Will the sixth try be the charm? SPX has futzed around in our target area for six sessions in a row. Today, we should finally get some satisfaction.

The dollar has broken out of and is back-testing the yellow triangle. Lots of juicy Fib levels ahead, starting with the cluster at 80.758-80.883.

RSI appears poised to break out of the red channel and explore the upper half of the white.

RSI appears poised to break out of the red channel and explore the upper half of the white.

While the EURUSD looks like it’s ready to tumble. The test I’ll be watching closest is the intersection of channels around 1.3253. But, merely popping back down below those falling white channel lines would be a great start.

While the EURUSD looks like it’s ready to tumble. The test I’ll be watching closest is the intersection of channels around 1.3253. But, merely popping back down below those falling white channel lines would be a great start.

If I’m right, the falling white and/or yellow channels will take it from here. Note the negative divergence represented by the last two spikes up to the top of the yellow channel. The flatish red channel dates back to the fall of 2008, and every sustained push below its midline — currently around 50.51 — has been accompanied by a nice sell-off in EURUSD.

If I’m right, the falling white and/or yellow channels will take it from here. Note the negative divergence represented by the last two spikes up to the top of the yellow channel. The flatish red channel dates back to the fall of 2008, and every sustained push below its midline — currently around 50.51 — has been accompanied by a nice sell-off in EURUSD.

Japanese finance minister Taro Aso is frantically searching for the “off switch” on the yen-cinerator. In a chat with a legislative budget committee, he admitted: “it seems that the government’s policies have fueled expectations and the yen weakened more than we intended in the move to around 90 from 78.”

Japanese finance minister Taro Aso is frantically searching for the “off switch” on the yen-cinerator. In a chat with a legislative budget committee, he admitted: “it seems that the government’s policies have fueled expectations and the yen weakened more than we intended in the move to around 90 from 78.”

The 7 sessions in (and slightly above) our target area are looking tenuous. A dip to the bottom of the white channel could take the pair back to 90.82.

And a fall from the white channel could easily see a back-test of the midline from the purple channel dating back to 2000.

And a fall from the white channel could easily see a back-test of the midline from the purple channel dating back to 2000.

continued for members…

I’m prepared to close out my longs at 1518 and switch sides — though it’s quite possible we’ll squeak a little higher in the next hour. Trade coming up.

UPDATE: 10:05 AM

That’s close enough to 1518 for me, though 1518.57 is just above. Closed out my longs at 1517.93 and will load up the shorts.

UPDATE: 1:00 PM

SPX inched a little higher after I shorted, touching 1518.31. I would take an intra-day long position on any strength above the actual Fib at 1518.57, with 1518 as the stop. In other words, I intend to defend that Fib if/when it’s broken — as such levels sometimes are (for a little bit.)

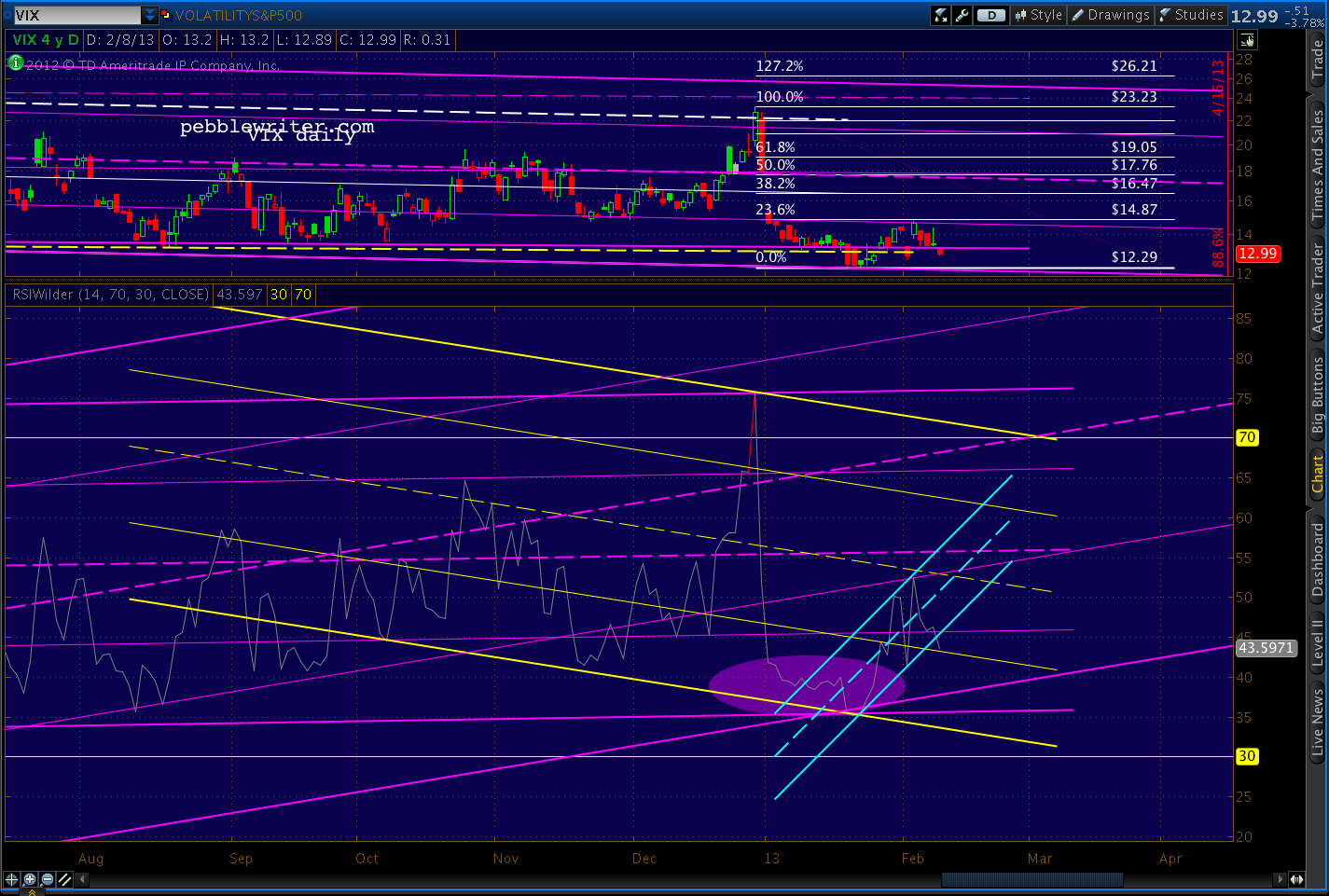

VIX finally seems like it’s turning a corner. Not that I ever recommend options for anyone (one of the fastest ways to blow up your portfolio), but I picked up some March 14 calls at 1.77 just for grins.

Daily RSI looks like a back-test of the yellow channel line, but there’s also a troubling dip below the purple channel line to worry about — and, I am prone to worrying about such things.

Daily RSI looks like a back-test of the yellow channel line, but there’s also a troubling dip below the purple channel line to worry about — and, I am prone to worrying about such things.

But, a quick glance at the 60-min RSI shows some really great positive divergence with a series of higher lows that are accelerating off the Jan 3 bottom.

But, a quick glance at the 60-min RSI shows some really great positive divergence with a series of higher lows that are accelerating off the Jan 3 bottom.

Comments

2 responses to “Satisfaction”

Hello PW, a few days ago you said you were working on 2 analogs. Can you provide an update? I am wondering about the big picture now. Thanks!

Bought some March $1500 puts for 15.85, 16.00 & 16.20 towards the close of the index options session.