The market bounced back a little into the close yesterday, and recovered further overnight. ES retraced a Fibonacci .886 of the initial plunge, and is hanging in the small channel established over the past week.

We shorted SPX at 1635 yesterday, but weren’t sure whether or not the upside was completely done. This morning, there’s still some question.

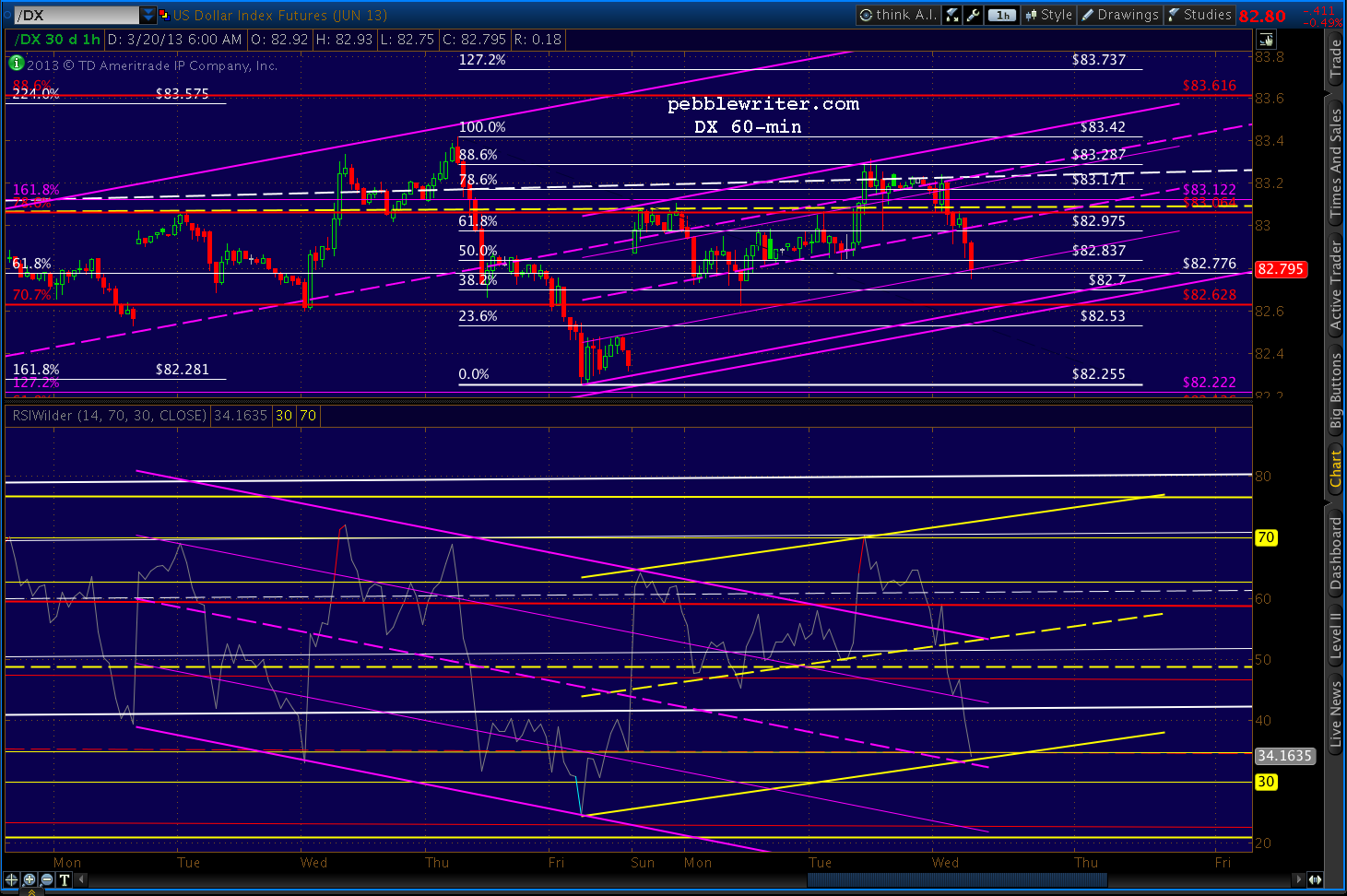

The dollar, which we remarked yesterday morning looked “ready to rumble” did just that — completing its largest move in the last 16 months. It retreated just a bit off the .786 before zooming up to tag our .886 target at the purple channel midline. How it handles this price level will determine whether or not we see any follow-through on equities this morning.

