Note: I will be on the road Wednesday and Thursday and will have a tough time posting throughout the day. The best I’ll probably be able to do is to post after hours, but I will look for opportunities to sneak in a comment here or there. GLTA.

* * * * *

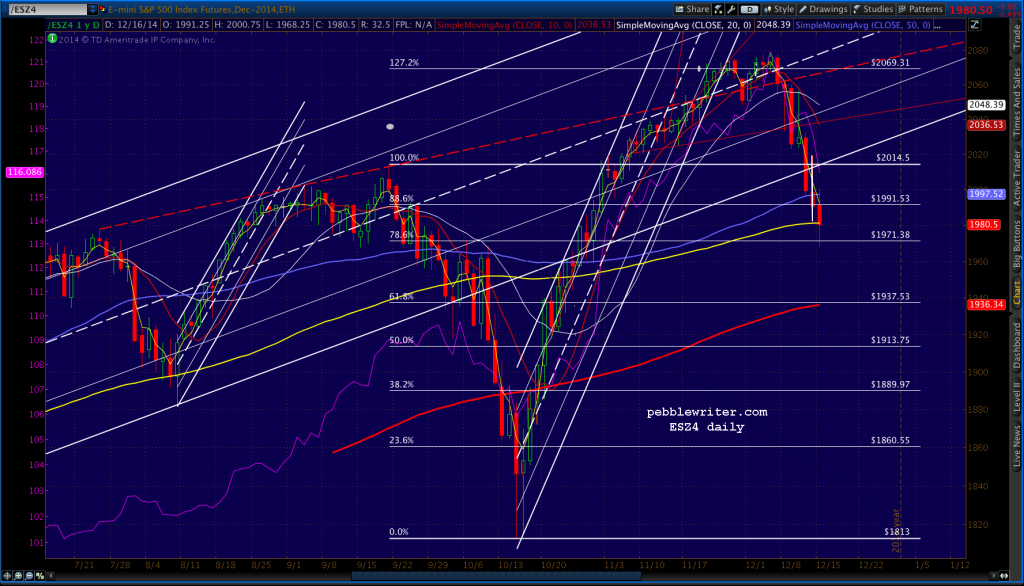

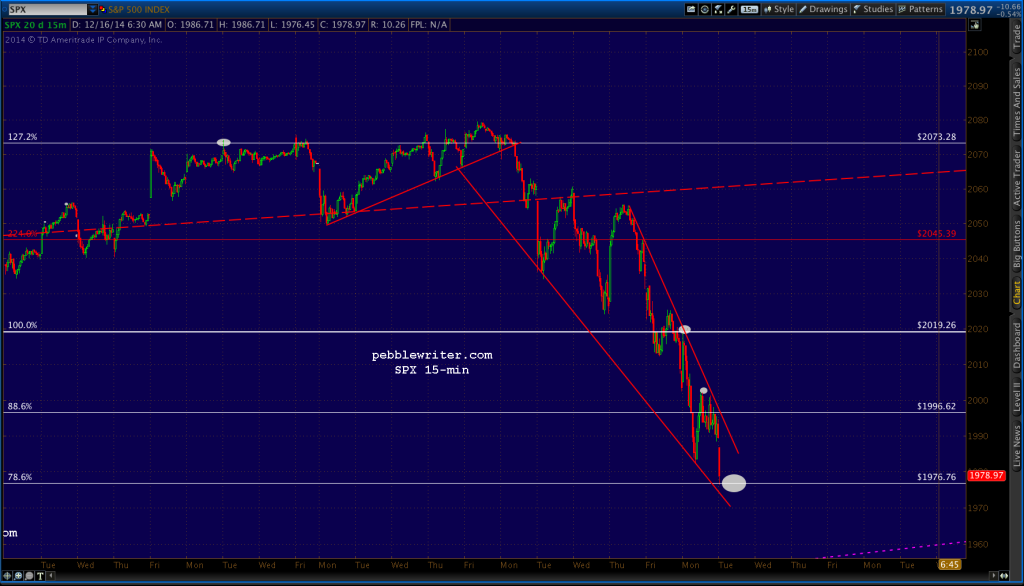

SPX maxed out at our 2019 target yesterday, and appears headed for our downside target of the .786 Fib. From yesterday’s post:

SPX should test 2019 — the previous high and the red channel top. I’d be mildly surprised if we didn’t get a reversal there — whether or not it eventually breaks out… Assuming we get a reversal at 2019, what next? It’s entirely plausible that SPX drops lower and actually tags the .886 at 1996 or even the .786 at 1976. The 50-day and 100-day moving averages are currently around 2002 and 1988, so that’s a nice cluster of support.

