UPDATE: 10:30 AM

Last night’s call on the dollar was timely. Check out the candle on the daily chart — the completion of both a Bat and Butterfly pattern.

EURUSD also seems to have put in a bottom, though as mentioned earlier it’s going to take ein Akt des Bundestages (literally) to save the euro now.

EURUSD also seems to have put in a bottom, though as mentioned earlier it’s going to take ein Akt des Bundestages (literally) to save the euro now.

ORIGINAL POST: 2:00 AM

Back on April 30, I held my nose and plunged head-long into the dollar, also shorting the euro. I’m pretty sure I invoked that age-old expression of confidence: “here goes nothing.” Hopefully, lots of pebblewriter members went along for the ride.

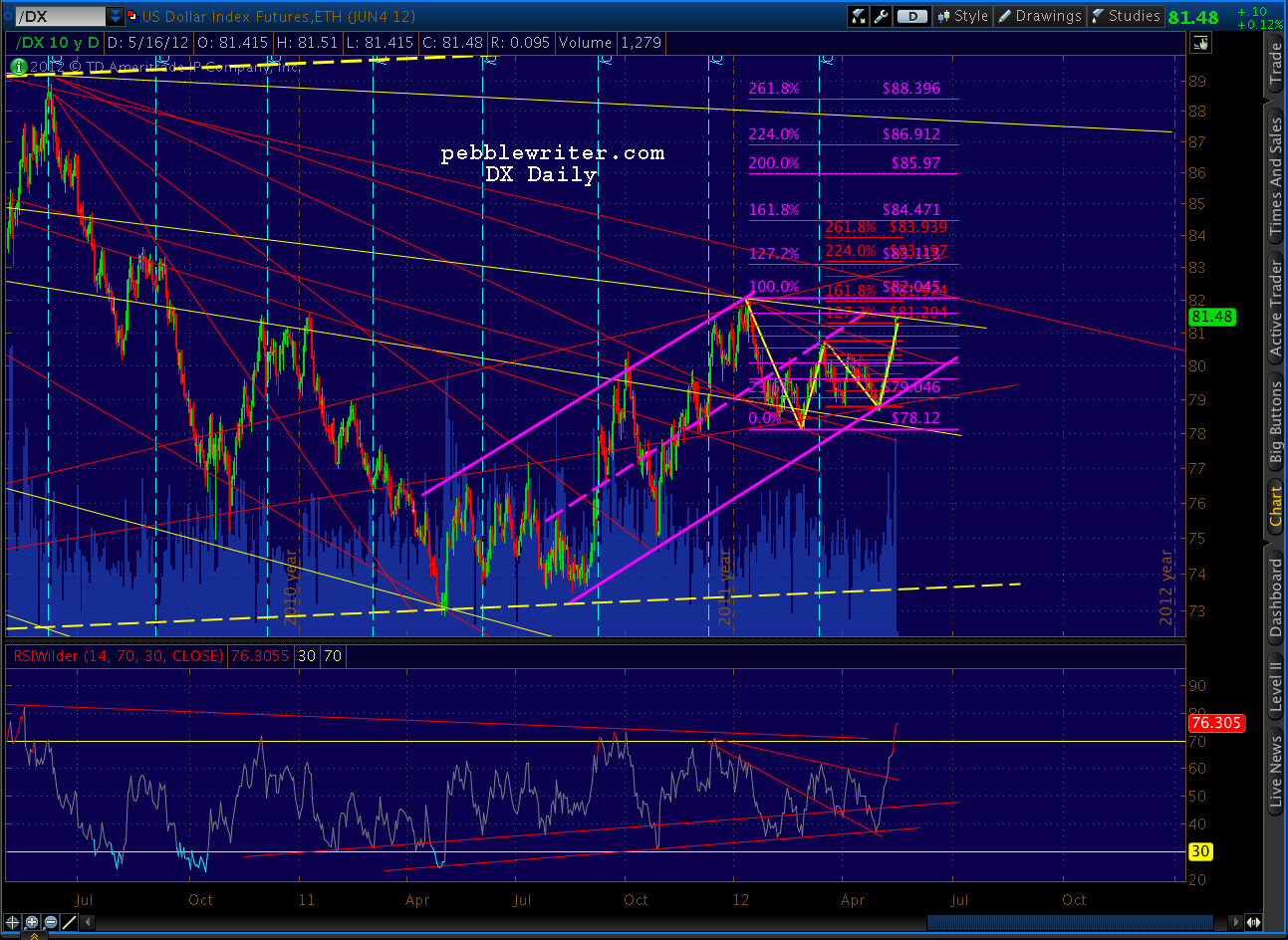

In that night’s post [see: Bet Your Bottom Dollar] I put up the following chart:

I immediately regretted sketching out the forecast in such detail; and, in fact, I caught a lot of guff from a few readers for so recklessly calling the bottom (you know who you are, wretched givers of guff!)

I immediately regretted sketching out the forecast in such detail; and, in fact, I caught a lot of guff from a few readers for so recklessly calling the bottom (you know who you are, wretched givers of guff!)

I didn’t look at the chart for a few days, but knew things were going my way. I just didn’t realize how well things were going my way… Here’s the same exact chart two weeks later.

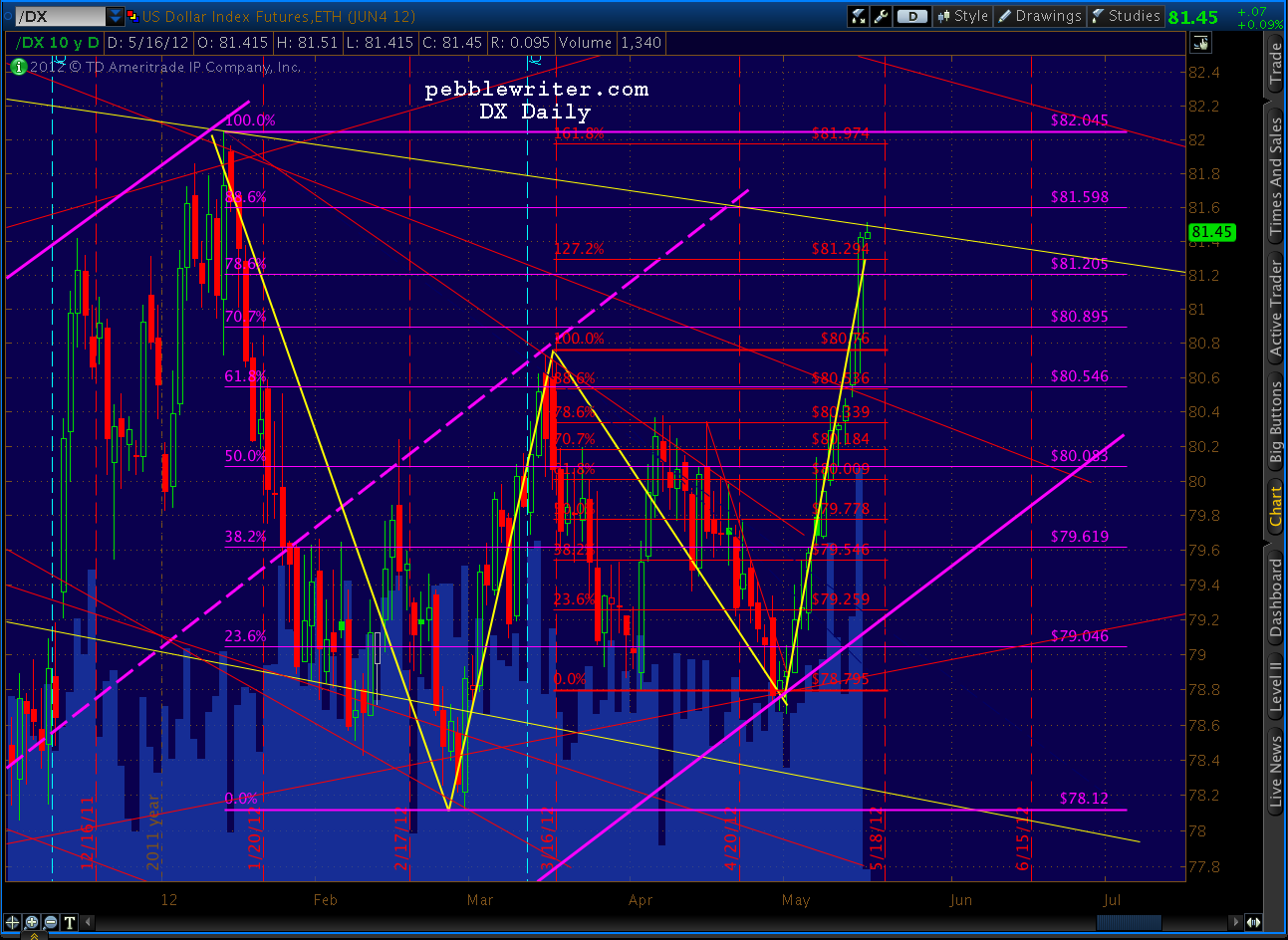

It deserves a close up…if only to show how spooky a forecast it turned out to be.

It deserves a close up…if only to show how spooky a forecast it turned out to be.

Throwing caution to the wind, I also posted the EURUSD chart below and wrote:

Throwing caution to the wind, I also posted the EURUSD chart below and wrote:

Meanwhile, the EURUSD shows signs of finally breaking down. Both the pair and the RSI action show a rising wedge that’s bumping up against a well-established channel.

Note Point D — the completion of a Bat pattern — sitting down there all by its lonesome.

Yikes! Harmonics don’t always work as well as they have this past month. But, when they do, man is it fun!

Yikes! Harmonics don’t always work as well as they have this past month. But, when they do, man is it fun!

************

As far as the road ahead, EURUSD crossed a incredibly important fan line today. It’s either fallen off a cliff, or it’s doing that roadrunner-running-in-mid-air thing. On the other hand, it has completed a Bat pattern (as has DX) that should mean a reversal. The next 24 hours are critical.

If I had to guess, the RSI leads me to believe we’re going to see a big bounce. But, I’m taking my profits and sitting this one out. If it plunges below the fan line, there’s plenty more downside where that came from.

If I had to guess, the RSI leads me to believe we’re going to see a big bounce. But, I’m taking my profits and sitting this one out. If it plunges below the fan line, there’s plenty more downside where that came from.

If it doesn’t, it’ll be because Merkel and Hollande are caught on video, breathlessly moaning “long live the troika” while mending post-election relations.

