ORIGINAL POST: 3:40 PM

Today’s shaping up as planned. We’ve had a nice 10-pt move after tagging our downside target range of 1303-1308 yesterday and again this morning [see: Mixed Signals.] After fading yesterday’s opening at 1335, that represented a nice daily gain of 2.1%.

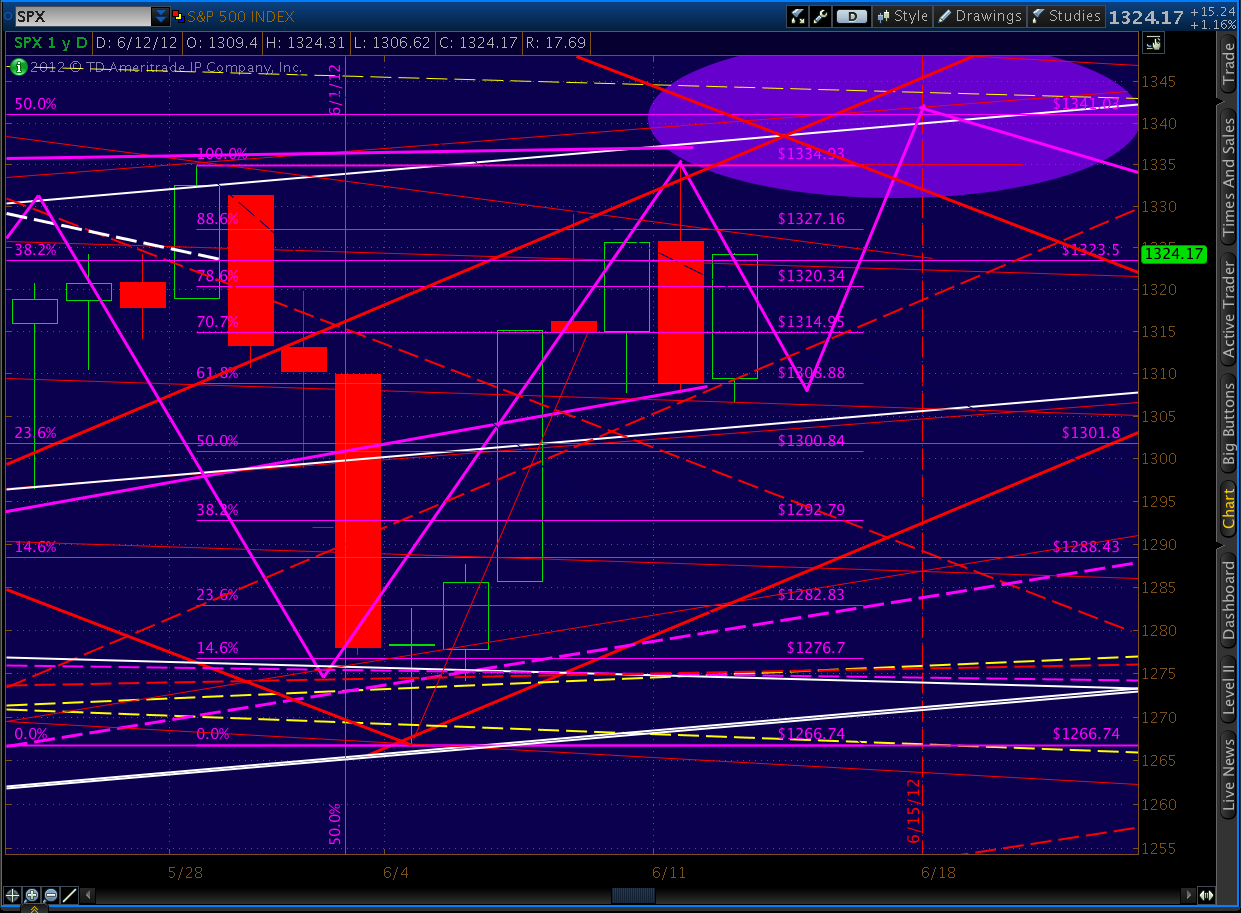

SPX has pushed up against its 60-min RSI channel and is showing signs of wanting to push through. Recall that our upside target for the next few days is 1342-1343. The ideal timing would be OPEX Friday, but don’t be surprised if we bounce around a bit and don’t arrive till Monday.

continued…

I consider the daily RSI’s channel back test complete — as also suggested by VIX [see: VIX Update.] A close above 1325 would be more confirmation still.

UPDATE: EOD

We finished up 15.25, a very strong comeback from a huge down day yesterday. Don’t freak out over the volatility. As I posted yesterday:

“Don’t take the next leg down as gospel. I think it’ll be choppier than that, testing as low as 1303.47-1308.88 over the next few days leading into OPEX — where I imagine we’ll finish around 1340.”