We would normally see a pull back at the .886 — a Bat Pattern. But, Bats can and do go on to become Crab Patterns — which would mean a move up through the channel midline to the 1.618 extension at 84.522.

Daily RSI arrived at a 4-way “stop sign” overnight — three channel midlines and a channel top. Though it might ultimately push through, this supports the idea of at least a pause and more likely a pull back, meaning stocks should rebound from here.

Daily RSI arrived at a 4-way “stop sign” overnight — three channel midlines and a channel top. Though it might ultimately push through, this supports the idea of at least a pause and more likely a pull back, meaning stocks should rebound from here.

The question, of course, is “how much?” The EURUSD, which we remarked yesterday was “hanging by its fingernails,” wasn’t able to hold the purple channel. It completed the small scale Bat Pattern we were expecting overnight (purple), and has potential to the red .886/purple 1.618 down around 1.28.

The daily RSI supports this move, as it fell right through its nearest support overnight.

The daily RSI supports this move, as it fell right through its nearest support overnight.

All eyes are on Bernanke this morning, as he speaks at the Chicago Fed. Evans and Plosser’s semi-public debate regarding QE has ratcheted up a notch the past couple of days. It’ll be interesting to see whether Bernanke can reassure the markets that economic conditions remain “just right” for continuing to pump $85 billion monthly into the markets: getting better every day, but not able yet to stand on its own two feet.

All eyes are on Bernanke this morning, as he speaks at the Chicago Fed. Evans and Plosser’s semi-public debate regarding QE has ratcheted up a notch the past couple of days. It’ll be interesting to see whether Bernanke can reassure the markets that economic conditions remain “just right” for continuing to pump $85 billion monthly into the markets: getting better every day, but not able yet to stand on its own two feet.

The other big story, of course, is the yen. We discussed yesterday how it was a moment of truth for the USDJPY. It was threatening an Inverted H&S Pattern, but had run into an important channel line.

The pair sliced through it like it wasn’t there, completing the IH&S, then reaching the IH&S target and a Crab Pattern near 102 in one fell swoop. In the process, it reaffirmed the dominance of the rising purple channel from 75.56 in October 2012.

A quick pullback could reassert the white channel; but, if not, the next stop is 105.57-106.98 as soon as May 21.

A quick pullback could reassert the white channel; but, if not, the next stop is 105.57-106.98 as soon as May 21.

But, the daily RSI suggests a very good chance of a quick pullback.

The Nikkei 225 has loved the yen implosion, zipping through the .618 retracement of the 2007 crash and a well-defined channel top on May 3 and threatening to top the Dow.

But, the collapse in JGB (and spike in yields) gives one pause. This is what Abe wanted, but is he prepared for the currency wars he’s unleashed with neighboring Asian countries? Sri Lanka, Vietnam, Thailand and South Korea have all either cut rates or are about to.

But, the collapse in JGB (and spike in yields) gives one pause. This is what Abe wanted, but is he prepared for the currency wars he’s unleashed with neighboring Asian countries? Sri Lanka, Vietnam, Thailand and South Korea have all either cut rates or are about to.

I wonder whether Japan, with government debt at 240% of GDP, will survive the cure for its economic malaise.

UPDATE: 9:30 AM

I’m taking an interim long position on the opening, but will be watching to see what happens at 1631. My core short position will remain in place unless we get a push up through the red channel midline. Stops on the long at 1626ish.

I would have been more than content to close out the short at yesterday’s close, but the low for the day was slightly lower than the previous “bottom” of 1623.30, leading me to believe we might see another leg down.

We’ll see what Bernanke has to say, then check back in.

