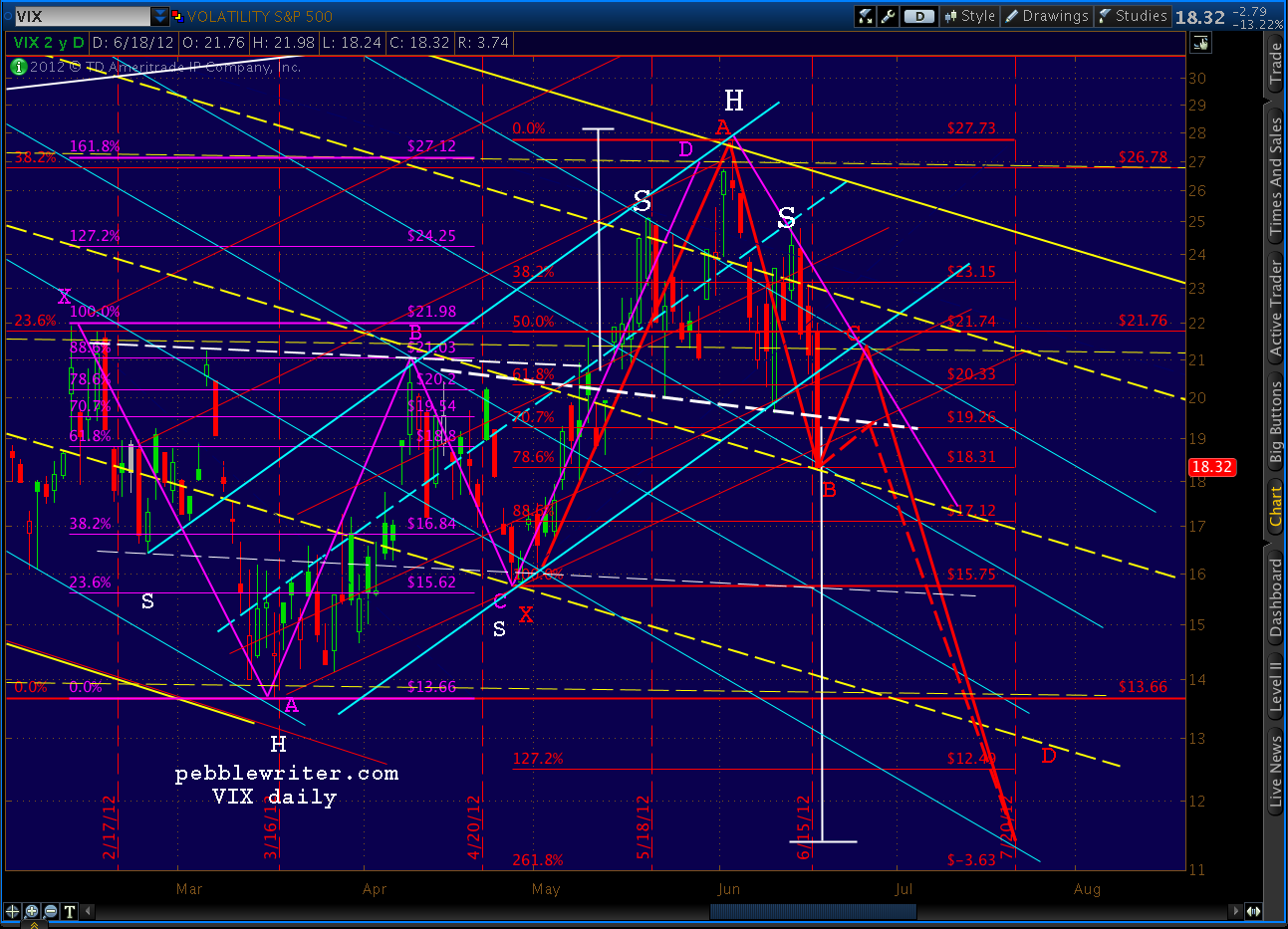

Earlier today [see: Close but no Cigarro], I opined as to how SPX wasn’t done back testing its IH&S because — among other reasons — VIX hadn’t even reached, let alone reacted off our target of 18.31 (the solid red line.)

Never mind the “reached” part. VIX nailed our June 12 forecast right at the close. I don’t know about you, but I get all tingly inside when a 22% move comes in right on target like that.

