This morning’s hunch to fade the futures’ ramp was a good one [see: Mixed Signals.]

“There’s a channel line just overhead at 1337.30 or so that should limit the current rally. Given the way the futures behaved overnight in equities, the dollar and the euro, I’m going to fade this ramped up opening and see if it settles back down.”

The market not only reversed within minutes of the open, but it got all the way back down to our target range of 1303.47-1308.88, putting in a low of 1307.73 and closing at 1308.93. Mind you, I hadn’t expected it to happen only six hours later, but I’ll take it thank-you-very-much.

Although we got to the right trade in time, it was the result of a great deal of brain-racking and teeth-gnashing. Had I bothered to look at the emini’s, the decision would have taken all of five seconds.

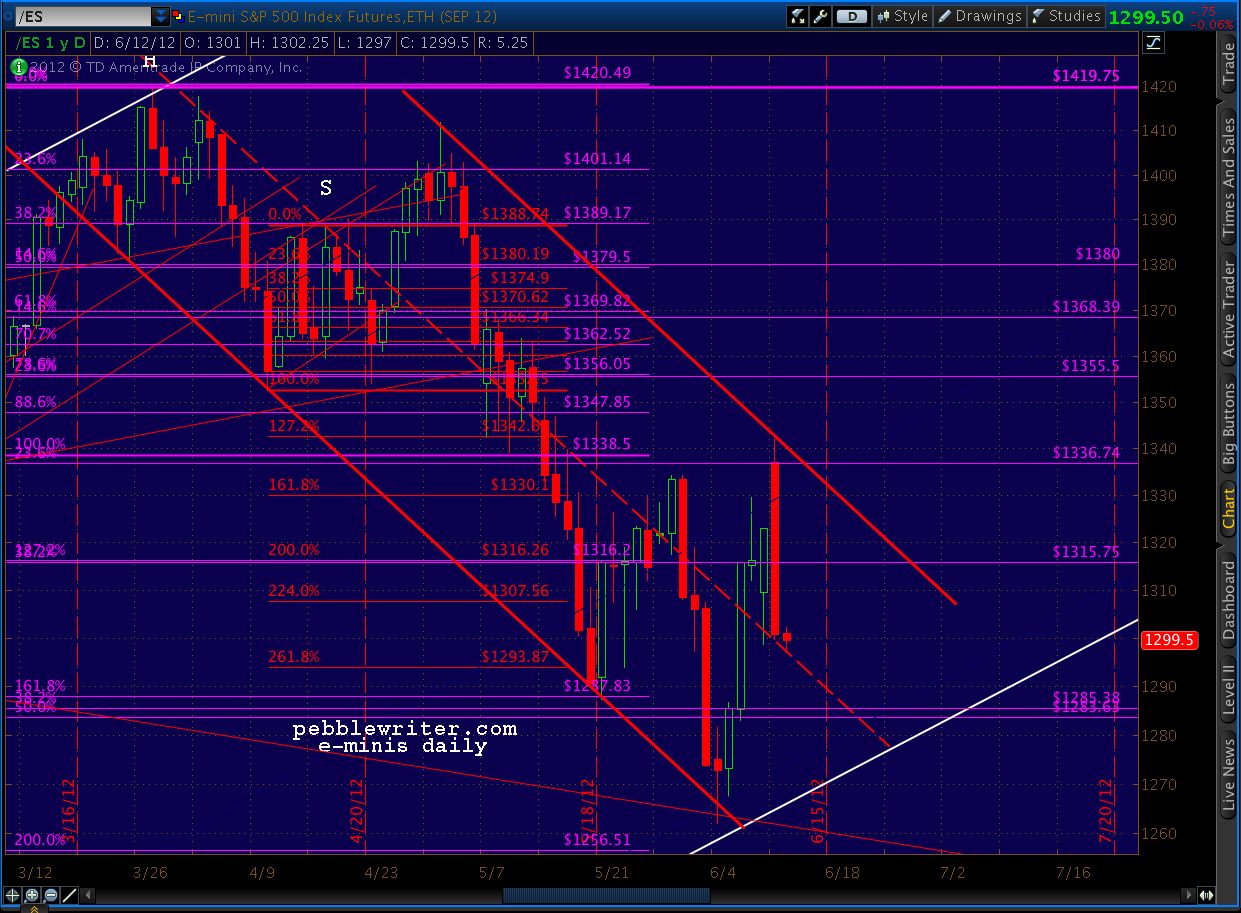

All-together, SPX reversed over 28 points. But, that was dwarfed by the e-minis reversal from +19 points to -23 points — a daily range of 42.25 points. This was the single biggest red candle since 2011’s crash.

All-together, SPX reversed over 28 points. But, that was dwarfed by the e-minis reversal from +19 points to -23 points — a daily range of 42.25 points. This was the single biggest red candle since 2011’s crash.

As noted in last night’s update on the dollar [The Dollar: Currents, See?]:

“I suspect the euphoria over the Spanish bailout will be relatively short-lived. Putting the rest of the eurozone in harm’s way seems like a better way to get them downgraded than it does Spain upgraded.”

Sure enough, there was plenty of talk about downgrades today — as doomers got the upper hand for a change. The argument — a good one — is that there simply isn’t enough firepower in the ES, ESFS and IMF to bolster the creditworthiness of all the countries currently circling the drain — let alone those that aren’t yet in the headlines (Italy and France are on deck.)

In the end, it will be up to Germany, the US and China to decide how much to contribute — a matter for another post. Returning to the markets, there are several important take-aways from the ES chart above.

continued…

First, it’s uncluttered by a lot of other stuff. That makes it easy to see some potentially important trend lines. Let’s start by adding a mid-line to the channel that ES completed in the wee hours.