UPDATE: 10:00 AM

A bit of a snoozefest in Chicago. Bernanke’s giving a history lesson, not saying anything yet about the topic on everyone’s mind: QE.

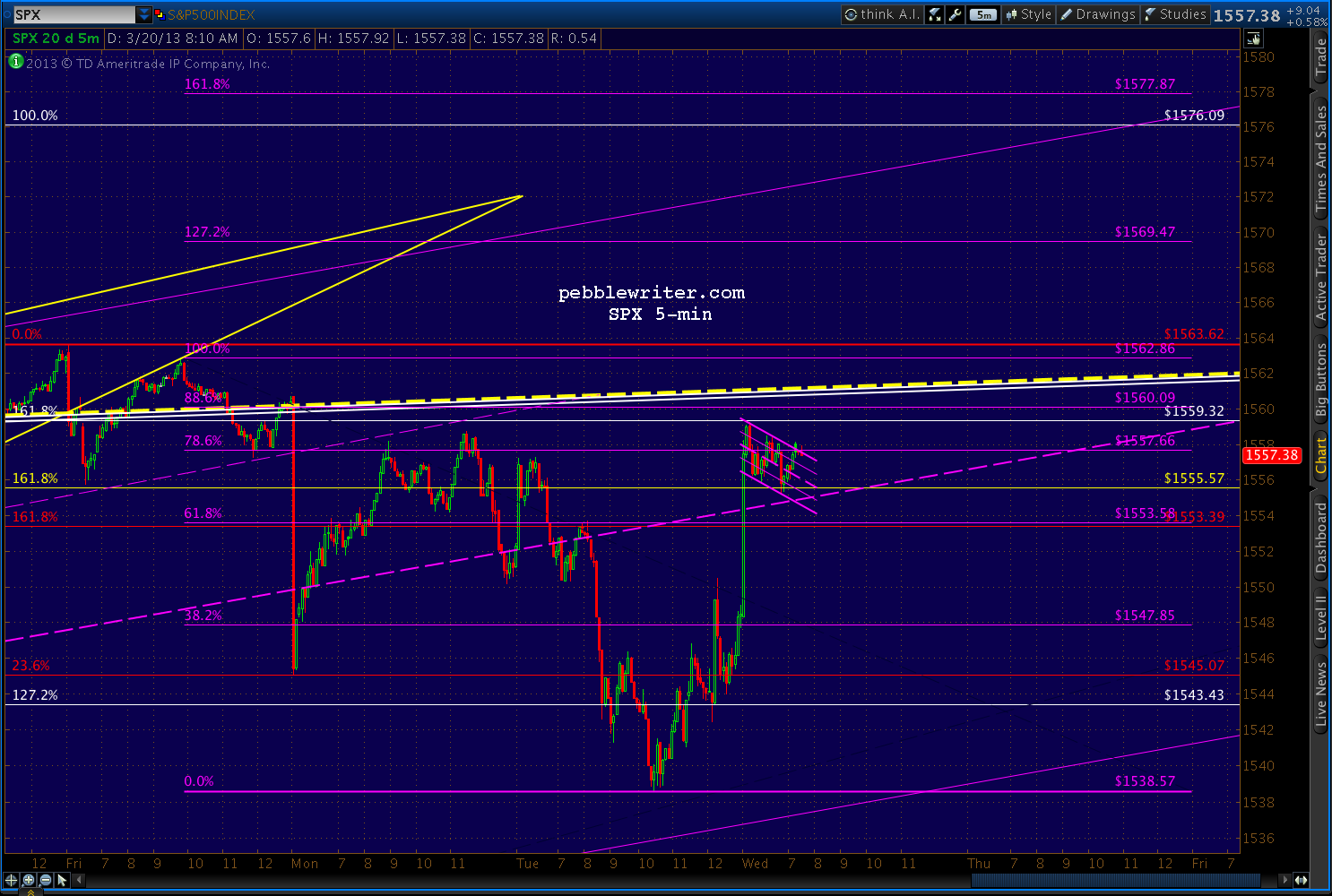

SPX just reached the red channel midline mentioned at 9:30, just shy of the .786, and is deliberating next steps.

