ORIGINAL POST: 9:25 AM

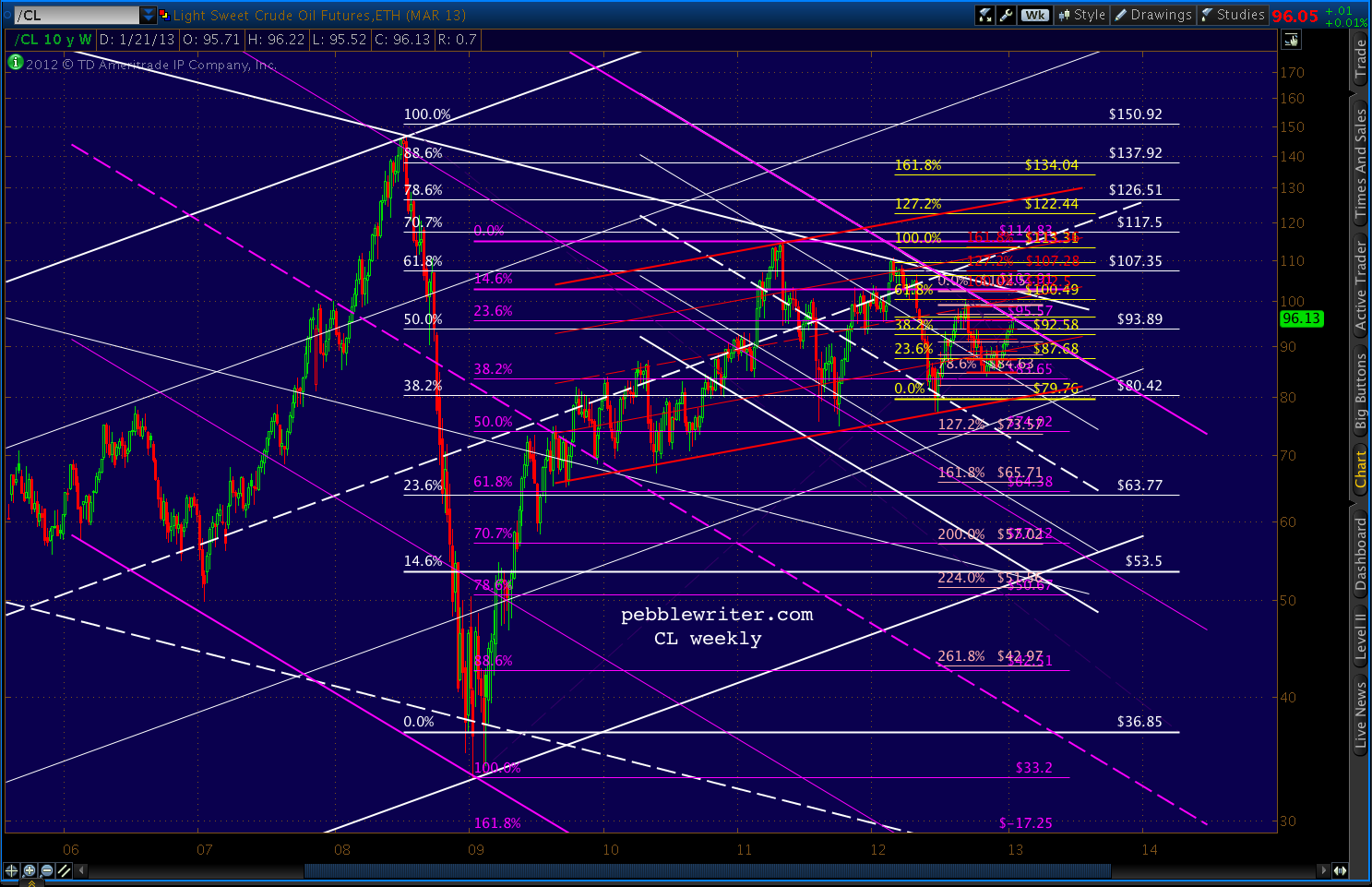

The EURUSD is still trying to change trajectories (purple channel to red), but hasn’t been able to break out yet.

The dollar is similarly facing a change in direction if the red channel can hold.

The dollar is similarly facing a change in direction if the red channel can hold.

