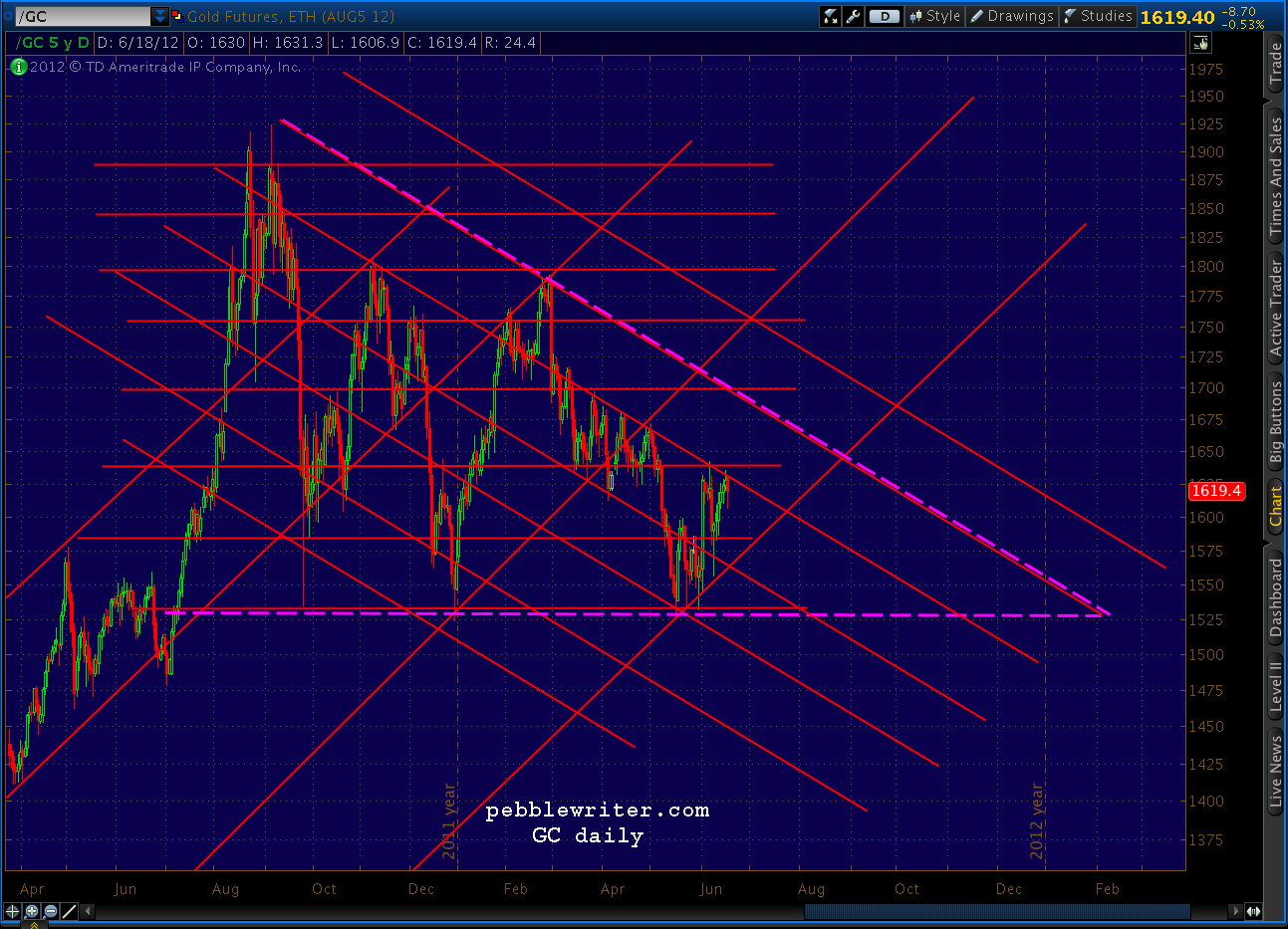

GC soared over $1200/oz since losing 30% in sympathy to the global market meltdown in 2008. Most of that rise took place in an acceleration channel.

In the past year, however, the most prominent pattern has been the descending triangle (purple, dashed.)

Continued…

According to Bulkowski, these patterns can break in either direction, but break downward 64% of the time. Whichever way they break, it typically occurs 64% of the way to the apex. Also, if prices rise into the pattern (obviously the case, here), the breakout is upward 73% of the time.

Note how the upper bound of the triangle is echoed in parallel trend lines below it. There’s a pretty good chance that parallel TLs will come into play in any breakout, too.

The pattern looks about 19 months from July 6, 2011 to Feb 2013, so 64% would be 12.16 months; we’ll call it mid-July and drop a couple of placeholders into the chart that fit the time frame as well as the major TLs.

The pattern looks about 19 months from July 6, 2011 to Feb 2013, so 64% would be 12.16 months; we’ll call it mid-July and drop a couple of placeholders into the chart that fit the time frame as well as the major TLs.

