Alice laughed: “There’s no use trying,” she said; “one can’t believe impossible things.” “I daresay you haven’t had much practice,” said the Queen. “When I was younger, I always did it for half an hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.”

― Lewis Carroll, Alice’s Adventures in Wonderland

The market never ceases to amaze me. Despite all the ingredients being in place for a sizable correction, it’s sailing along as though everything were copacetic.

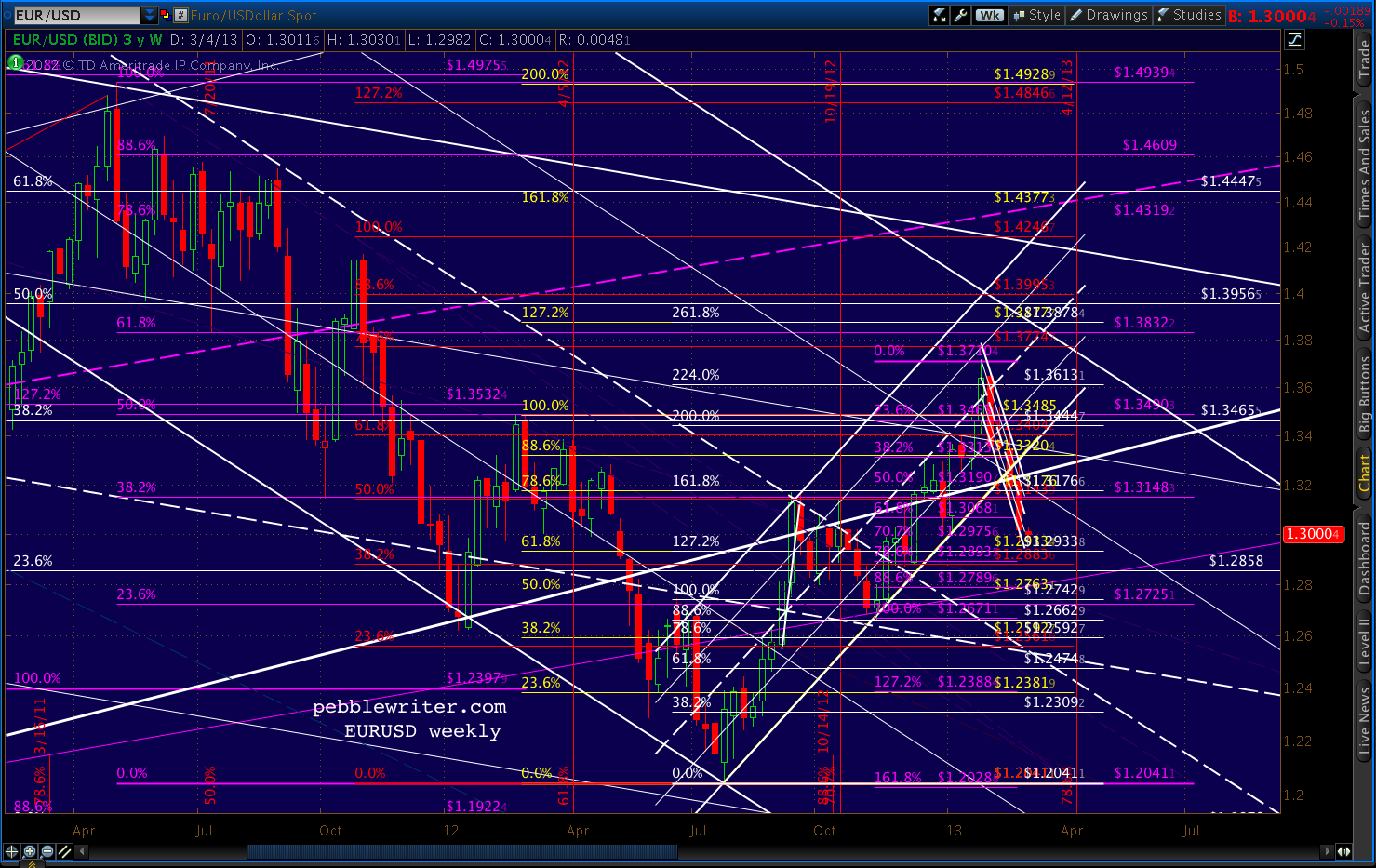

Negative divergence abounds. The correlated currencies are all selling off. Gold is down. Silver is down. Even AAPL is down. Numerous indices have completed bearish Harmonic or Chart Patterns.