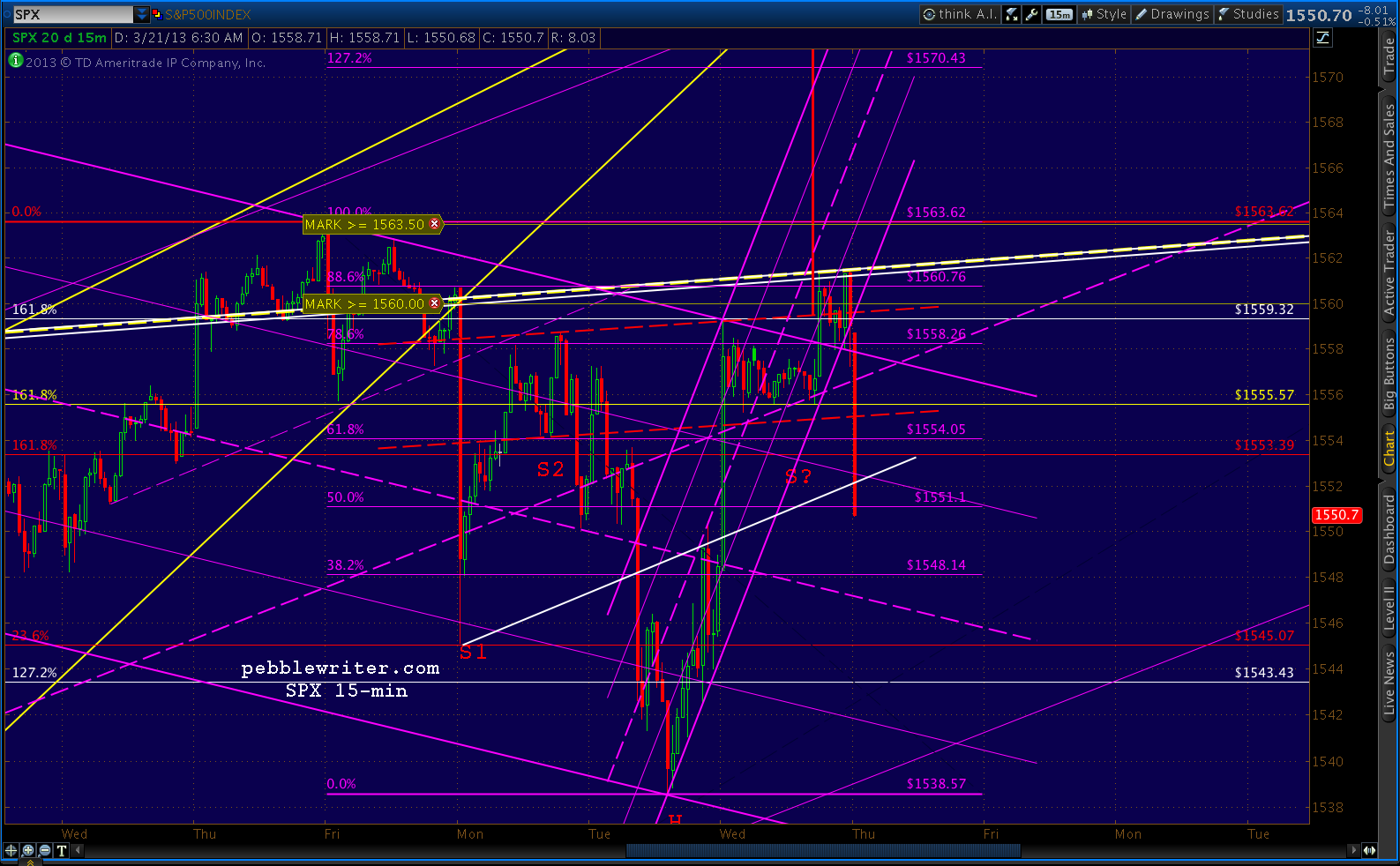

Judging from the futures, SPX is set to react off the neckline and TL we’ve been talking about for several days. Though, daily RSI still shows a little more upside potential.

I’ll play along on the downside, but will be looking to see if it gains support at the purple channel midline.