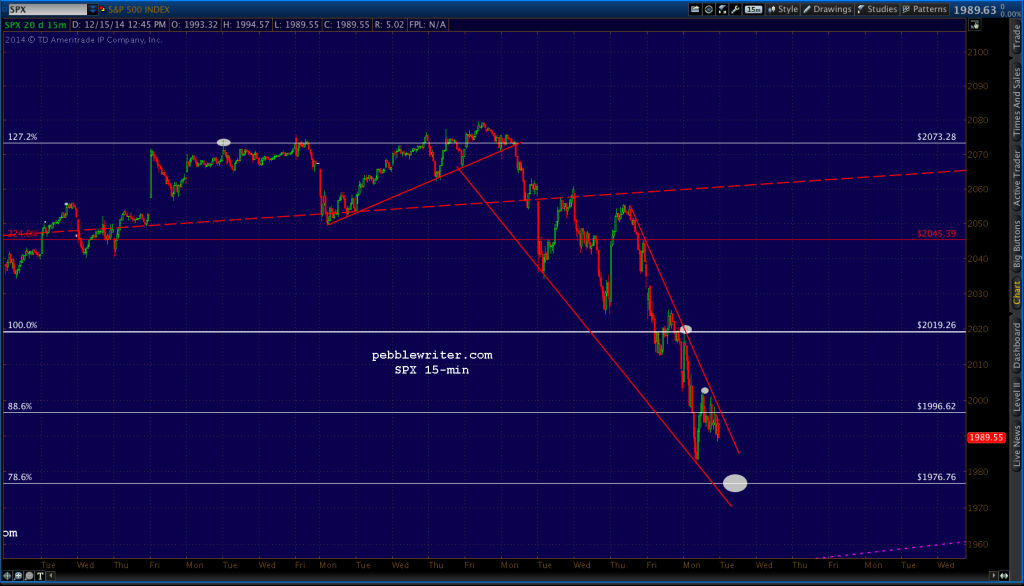

After reversing, SPX went down and dutifully tagged the SMA100. From there, it bounced to the SMA50 as we expected. From the 11:30 update:

After reversing, SPX went down and dutifully tagged the SMA100. From there, it bounced to the SMA50 as we expected. From the 11:30 update:

I think it would be worth trying a long position here (1989) for a good-sized bounce, but with tight stops. Just watch for ping-ponging, as the SMA50 at 2001.37 is now resistance.

After SPX reversed at 2002, we took a shot at the next leg. From the 3:20 update:

After SPX reversed at 2002, we took a shot at the next leg. From the 3:20 update:

