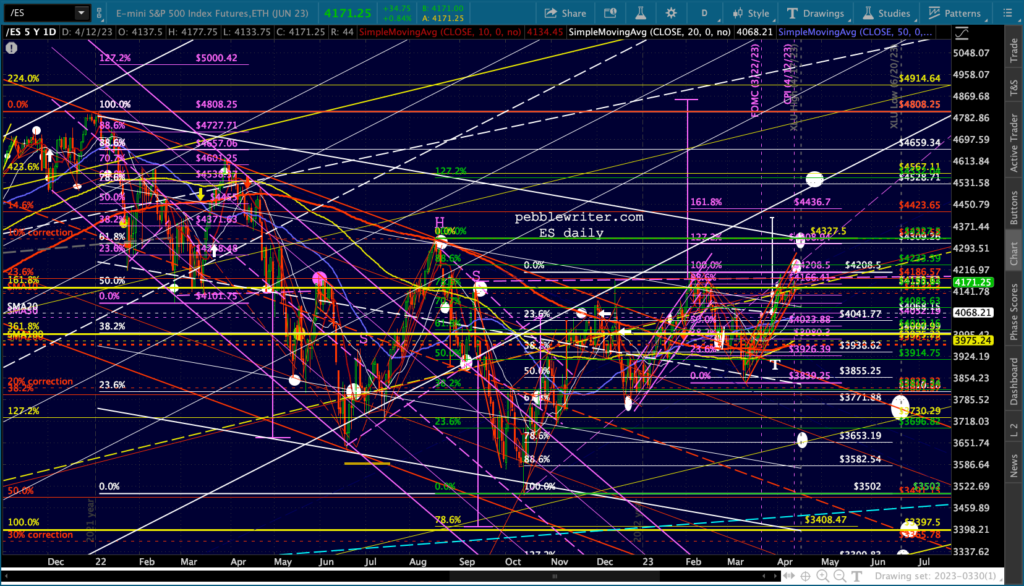

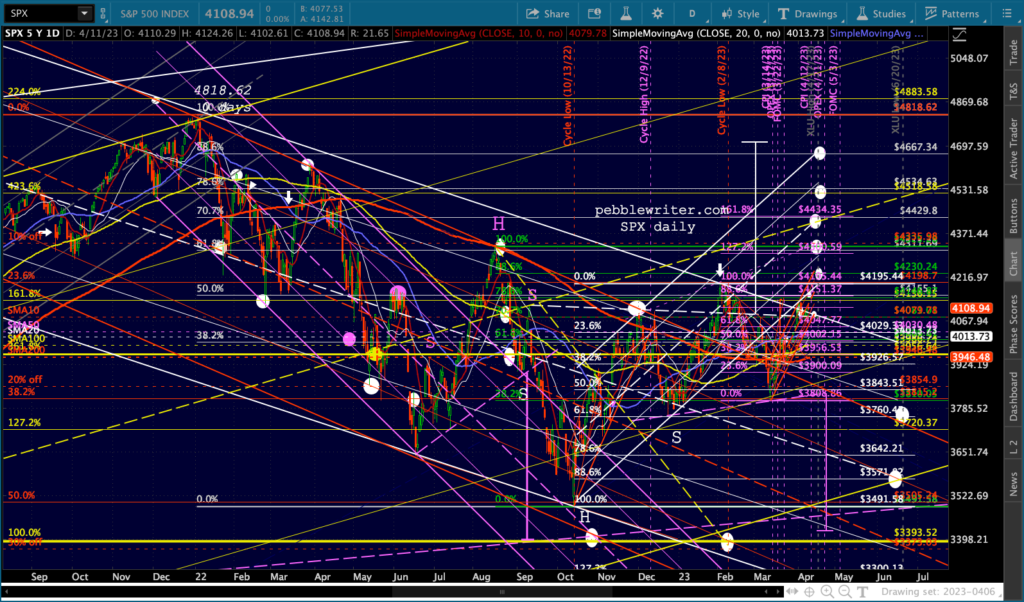

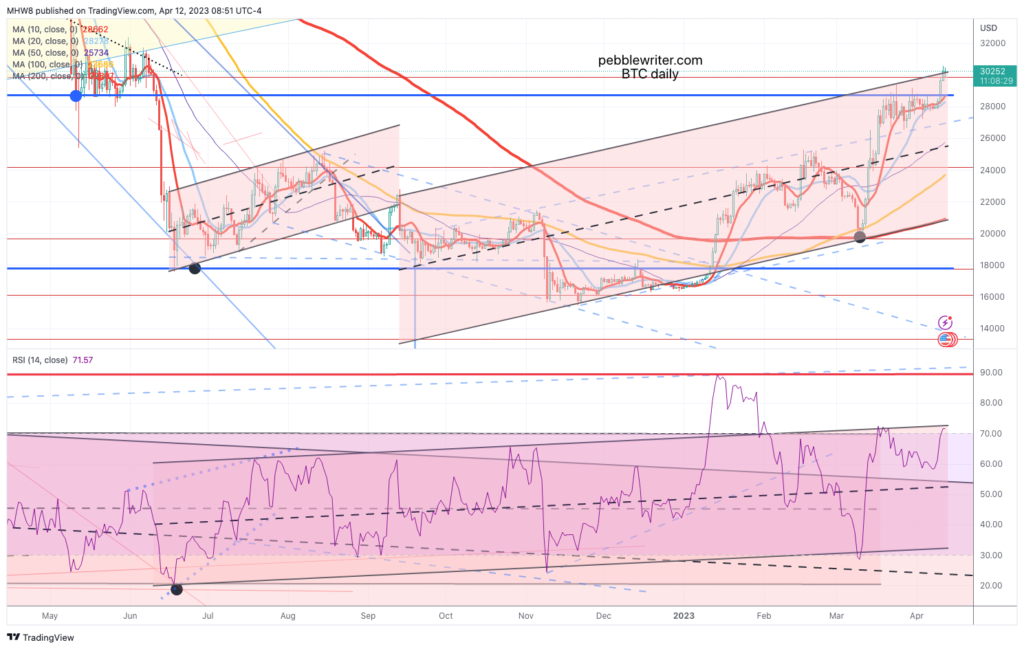

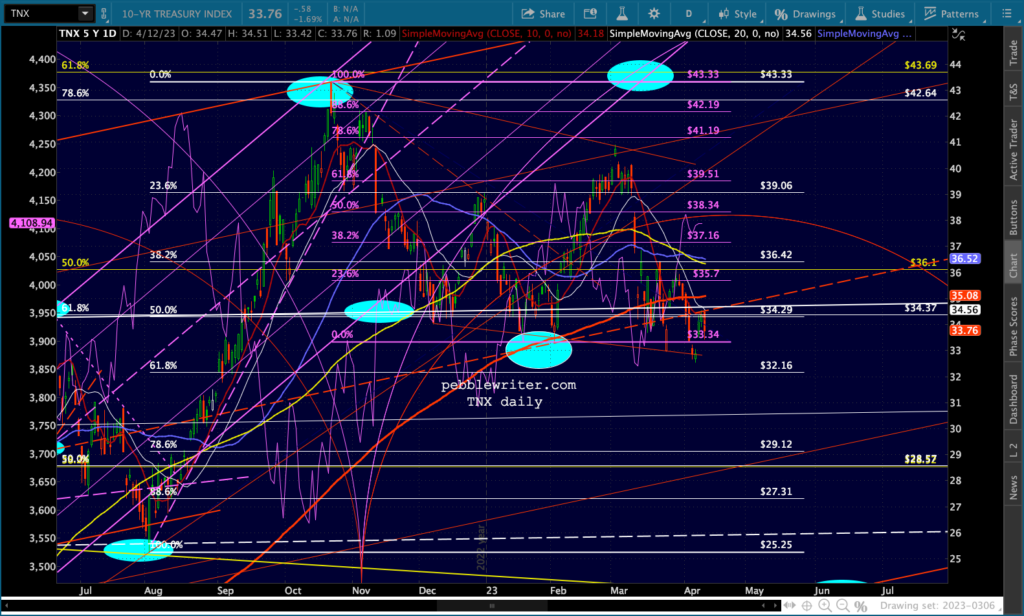

Not surprisingly, futures jumped at the news that headline CPI had dropped. But, our charts still show an important risk just ahead.

Not surprisingly, futures jumped at the news that headline CPI had dropped. But, our charts still show an important risk just ahead.

continued for members…

The IH&S we’ve been watching in ES would complete at 4186 and signal new all-time highs. I remain skeptical that TPTB would play that card just yet.