UPDATE: 09:23 AM

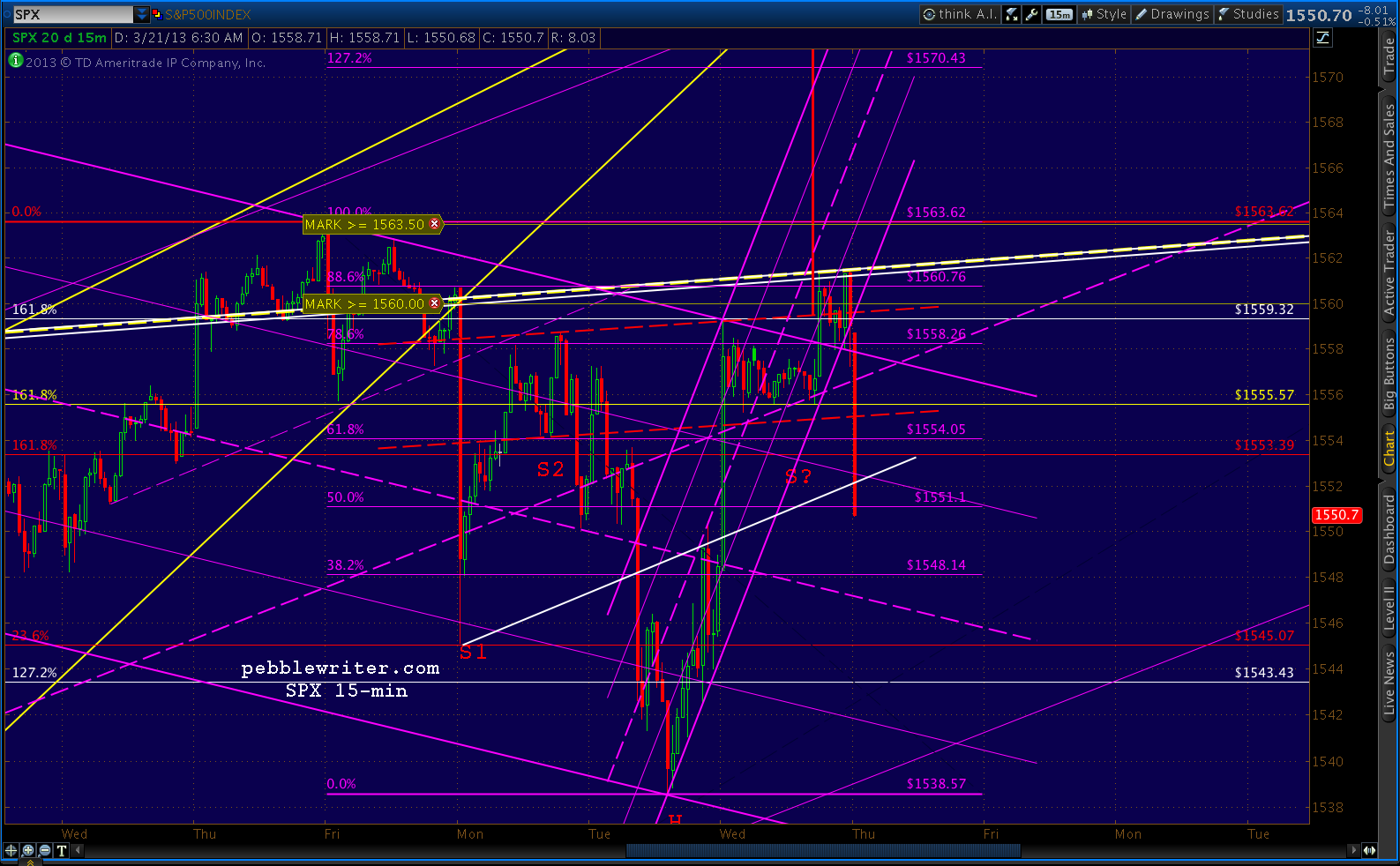

That should do it for the short side, going full long again here at 1550.7 with stops at 1548ish. Always fun, trying to catch a falling knife…

The 15 min RSI shows support with SPX here at the .500 Fib.

Fresh charts in a few…

Fresh charts in a few…

UPDATE: 9:50 AM

If SPX reverses here, it leaves a much nicer right shoulder for the IH&S we discussed yesterday. And, the revised purple channel looks more sustainable.

Existing home sales, Philly Fed and Leading Economic Indicators are due out at 10 EDT.

Existing home sales, Philly Fed and Leading Economic Indicators are due out at 10 EDT.

UPDATE: 10:01 AM

Data better than expected on Philly Fed and Conference Board Leading Indicators, a miss on NAR existing home sales.

The leading indicators look a lot more positive than the current, which barely moved.

The leading indicators look a lot more positive than the current, which barely moved.