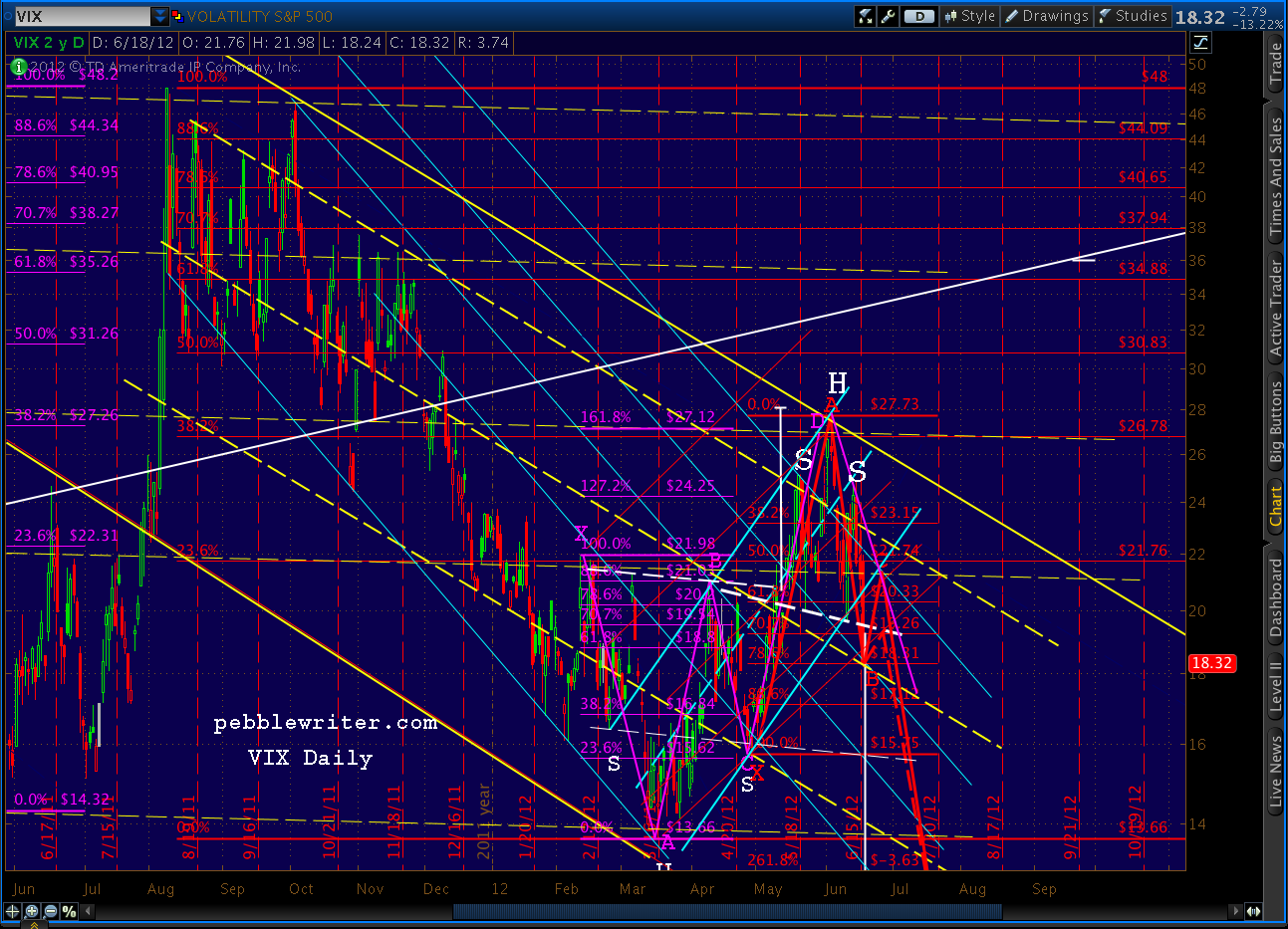

We’ve hit three bulls eyes in a row with VIX — including the interim top on April 10 [see: Bottom Fishing], calling the June 4 high of 27.12 back on April 18 [see: VIX at a Crossroads] and, now this. The fourth will be a little trickier.

We’ve hit three bulls eyes in a row with VIX — including the interim top on April 10 [see: Bottom Fishing], calling the June 4 high of 27.12 back on April 18 [see: VIX at a Crossroads] and, now this. The fourth will be a little trickier.

continued…

First, I’m operating under the assumption that we just completed Point B in a Butterfly pattern (the .786 Fib.) It’s possible we’ll go lower and turn at the .886 @ 17.12, but I don’t think so.

If 18.32 was our Point B, it leaves open lots of possibilities for Point C — which generally reverses at a Fib level somewhere between .382 and .886 of the last leg. The least back test would be to the necline at around 18.26, and the greatest is probably around 23.15; whichever target it is, expect the entire move to complete within a week or so.

I’ve drawn in a Point C on June 26th at 21.74 with an alternate of 19.36, and will try to nail it down as we progress. The important point is the Point D which, if this is a Butterfly pattern, normally means the 1.272 (12.49) or the 1.618 (8.35.) The H&S pattern targets about 11.39, so 8.35 is probably just too extreme.