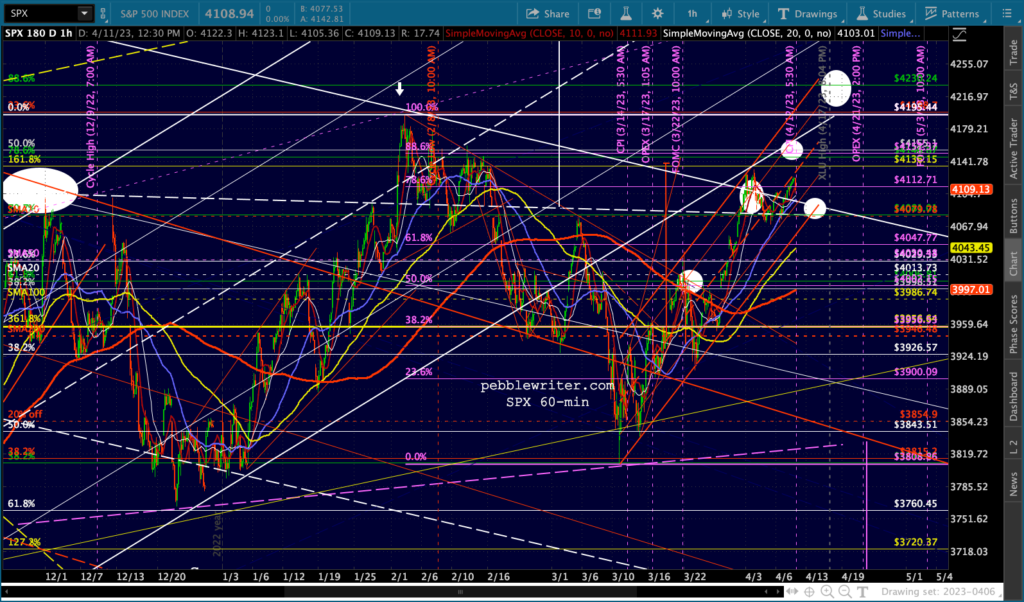

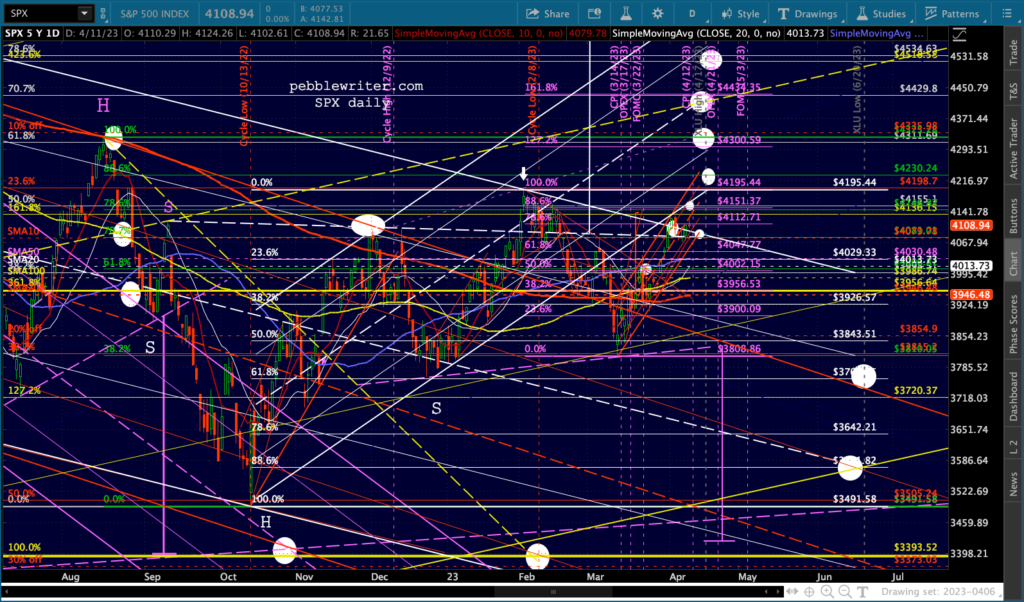

The SPX itself has already completed its IH&S, though it is a rather sloppy affair with the neckline already breached and lost back in Feb.