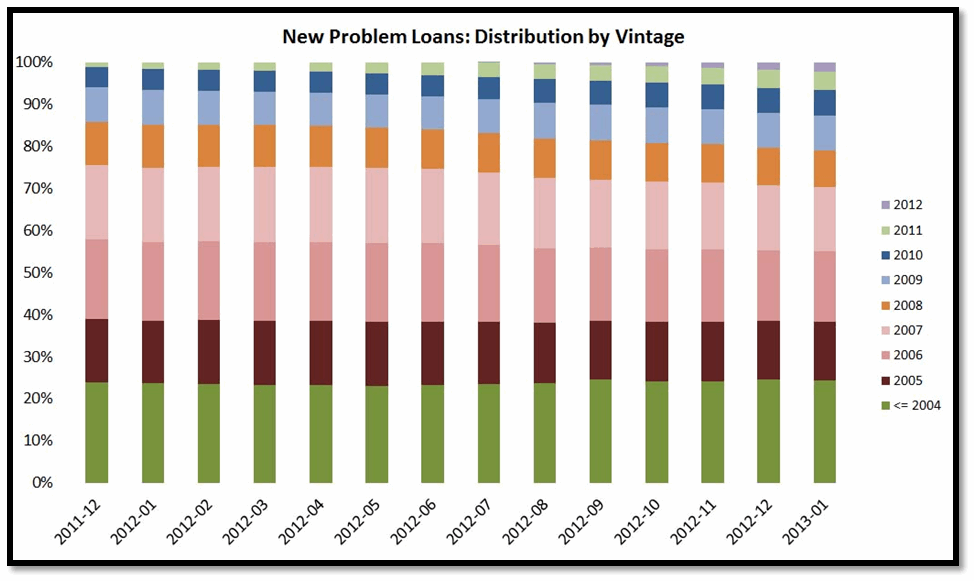

No charts for the NAR, but sales came in at 4.98 million vs expectations of 5.0 million. Inventory increased from 4.3 to 4.7 months, which flies in the face of the most commonly heard argument that a shortage of product was driving prices higher.

There are no doubt pockets of actual product shortages, just as there are many with a huge excess. But, the price increases have more to do with math than with supply and demand at the moment.

The NAR, like everyone else, reports average (median) prices. The entire market could remain at a standstill, but if the bottom 5-10% (in price) of houses are bid up, the average price increases. It wouldn’t affect the average house, just the average price of all houses.

That’s why many average homeowners remain underwater and unable to sell their houses for the asking price despite the “good news” from the NAR/MSM. So, what’s happening to bid up prices on the low end? Enter our friends at the Fed.

As Bloomberg reported a few days ago, big institutional money is chasing single-family homes. With the stock market at all-time highs, bonds at 2% and much of the rest of the world in questionable economic condition, the new bubblicious investment is housing.

Blackstone, which put $3.5 billion to work buying 20,000 houses, just increased its credit line by another $1.5 billion. Colony Capital owns 7,000 units and is raising another $2.2 billion. American Homes-4-Rent owns 10,000, and is buying up more.

Institutions represent a large percentage of the buyers in many markets which have rebounded the most: Miami (30%), Phoenix (23%), Charlotte (21%), Las Vegas (19%.) But, will the dead cat bounce translate into profits for investors?

As fools rush in, rents are falling in many of the markets in play — making it tough to derive much cash flow. Colony Capital will be buying another $2.2 billion worth of houses, even though their current portfolio occupancy is only 53%. In an environment of 2% 10-year treasuries, the 4-5% cash-on-cash yield might look pretty good — especially coupled with some degree of inflation protection.

