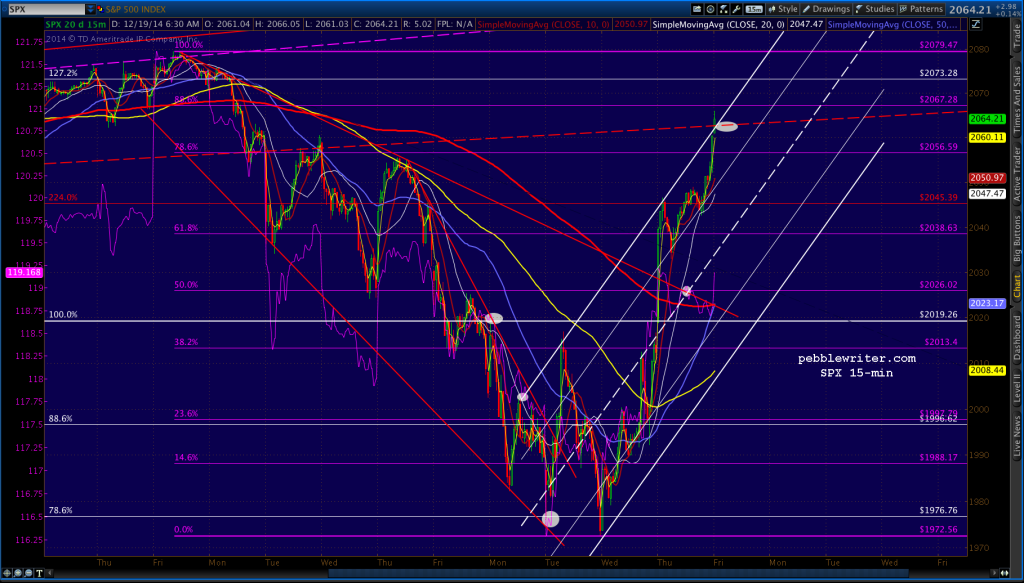

SPX reversed as expected at the SMA20, but didn’t quite reach the optimal backtest of the megaphone pattern (2033 v 2026.) From Tuesday’s update:

As for key levels, look for resistance at the SMA10 (2040, also the purple .618) and SMA20 (2050.) The more important level is probably the red TL — currently around 2060 — and then the former high and white neckline.

And, as updated yesterday morning:

So, we’ll look for a reversal at the SMA20 (currently 2046.84) and count the .618 and SMA10 as support for the first pullback.

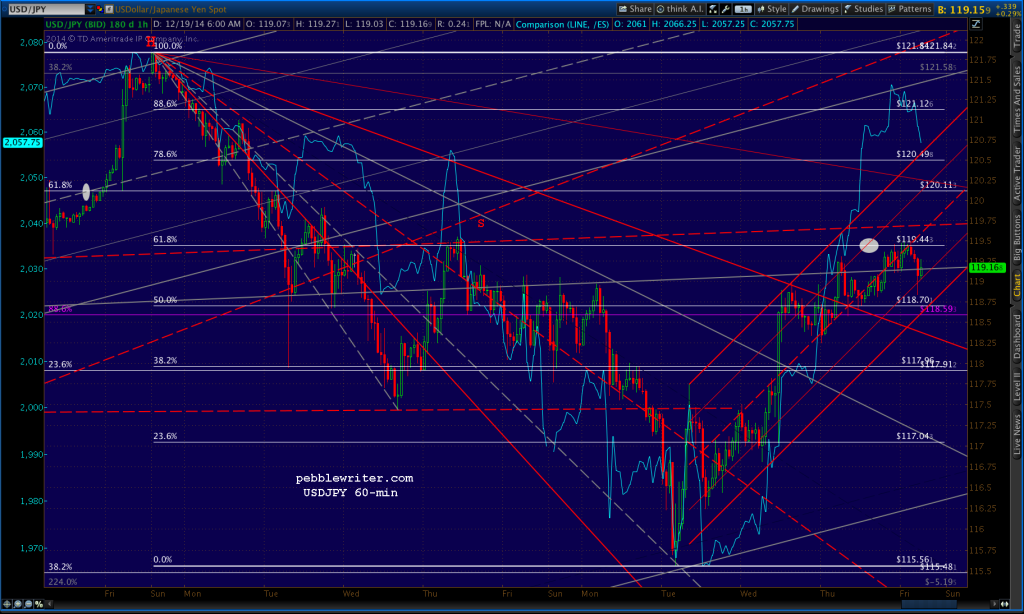

We’ll tag the red TL on the opening. The only question is whether SPX will take a breather there or run on up and tag the .886 (2067) before taking a breather. The key, as usual, is USDJPY — which just reached the .618 on its white grid.

We’ll tag the red TL on the opening. The only question is whether SPX will take a breather there or run on up and tag the .886 (2067) before taking a breather. The key, as usual, is USDJPY — which just reached the .618 on its white grid.

It’s reversing, but should remain in the rising red channel — which would mean not too much of a reversal here for it or for SPX.

It’s reversing, but should remain in the rising red channel — which would mean not too much of a reversal here for it or for SPX.

UPDATE: 09:40

SPX just reached 2066, close enough for government work. Should see it settle back from here. Targets coming up.

Sorry, this content is for members only.Click here to get access.

Already a member? Login below… |