The SPX itself has already completed its IH&S, though it is a rather sloppy affair with the neckline already breached and lost back in Feb.

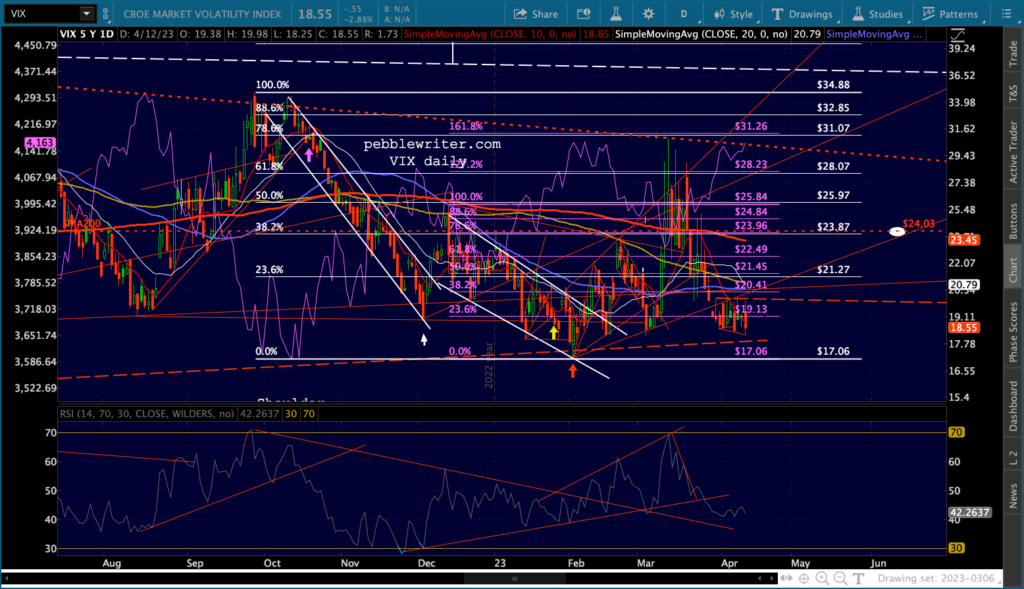

Should they decide to, VIX can break below a key TL of support at about 17.85. Otherwise, stocks should run out of steam here.

Should they decide to, VIX can break below a key TL of support at about 17.85. Otherwise, stocks should run out of steam here.

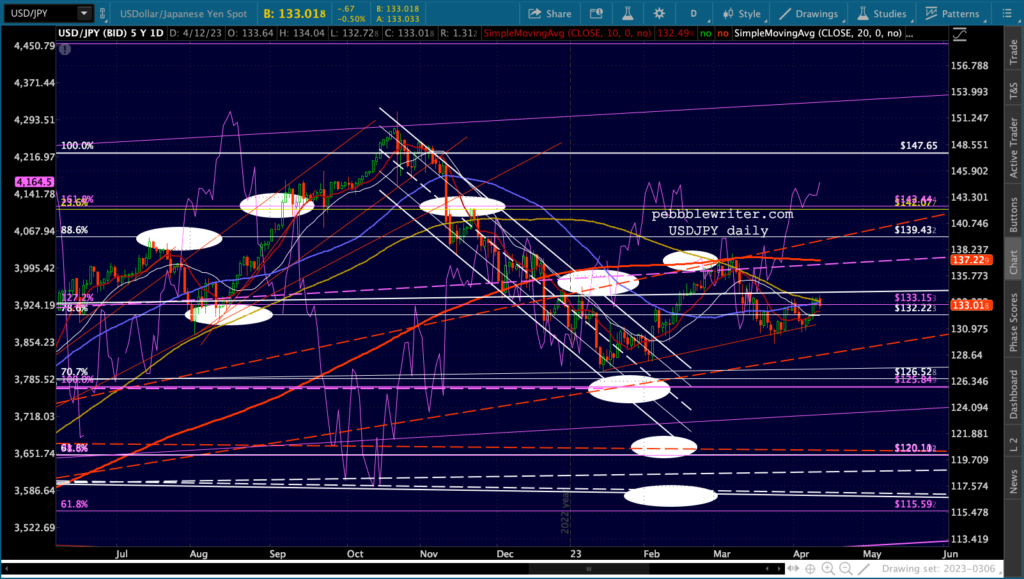

Currencies are generally supportive of equities this morning, but we’d have to see EURUSD make new highs and DXY break down before it means much.