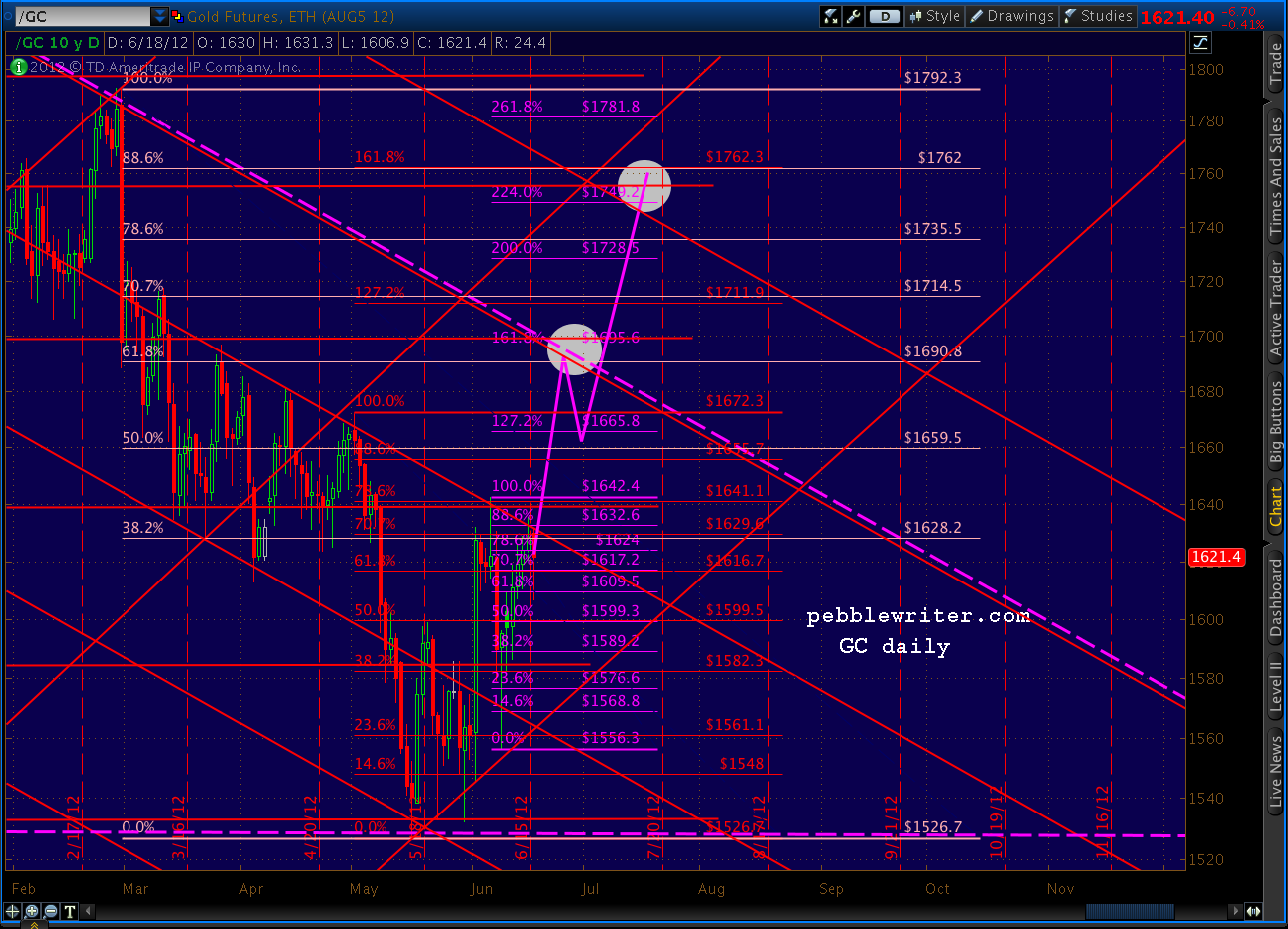

Next, we’ll look at the harmonic picture. Overlaying some harmonic grids over the current chart, we can see three potential patterns to the upside. The largest (pink) pattern has retraced a little over .382 so far, so all options are on the table. The lower target is right around the .618, so I’ll keep that in mind as a potential turning point.

Next, we’ll look at the harmonic picture. Overlaying some harmonic grids over the current chart, we can see three potential patterns to the upside. The largest (pink) pattern has retraced a little over .382 so far, so all options are on the table. The lower target is right around the .618, so I’ll keep that in mind as a potential turning point.

It’s also right at the 1.618 of the smallest (purple) pattern — a pattern, BTW, that recently completed a Bat pattern at its .886. Bats often go on to become Crabs, which I suspect might be the case here.

Interestingly, the upper target is right around the .886 of the larger pattern, the 1.618 of the mid-sized red pattern and the 2.24 of the smallest pattern. The red pattern recently completed a reversal at its .786, so a Butterfly pattern completion at its .1.618 fits. And, of course, the .886 of the larger pattern would complete a Bat.