The Fed let slip yesterday that the adrenaline drip will soon be removed — leaving banks without a buyer for their underwater mortgages and the stock market without any downside protection. They’ve finally admitted what we’ve all known for some time: QE’s effect is diminishing, and the risk is growing.

The budget showdown is still ahead (the part of the fiscal cliff that really matters.) The most fractured Congress in modern history, which utterly failed to resolve the important issues, will now turn the task over to an arguably more partisan Congress.

The country’s AAA credit rating is hanging by a thread at both Moody’s and Fitch. A downgrade by either would require massive selling by institutions which require at least two AAA ratings in order to comply with their investment policies (especially insurance companies.)

Unemployment has reportedly declined, but only because we no longer count the dejected job seekers who are leaving the work force in droves. Include them, and the actual picture is startlingly bleak. (source: Shadowstats.com)

The EU is officially back in a recession (though it never really left.) Its banks are being kept afloat by the ECB/ESM, which is exchanging (somehow AAA) paper backed by shaky sovereigns for junk sovereign debt as fast as it can. Meanwhile, unemployment continues to soar.

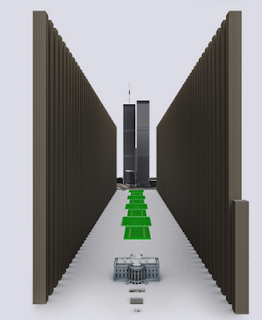

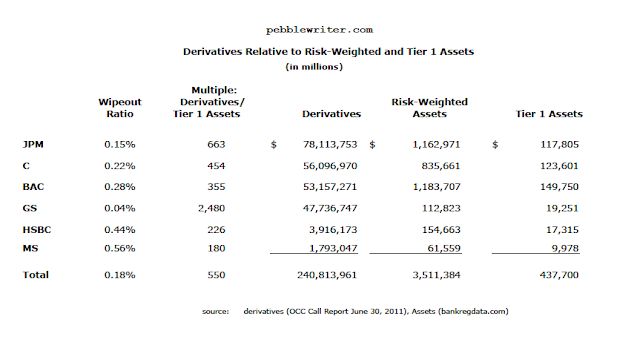

The big 2013 headline that isn’t (yet) is the global derivatives debacle: $700 trillion — over 10 times the global economy — of unregulated, unpriced, unreported private contracts which have been sliced and diced so many times that no one has the slightest notion what the risk really is — except that it dwarfs the capital of the banks that hold it.

In my opinion, the only things keeping the economy and the market afloat are the unrelenting screech of MSM fairy-tale “good news” and the Bernanke Put (the Fed’s money printing and plunge protection operations.)

As long as these two factors can outweigh the negative fundamental picture, the market stands a good chance of rising. Take one of them away, and the resulting crash will be swift and severe.

That said, I’ve spent the past two days assessing the current state of our analog and forecast. I’ve quantified it as best I can in an attempt to eliminate my admittedly negative bias. I’ll lay it out over the next several hours, a few charts at a time.

If you’d rather skip to the punchline, I’m still bearish. In the absence of a push through 1474, I think we’re in for a sizable correction and remain short from 1462. If 1474 is broken, everything changes.

For members who enjoy getting their fingers dirty, stay tuned.

* * * * * * * *

About an hour ago, we completed a Bat Pattern which is nestled inside of a Bat Pattern which is nestled inside of a Bat Pattern.

UPDATE: 3:15 PM

RSI channels show how much is riding on this moment. A push through the top of the purple channel brings the red channel mid-line into play. Could it correlate with 1474, or maybe just the next channel line on the intra-day?

I’m not sure. The intra-day 1.272 is 1468.17 and the 1.618 is 1471.61. A double-top would be a real nut-buster.

All I know is there’s still negative divergence across the board, so I don’t expect the red mid-line to be broken.

My apologies for the delay in getting the forecast charts up. They’ll have to wait until after the close. I’ve been distracted by the melt-up, checking and re-checking my charts to see what I might be missing.

My apologies for the delay in getting the forecast charts up. They’ll have to wait until after the close. I’ve been distracted by the melt-up, checking and re-checking my charts to see what I might be missing.

continued for members… (more…)

Will it pop and drop, again, or will this one take?

Will it pop and drop, again, or will this one take?