Currencies are generally supportive of equities this morning, but we’d have to see EURUSD make new highs and DXY break down before it means much.

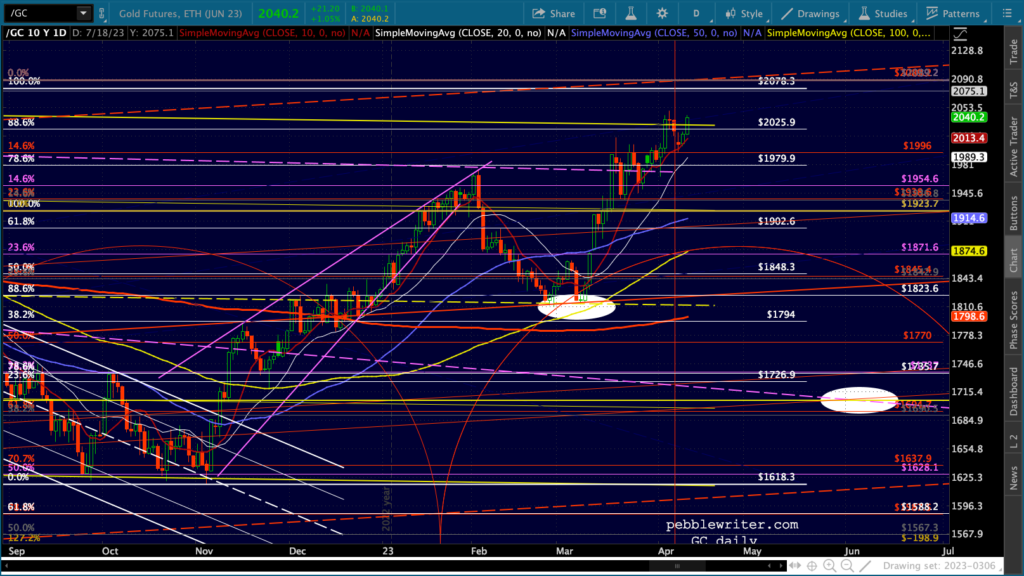

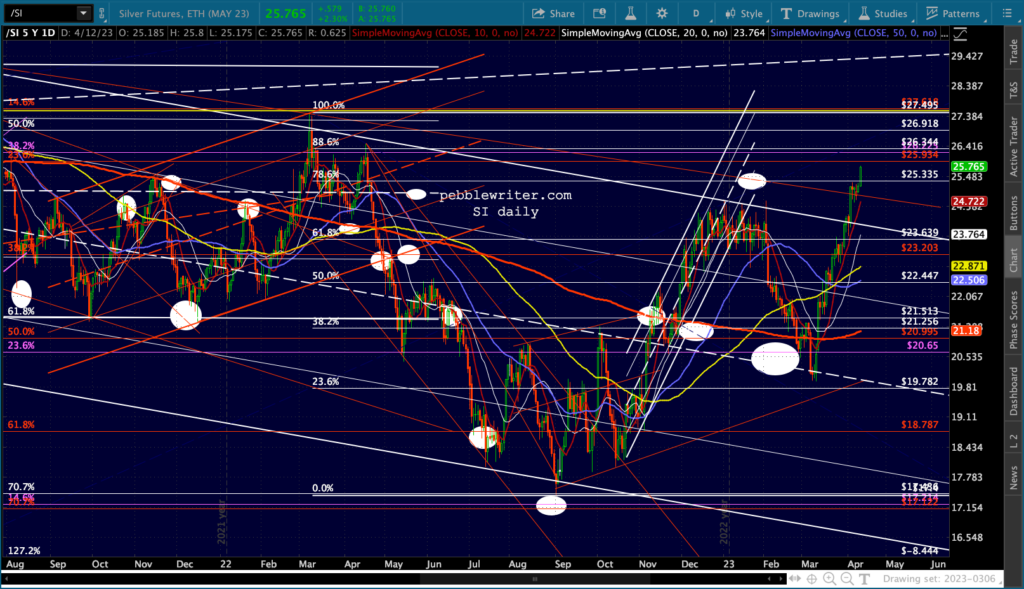

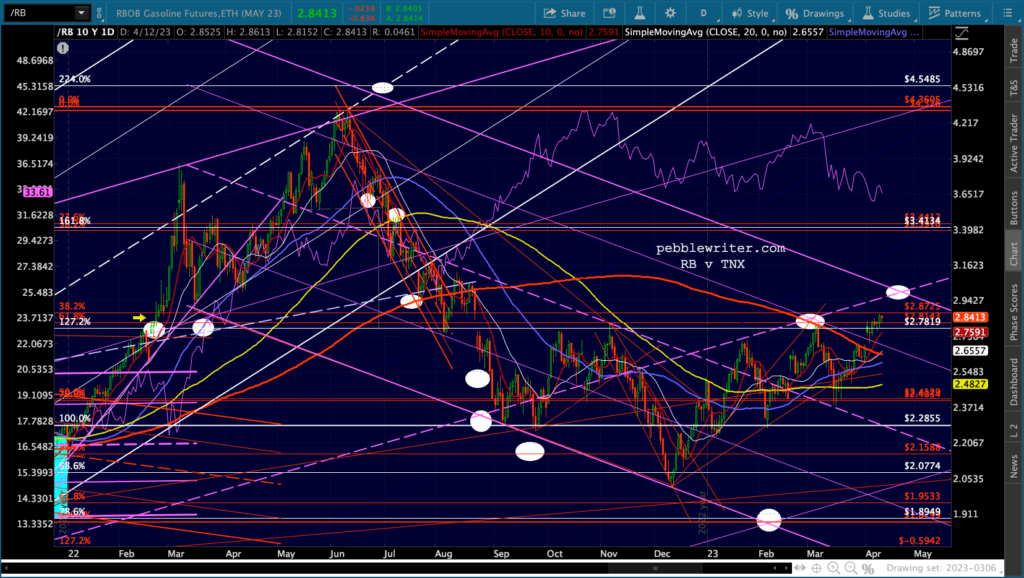