The dollar continues to strengthen, making a series of smaller waves higher while remaining above the .886 Fib discussed above. And, the EURUSD continues to leak lower — just reaching the .236 of the 1.37 high In Feb.

The dollar continues to strengthen, making a series of smaller waves higher while remaining above the .886 Fib discussed above. And, the EURUSD continues to leak lower — just reaching the .236 of the 1.37 high In Feb.

UPDATE: 11:5 AM

I’ll be closing the interim long here at 1626 due to the triangle breaking down. Full short for 1613-1617 (favored target about 1614.) Confirms with a drop through 1623; should get a bounces around 1624 and 1622.

60 min RSI shows a little room to run.

60 min RSI shows a little room to run.

Watch out for a possible backtest of the triangle to around 1627.75. Stops on the short at the top of the triangle, currently about 1629.

Watch out for a possible backtest of the triangle to around 1627.75. Stops on the short at the top of the triangle, currently about 1629.

If there’s something that could derail any further downside, it’s the EURUSD.

It reached the .618 of the 1.2743 to 1.3242 rise this morning (small red pattern), and can be expected to bounce.

It’s also getting dangerously close to the bottom of the light blue channel that rises from July 2012.

It’s also getting dangerously close to the bottom of the light blue channel that rises from July 2012.

Technically, the .618 is enough of a retracement for this wave to be finished. But, it certainly doesn’t look finished. I think it’s more likely we’ll get an intra-day push down to the red .786 (1.2850) or even .886 (1.28) before all is said and done.

Technically, the .618 is enough of a retracement for this wave to be finished. But, it certainly doesn’t look finished. I think it’s more likely we’ll get an intra-day push down to the red .786 (1.2850) or even .886 (1.28) before all is said and done.

A sustained break of the channel bottom, needless to say, would be exceedingly bearish for the euro and for equities.

