ORIGINAL POST:

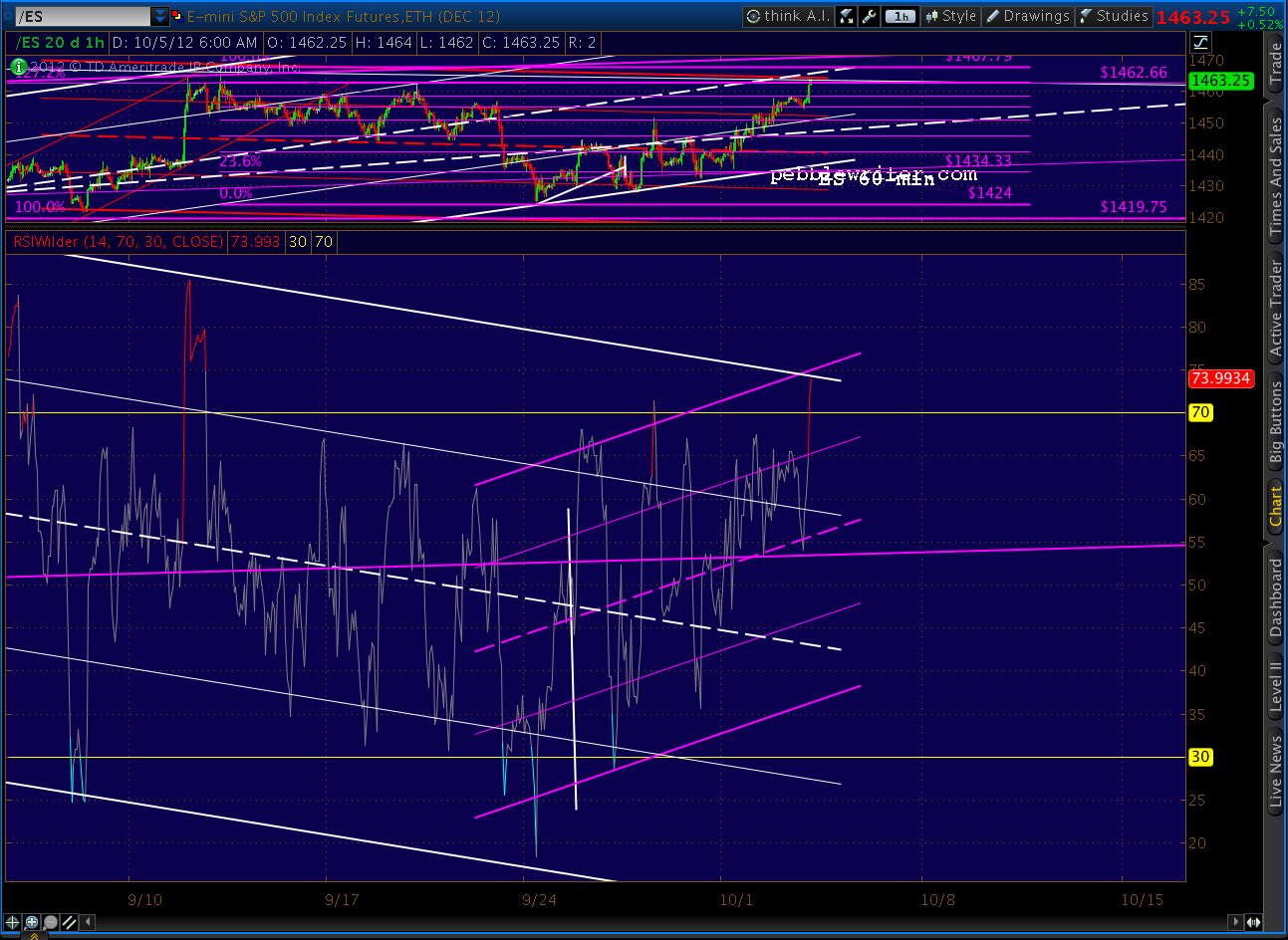

This morning’s election eve NFP ramp should reach our target #2 from last Friday at the .886 of 1469.50. I would fade this rally if/when SPX reaches that level. This has pop-and-drop written all over it.

If you’re stopped out on the opening, I would look to reshort at the .886. As always, please use stops.

DX just bounced off the .618 of the 78.725 low.