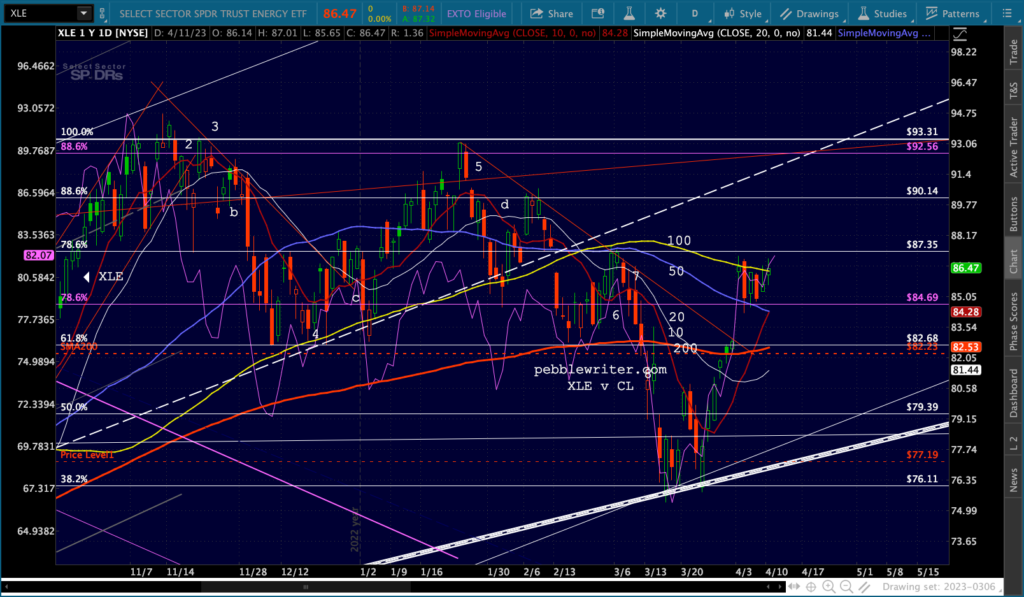

CL and RB still have a little room to run, but that would be counterproductive at this point.

CL and RB still have a little room to run, but that would be counterproductive at this point.