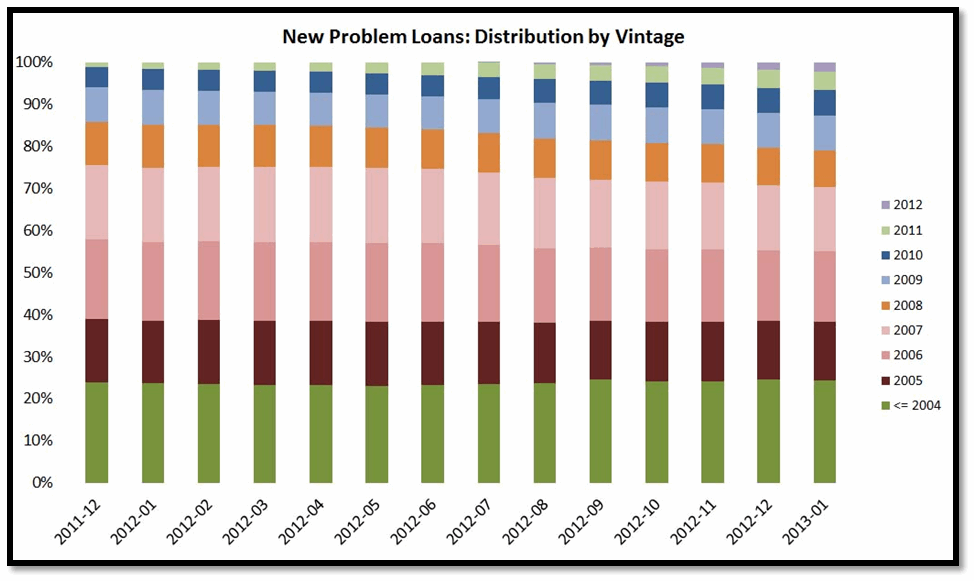

I can’t help but think this is another big bubble in the making — courtesy of the Fed’s ZIRP. Even after 5,000,000 foreclosures since the 2006 peak, new delinquencies continue to surface — including a steady contingent of older, more seasoned loans as this LPS chart shows:

Global Economic Intersection ran a nice piece Tuesday posing a thought-provoking idea:

Global Economic Intersection ran a nice piece Tuesday posing a thought-provoking idea:

“The housing market is therefore the hostage of economic growth and not the signal of economic growth.”

The evidence of yet another liquidity-fueled, lack-of-any-better-alternatives bubble is here. Investors must decide whether to button their chin straps and get in the game, or watch from the sidelines as the greater fools slug it out the red zone. Stay tuned.

UPDATE: 2:05 PM

With the move down through 1548, I gave SPX a little more wiggle room to the .618 of the last move up at 1547.35. It bounced, but couldn’t hold, prompting me to take a short-term short to cover my core long position.

I’m closing the short here at the .786 of 1543.75 for a small gain. More charts, revised channels coming up.

The bullish case needs 1546.27 to hold firm.

The bullish case needs 1546.27 to hold firm.

UPDATE: 2:30 PM

Hard to keep up with charting this morning, with things moving rather quickly and dropping a little further than I expected. Looks like the .786 will hold, but let’s make that the new stop.

The 60 min RSI has found midline support at a potential falling channel (purple) and a rising channel which isn’t as convincing as I’d like (yellow.)

UPDATE: 5:30 PM

UPDATE: 5:30 PM

Weakness everywhere around the close. I’m going to lay out the bullish and bearish scenarios, but from a chart pattern standpoint, this is a toss-up.

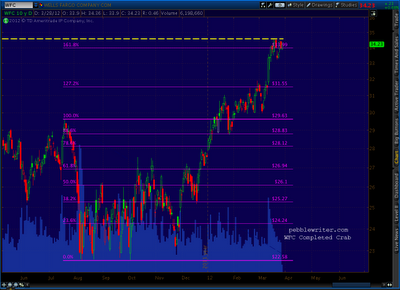

Taking a look around the indices, I see a lot of indices at make or break points. I just revisited RUT, a great case in point. Drawn from the 98 and 02 lows, one channel makes a great case for the upside being done.

The daily chart CU shows just how precisely we’ve tagged the top of that channel and the TL’s the make up the rising wedges.

The daily chart CU shows just how precisely we’ve tagged the top of that channel and the TL’s the make up the rising wedges.

Drawing the channels off the 98 and 09 lows, however, shows RUT has already pushed above and backtested the channel top (in purple.)

Drawing the channels off the 98 and 09 lows, however, shows RUT has already pushed above and backtested the channel top (in purple.)

Throw in some Harmonic Patterns and things get really interesting…

Throw in some Harmonic Patterns and things get really interesting…

There was a big reversal at the .786 of the 2007-2009 crash, so we should expect a Butterfly Pattern to play out at the 1.272 of 996.26, right?

But, look at all the TL’s of resistance we’d have to push through first…

But, look at all the TL’s of resistance we’d have to push through first…

Besides the trend lines, the purple 1.618 hasn’t really caused a reaction yet. The white 1.618 has, but not much of one. And, note that the yellow pattern calls for a run to the 1.618 at 1033. Mixed signals, to say the least.

Besides the trend lines, the purple 1.618 hasn’t really caused a reaction yet. The white 1.618 has, but not much of one. And, note that the yellow pattern calls for a run to the 1.618 at 1033. Mixed signals, to say the least.

More in the morning…

Bernanke’s 2014 words came back to me as I did the math.

Bernanke’s 2014 words came back to me as I did the math.