By itself, it’s almost enough to convince me we’re about to snap back in the other direction. Throw in a VIP fan line, a few channel lines and a budding IH&S… and I’m sold.

By itself, it’s almost enough to convince me we’re about to snap back in the other direction. Throw in a VIP fan line, a few channel lines and a budding IH&S… and I’m sold.

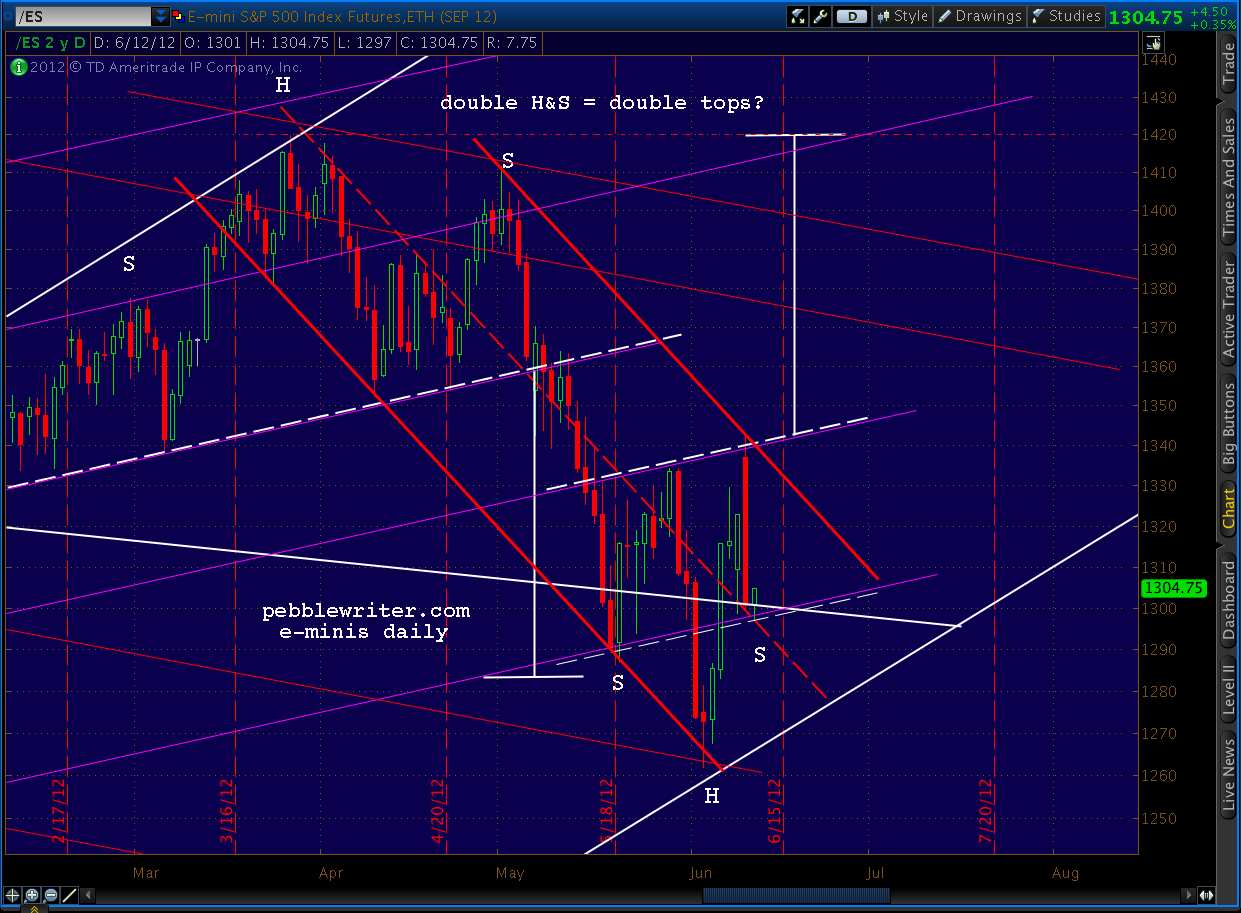

The really crazy part is that the last H&S shoulder top produced a target 76 points away from its completion. The inverse H&S pattern under construction, assuming it completes in the next week or so, would also produce a target 76 points away — at 1420.

I’ve spent a lot of time lately agonizing over whether we’ll go back up and produce a new high. The harmonic picture suggests we’ll put in a lower high — a point C which, less than A at 1419 (on ES, 1422 on SPX), would get the party started to the downside.

I can only imagine the amount of good money bears would throw away on puts and the like, trying to anticipate whether it was going to be a .618, .786 or .886 retracement.

Once we approached 1420, though, the momentum would shift to the bulls and an enormous amount would go into positioning for the upside.

What if it were simply a double-top?

Comments

3 responses to “Big Picture: June 11, 2012”

A possible H&S on the VIX looks like it would confirm a move up to the 1400 area and

maybe a double top would be very fitting.

The RUT today had a classic double top on the 15 min chart and imploded. I like how harmonincs work but it is hard to see the forest for the trees right now. I think only a stick save by CB’s will bring the upside into play. The only CB that is capable is the FED. How long before a fade of that? Maybe that is what the harmonics are saying about the fade. Thanks again for your work.

The charts ARE pretty busy, for sure. I’ll try and post the various harmonic paths tomorrow. The Fed fade…like it. But, it’s a toughie. What other alternatives does the world have? All that money has to go somewhere… Will the euro be a better alternative after it crashes? The renminbi? Many issues that we’ve never before faced.