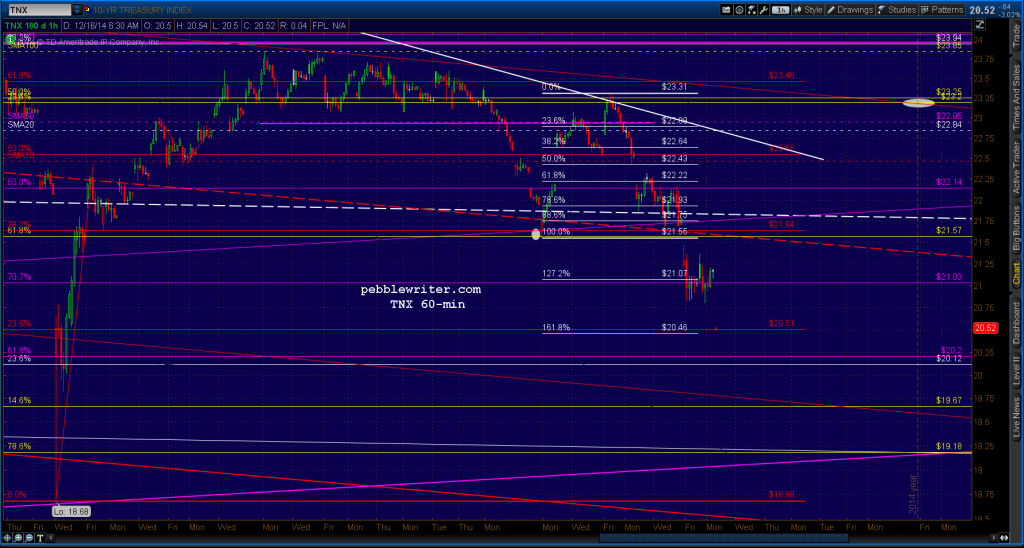

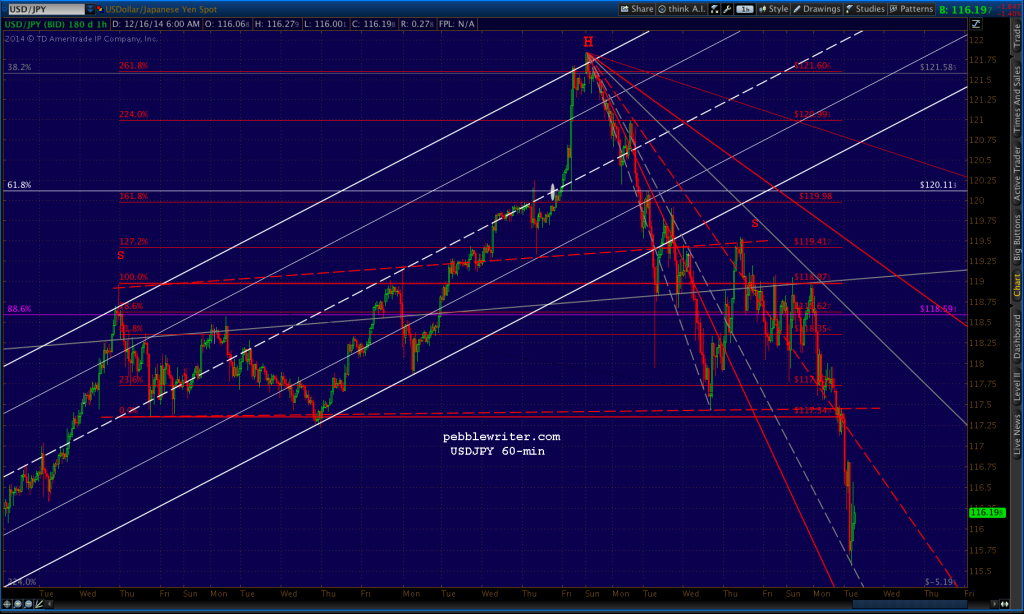

My best guess is it goes down and tags the .786 to coincide with 10-yr yields slipping a little further (2.05%) and maybe even a dip to or below 117.45 for USDJPY.

The 10-yr note nailed 2.05% this morning. USDJPY has certainly broken 117.45. If SPX is to hold, USDJPY should get busy backtesting or pushing back above the H&S neckline.

USDJPY has certainly broken 117.45. If SPX is to hold, USDJPY should get busy backtesting or pushing back above the H&S neckline.

And, the futures have accommodated with a .786 tag. We’ll see if the cash market follows suit.

And, the futures have accommodated with a .786 tag. We’ll see if the cash market follows suit.

SPX was right on the money, tagging the .786 in the opening minute of trading. From here we should get a nice bounce, as long as USDJPY plays along and scurries back to the neckline of the newly completed H&S Pattern (see chart above.)

If there’s one thing I’ve learned from the past year, it’s that chart patterns and Fibonacci levels have been much more effective when the market is being allowed to run. That is to say, when the “market” isn’t being propped up or forced higher.

If there’s one thing I’ve learned from the past year, it’s that chart patterns and Fibonacci levels have been much more effective when the market is being allowed to run. That is to say, when the “market” isn’t being propped up or forced higher.

And, as I’ve learned the hard way, any serious decline that comes along is only occurring because TPTB have decided to allow it to occur (after they’ve positioned themselves accordingly, of course.)

It won’t always be this way. Eventually, things will get out of hand as they did in the summer of 2011 (to a point.) The timing of such an event will be tough to predict — but hopefully not impossible.

When I start nailing downside and intra-day targets as I have the past two weeks, it’s probably time to expect a massive rally that defies traditional patterns and technical analysis. New targets coming up shortly.

continued for members…

Sorry, this content is for members only.Click here to get access.

Already a member? Login below… |