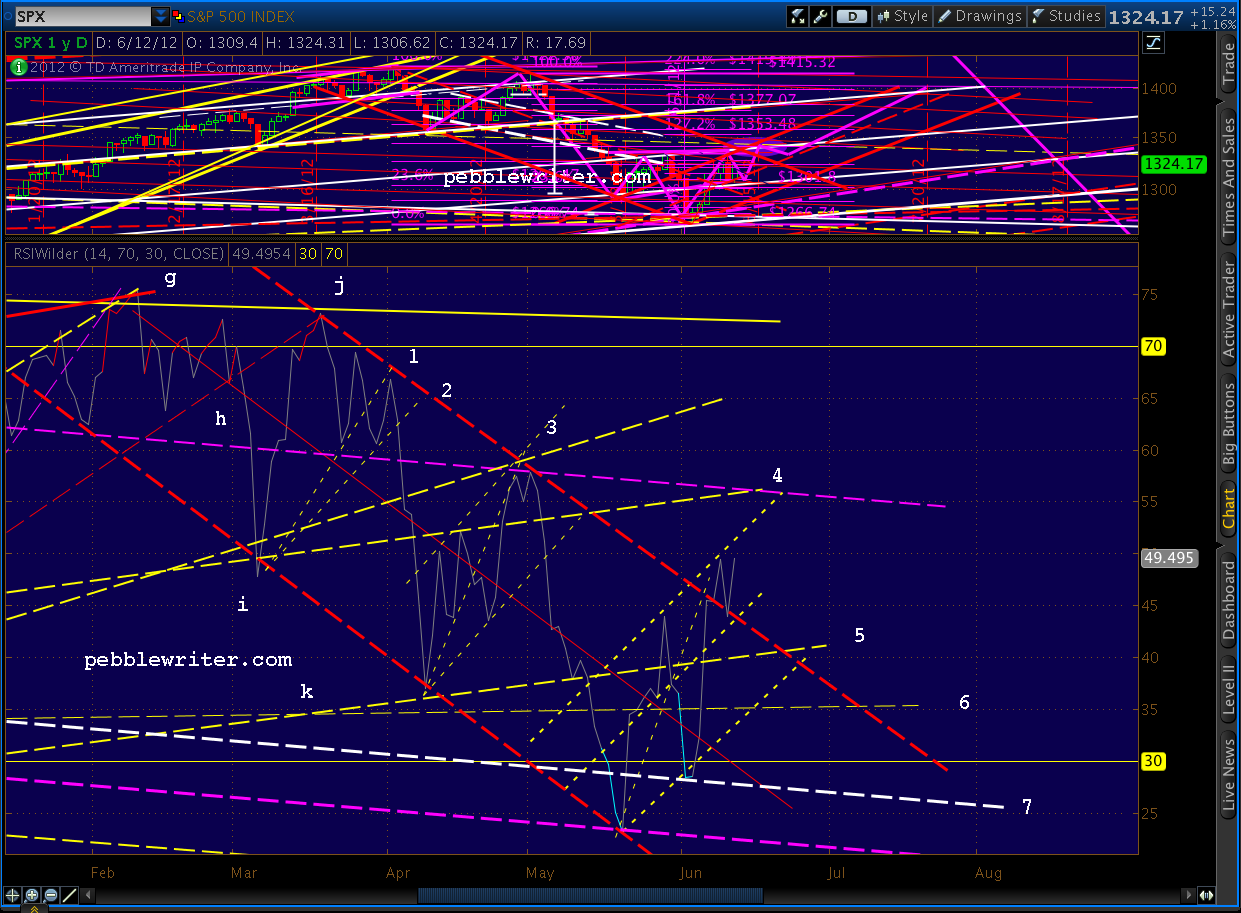

I wouldn’t be surprised to see another day or two like today before we reach our next target: 1342-1343 between June 15-20 (with a bias toward sooner in that range.) Looking at the daily RSI channel, I think we’ll go up and tag that TL marked “4.” But, don’t be surprised if we bounce around a bit in getting there.  Here’s a close-up of the daily picture, messy as it is. Focus on the purple line, our forecast.

Here’s a close-up of the daily picture, messy as it is. Focus on the purple line, our forecast.

I have to run out for a bit. In the meantime, Tony does a very nice job of describing how I’m feeling lately. Enjoy!

I have to run out for a bit. In the meantime, Tony does a very nice job of describing how I’m feeling lately. Enjoy!

Comments

3 responses to “I’d Rather be Lucky”

Pebbles,

What about the H&S setting up on the S&P targeting 1295-1300 which would set up a more

balanced right shoulder of the inverted H&S thus targeting high 1380’s? Any RSI action

support for this scenario? Thank you your work is impressive.

Yep. It’s always concerned me that the right shoulder was being thrown together too quickly. Lately, I’m leaning more towards a June 20-24 completion instead of June 15. But, I think that little H&S you’re talking about is no more than 50:50. More likely we’d bounce just shy of the neckline.

We’d need to shed about 20 points to complete it, and it would send SPX back to 1280 or so. The case FOR it is that the little channel RSI is establishing to the upside is quite narrow. A test of the lower bound would balance things out. The case AGAINST it is that we’d have to break what I’ve drawn as the midline in RSI, and a couple important channel lines in SPX.

Somehow I’m feeling just a bit smug today 🙂

I shouldn’t be but I imagine you are too my friend. I think the market gaps way up tomorrow and saves our reputations, lol. Great work.