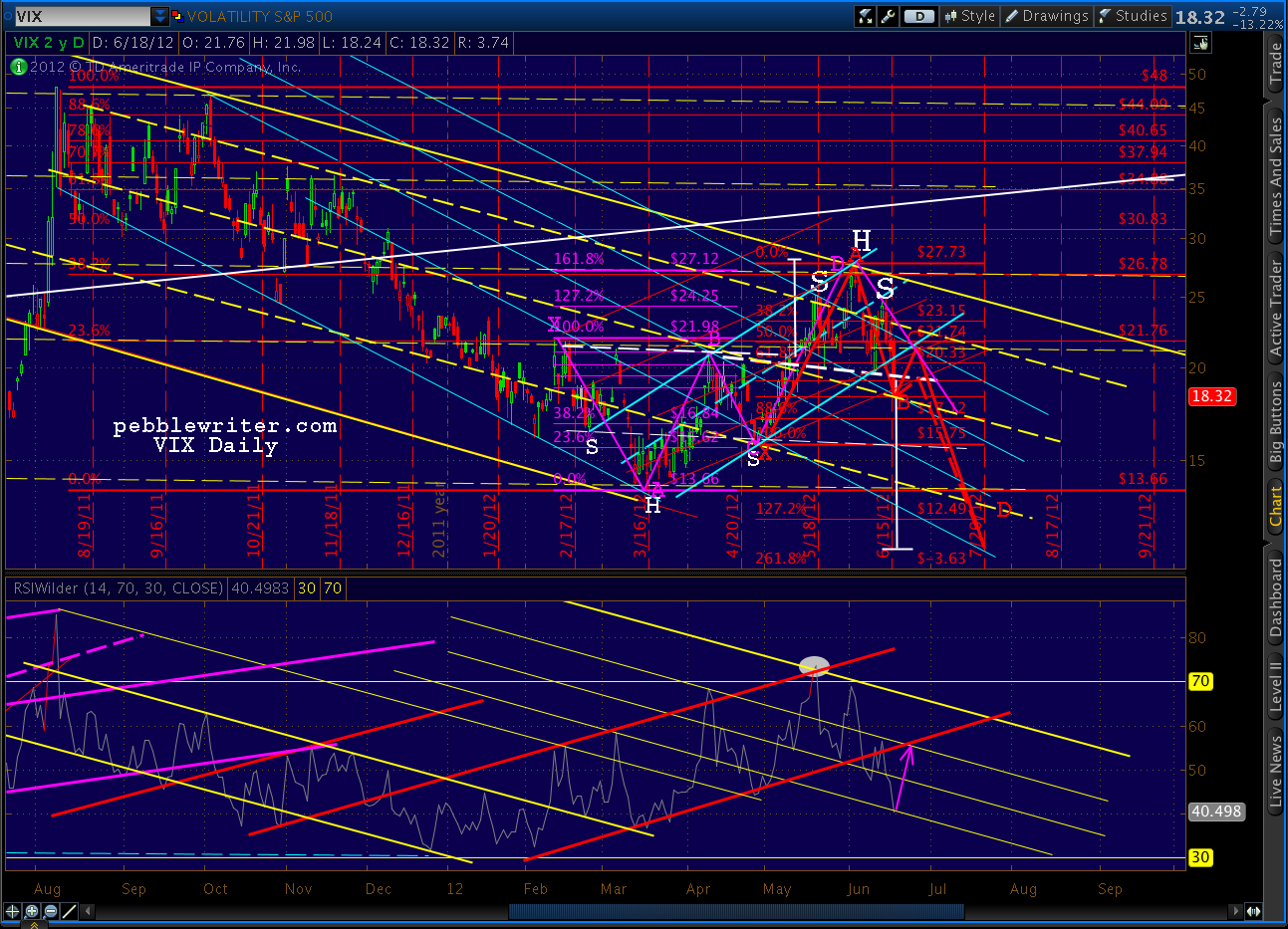

Last, we take a look at VIX’s RSI, which has done a bang up job of guiding my forecasts all along. It looks very ready to turn. The big question is whether we traverse the small channel or the big one with the next move.

Last, we take a look at VIX’s RSI, which has done a bang up job of guiding my forecasts all along. It looks very ready to turn. The big question is whether we traverse the small channel or the big one with the next move.

Stay tuned.

*************

Comments

5 responses to “The VIX is In”

I do not remember hearing before this post about the vix 17.12 target. I traded this too early around the 18.31 target. I need to pay closer attention.

What are some common non-leveraged ETF’s to track the decrease of the VIX? SVXY?

I haven’t any experience with any of them, so can’t really recommend one. Besides SVXY, there’s also XIV.

Good stuff PW. How do you interpret things on the days like today when the VIX plunged but the S&P barely moved?

I think VIX was way overbought as a means of playing the downside in the event the Greek situation blew up. I saw some forecasts over the weekend of VIX reaching 80!