UPDATE: 9:35 AM

That’s the tag of target #2 at the .886. It could leak a little higher, but I’m re-shorting here at 1469 with stops at 1474.

In retrospect, I should have expected them to ramp this after-market due to the election season BLS report which comes out in the pre-market hours. I thought we’d get a proper 3-wave correction before heading up to our target # 2, but neglected to consider the timing.

In retrospect, I should have expected them to ramp this after-market due to the election season BLS report which comes out in the pre-market hours. I thought we’d get a proper 3-wave correction before heading up to our target # 2, but neglected to consider the timing.

There’s some consolation in having nailed target #2 as well as we did target #1 yesterday. But, I’m disappointed to have given back some of the profit we’d booked EOD yesterday.

UPDATE: 10:50 AM

The dollar pushed lower to a 1.272 extension, a little beyond the .618 of the rise since Sep 14. This means DX is less likely to reverse at the .786 of 79.05 (other than a bounce) but could make its way down to the .886 of 78.899 by as early as Monday.

This implies that 1474 won’t stand as the high. Sure, we should pull back from current prices. The dollar is currently very oversold. But, we have to remain open to the possibility of a double top or even slightly higher.

UPDATE: 3:05 PM

The market has given back all this morning’s gains and is clinging to support. 1459 is an important level for it to hold, or there’s potentially much more downside — perhaps the .618 at 1457 or even the white channel midline at 1450.

If we get a bounce here, I’d consider taking profits at 1461. I can see a broken rising wedge and broken channel lines, but others show support at this level. I’ve spent the past several hours trying to get a handle on things and am, frankly, a little baffled.

I believe when things are unclear, it’s usually best to step aside and let them sort themselves out. So, I’ll let the market tell me which way it wants to go.

UPDATE: 3:50 PM

I’ll likely take profits going into the close. I still see a mixed next few days, and it seems silly to hold shorts into the weekend. So far, we retraced .886 of the drop from 1474, reacted down to the .618 from that, and should be up on Monday. But, I have no conviction. So, to cash I go.

Just looking for a little more action into the close.

UPDATE: 4:00

Gone to cash at 1460. Post mortem probably Saturday afternoon.

woo hoo…scalped SSO from 62.71 to 63.02 into the close. GREAT targets PW, they worked very, very well for me! Holding a balance right now, 1/4 SPXU bought at 1469 and 1/2 the SSO bought at 1457. Nice day trading profits today…yeah!

PW rocks! Now I just need a hole-in-one and blow all that profit on drinks in the clubhouse. 🙂

Hi, guys, long time no see. Literally. US election campaing seem to behave in a strange fashion. I mean different than many other times. Maybe I have no clue. Well, most certainly. But for the markets it might have a meaning. Anyways.

staying short into the weekend?

Just had my trailing stop take out my BB play outlined below…sold at $36.802. Definitely have dinner money in my pocket…time for some golf. Holding 1/4 of my SPXU since PW hasn’t given the “buy, buy, buy” signal yet. Have a great weekend everyone. GLTA.

Took 1/4 of my shorts off the table at 1:49 today…so far, top tick on SPXU at $36.54. YES! I shared my 60-min BB trading strategy before PW, but I’ll review for those that haven’t used it: price OUTSIDE BB (upper or lower), buy or sell when price CLOSES within BB again, expecting trade to move back to the SMA(20) on the 60-min chart.

In this case, I bought SPXU at 36.25 and will look to sell at roughly 36.90.

Have a great weekend everyone, PW rocks!

Is there still an expectation of the SP moving lower in to the 1450’s?

PW…on 10/3 you spoke about the SPX coming close to completing a very large bat pattern, possibly at the ..886 1469.50 and that this rally is “merely a corrective wave 2 on the way to a 100 point reaction that would be typical of completing that large a bat pattern”. Thus far today’s high reached 1470.96 on SPX. Do you see the SPX on the verge of a pullback of this magnitude that you spoke of beginning next week now having completed this pattern or is the FED backing too strong and this market continues up into the election? I am sort of looking for a couple weeks to a month out as what you see. Am waiting patiently and looking forward to seeing your Analog. Keep up the good work!!!

You mentioned Apple a couple days ago. An update would be appreciated.

Right with you PW…glad I was in cash last night. Time to put on the short pants. 1469.2 is where I jumped in with first tranche of shorts. Let’s watch this pop and drop please!