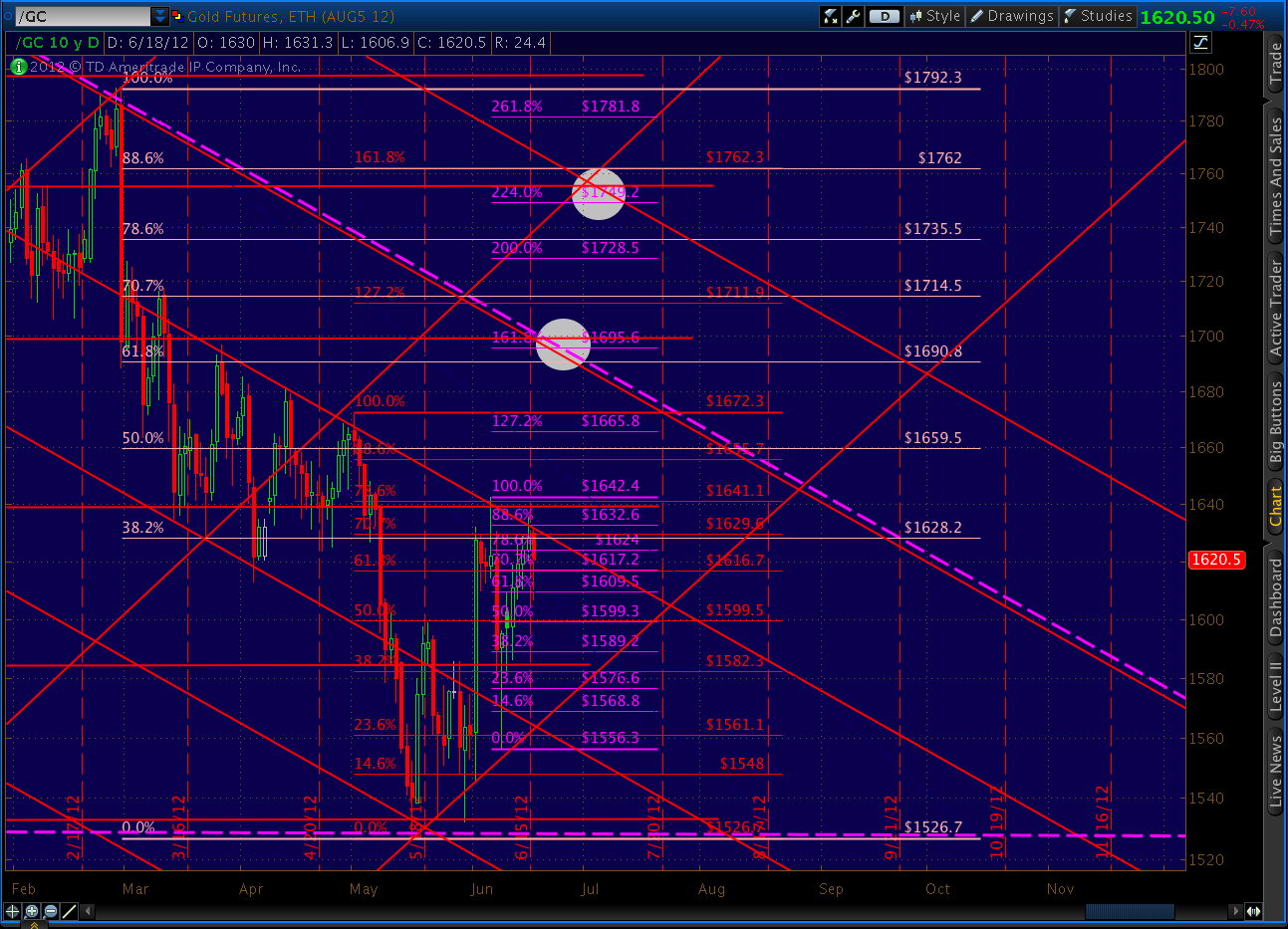

Put it all together and we get a very bullish forecast for Gold: a fast rise to 1762, followed by a significant pull back (assuming we get a boost from the central planners in the next few days.) The big caveat is that gold, as in 2008, is susceptible to a general market meltdown like most other commodities. If we don’t get that boost I mentioned above, there’s good downside risk. But, this forecast fits with the scenario that a major central bank injection is coming — one that will boost asset prices at least temporarily.

The big caveat is that gold, as in 2008, is susceptible to a general market meltdown like most other commodities. If we don’t get that boost I mentioned above, there’s good downside risk. But, this forecast fits with the scenario that a major central bank injection is coming — one that will boost asset prices at least temporarily.

Comments

3 responses to “Update on Gold: June 18, 2012”

Are we still looking for VIX to reach 18.3 then turn up?

yes, 18.30 woud be ideal.

Thank you