Seriously, though, a stick save would almost certainly entail a commitment to all things Greek, Portugese, Spanish, Italian, etc. and more LTRO — lots and lots more LTRO.

Stay tuned.

*************

For the last several weeks I’ve been double-posting pebblewriter.com stuff on the original blog and holding this open for former followers. This website has been up for nearly a month now, and it’s time to start winding the other one down. [why?]

If this blog is helpful to you, jump on the introductory prices while they last. I’ve extended the 10% off discount for all new members through this Friday, the 18th.

Agreee 100% Pebble on the currency stuff–and yes, I’ve been in EUO and short the markets. BUT, I’ve taken most of the profits off the table on EUO and have a small runner position (1/4 original) remaining waiting for a reversal to take me out…I’ll tighten up the stops on that. It has been a nice trade. Thanks for all your insights.

Nibbled into a long position on the SPX today based upon the BB violation, extremely low slow stochs readings on the daily, daily and shorter time frames of the RSI at, below, or near 30, plus Euro and DX completing these patterns/hitting resistance.

Been buying the bottom and selling the top of this 10 point channel we’ve been sliding down. Definitely favoring the short side, but taking great scalps at the bottom of the channel and selling at the top. Let’s see if the DX reverses in here and the SPX has a bigger bounce than the 10 pointers I’ve been enjoying.

I like that strategy! SPX getting a nice bounce this morning, but my gut is it’s just relieving the oversold for a last push down. Maybe stocks and currency out of sync for a day or two? That’s a heck of a candle on the daily DX.

Thanks. Got stopped out on the SSO try. bought at $52.45 and stopped at $52.65. A swing and a foul tip. No harm, no foul.

I’m watching an IH&S on the SPX right now. right shoulder forming possibly. Looking for an entry again, but I’ll be cautious since the RSI, etc… aren’t in oversold conditions and the likely direction is down from here. I just hate to reshort this low on the chart.

I’d be cautious adding longs unless we’re able to break out of the channel on the 60-min chart — at the very least.