UPDATE: 1:30 PM

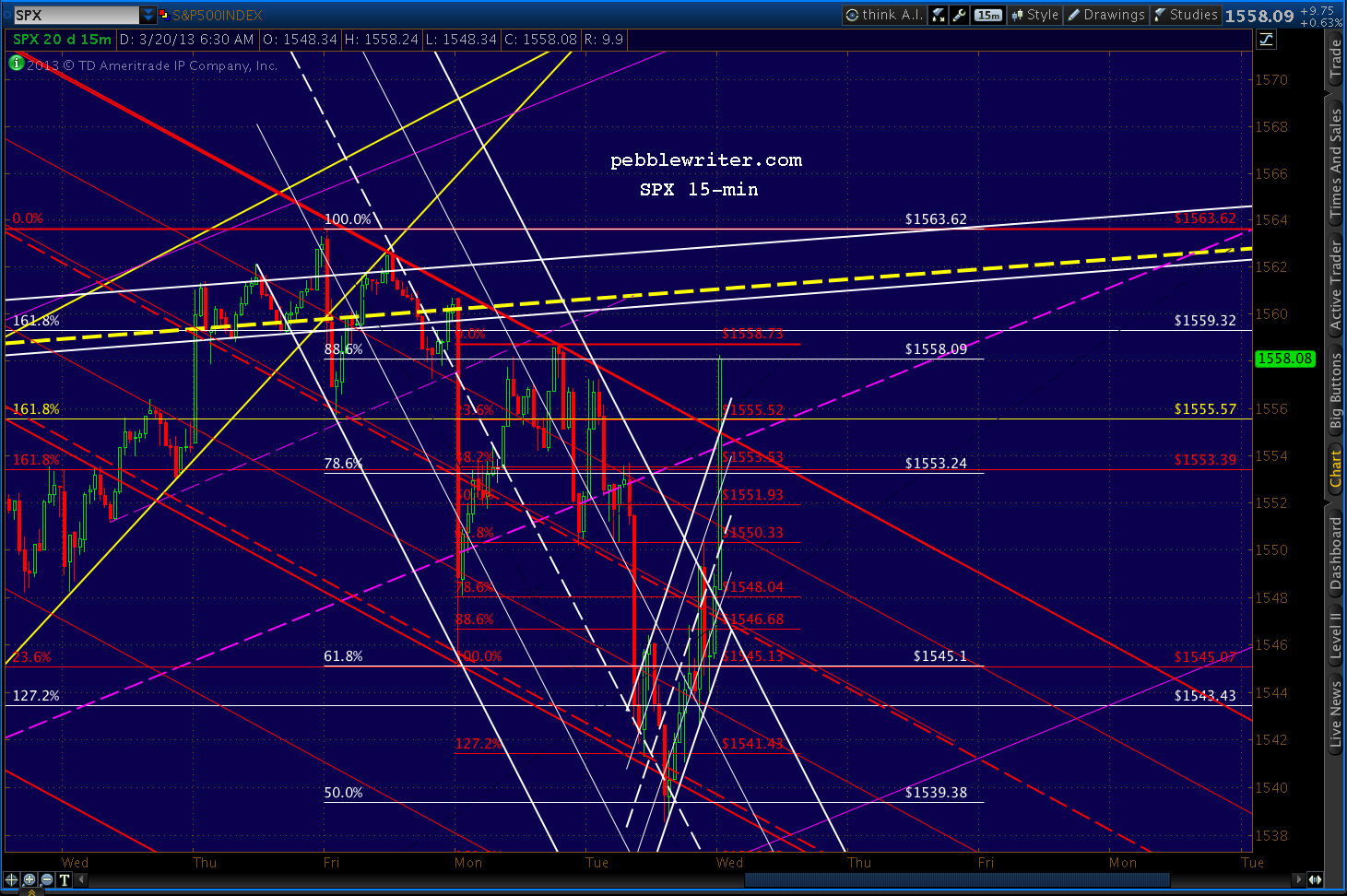

Based on my best stab at placing the falling white channel, I believe SPX just topped out on the day.

Next stop should be around 1622 at the midline, but ultimately the green 2.618 should come into play where the white channel bottom and red channel bottom intersect — probably around 1614 on Monday.

Next stop should be around 1622 at the midline, but ultimately the green 2.618 should come into play where the white channel bottom and red channel bottom intersect — probably around 1614 on Monday.

The next major support would be the purple midline — around 1593 on Monday — and then the previous high and purple .25 of 1576.

If I’m wrong, stops at around 1630 ought to do it. I have to run out till 3PM ET, but will post more when I return.

GLTA.