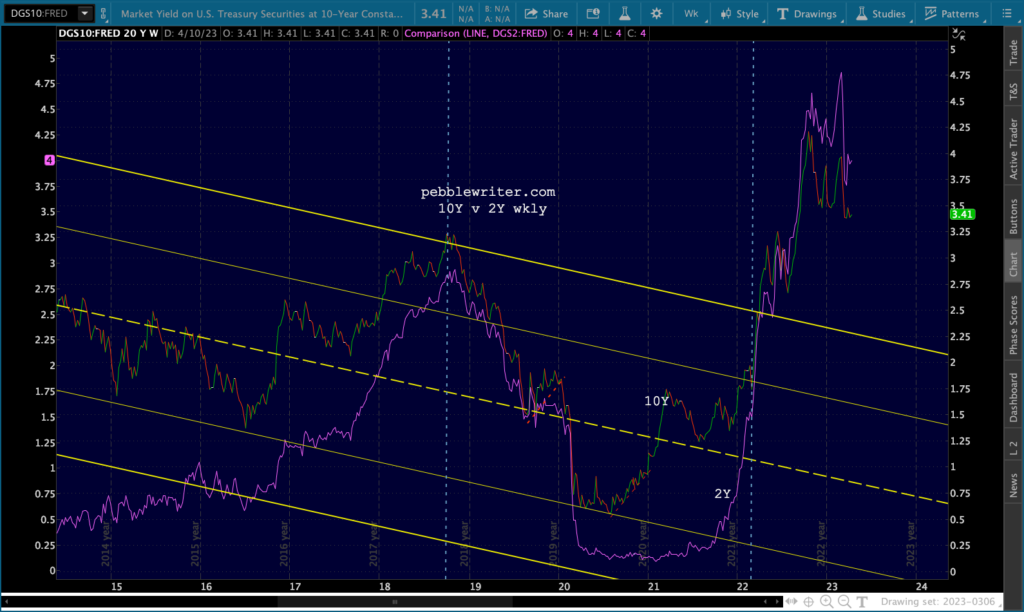

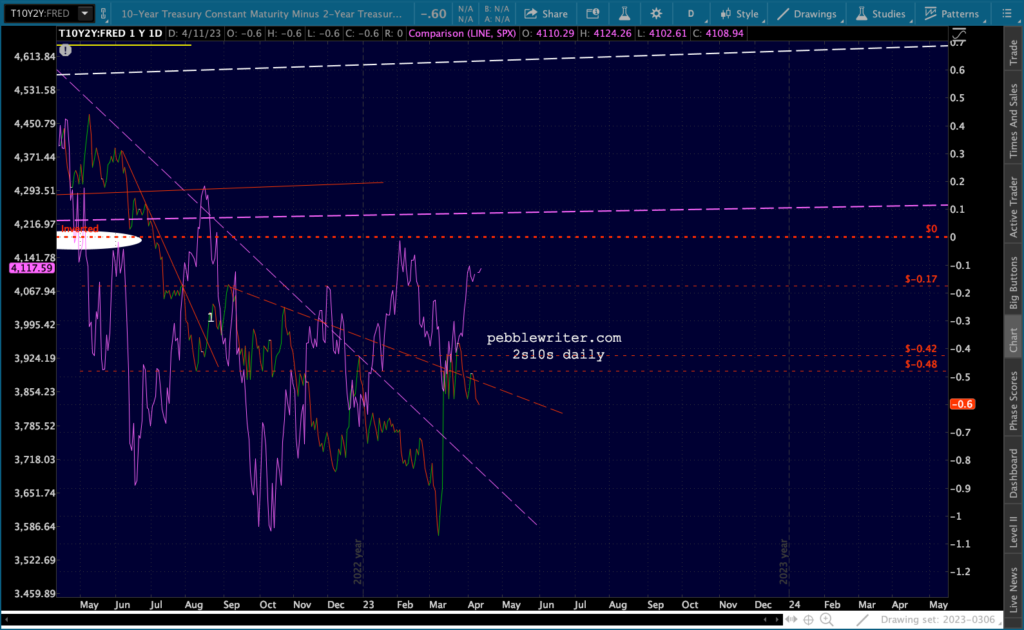

Remember, if the 2Y plunges faster than the 10Y, equities will have a very tough time of it.

Remember, if the 2Y plunges faster than the 10Y, equities will have a very tough time of it.