UPDATE: 3:44 PM

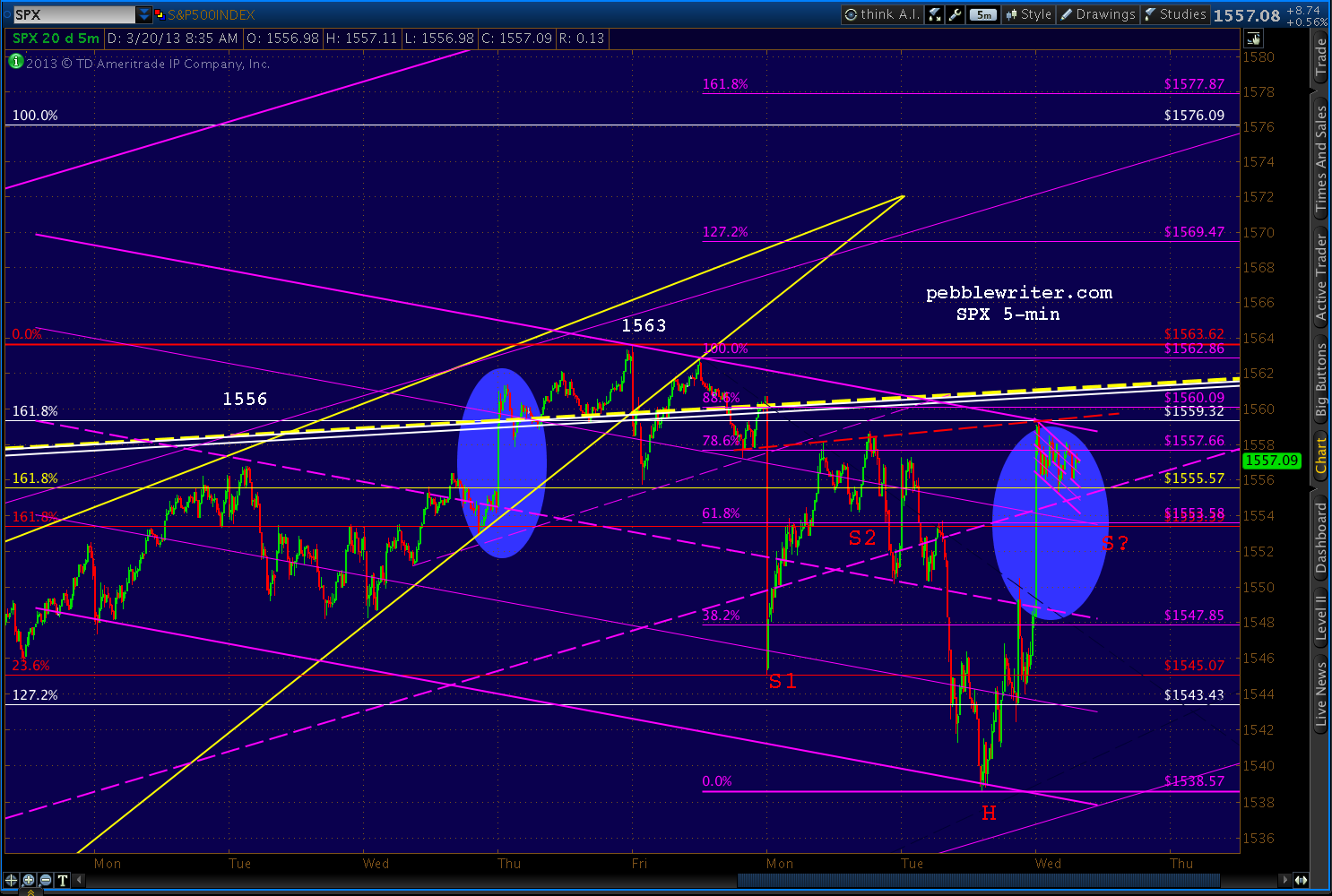

SPX just moved up past my comfort zone — not to mention out of the channel — so I’m switching sides here at 1630. Next stop 1641-1642? It’s the 1.618 extension of the fall from 1635 to 1623 and the approximate level of the IH&S.

Best of all, it will happen on the 13th, which is when we originally had the interim top scheduled. All is right in the world again.

Legible chart coming up…

Legible chart coming up…

I wouldn’t normally stay long over the weekend, but I imagine we’ll gap up to 1641-1642 Monday morning, so it’s worth a shot.

I wouldn’t normally stay long over the weekend, but I imagine we’ll gap up to 1641-1642 Monday morning, so it’s worth a shot.

Looks like we’ll probably close at the .886. We might get a small reversal just ’cause, but Point B in this case was almost the .786, so that technically rules out a Bat Pattern. Instead, it’s a Butterfly/Crab that should extend to the 1.272 or 1.618.

Of course, things don’t always go according to plan; but, I like where the currencies are finishing up.

More in a few…

UPDATE: EOD

The revised view from the treetops:

And, a little closer in…

And, a little closer in…

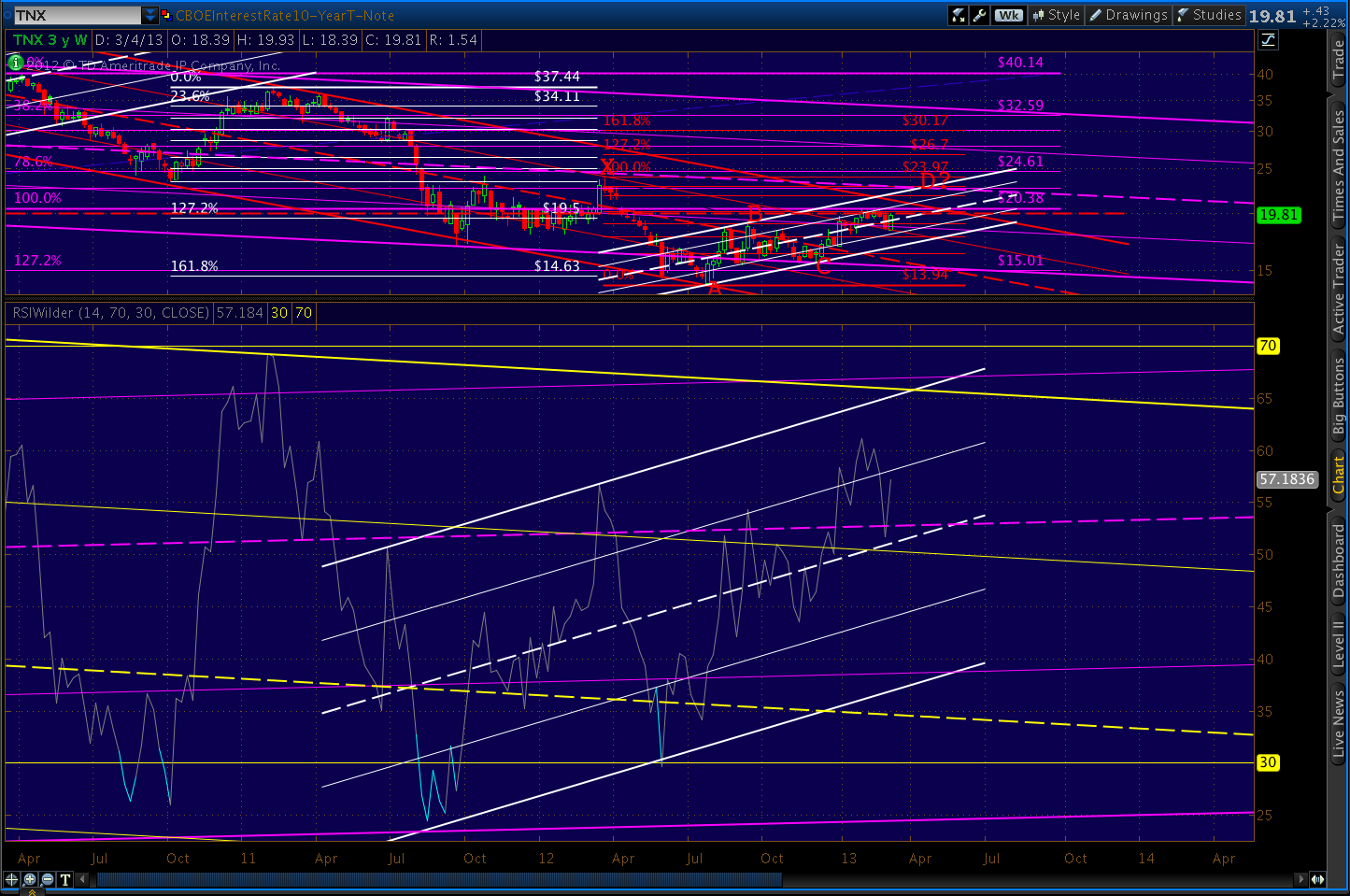

“D?” doesn’t work as a Bat Pattern because “B” is higher than the .618. We could use the reversal at the .500, but “A” is the lowest low, so that doesn’t work. That leaves a Crab Pattern with roughly a .707 Point B — if it follows the rules.

“D?” doesn’t work as a Bat Pattern because “B” is higher than the .618. We could use the reversal at the .500, but “A” is the lowest low, so that doesn’t work. That leaves a Crab Pattern with roughly a .707 Point B — if it follows the rules.

Close up, there’s a potential IH&S that targets 21.50 or so that completes around 20.00 — otherwise, no remarkable patterns. The Jul 1 high was a .786 retracement of the May 22 high.

Close up, there’s a potential IH&S that targets 21.50 or so that completes around 20.00 — otherwise, no remarkable patterns. The Jul 1 high was a .786 retracement of the May 22 high.