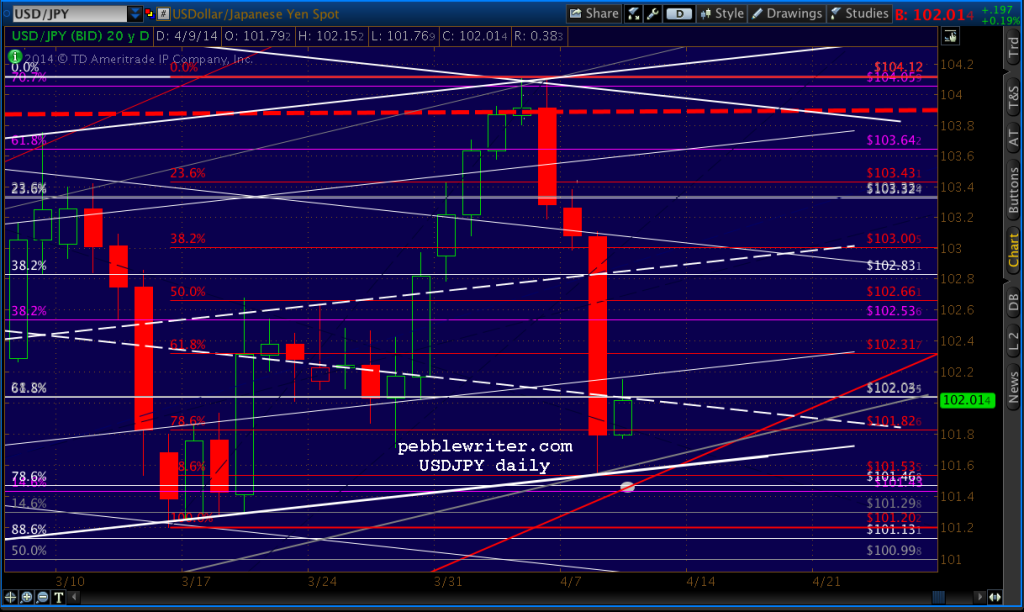

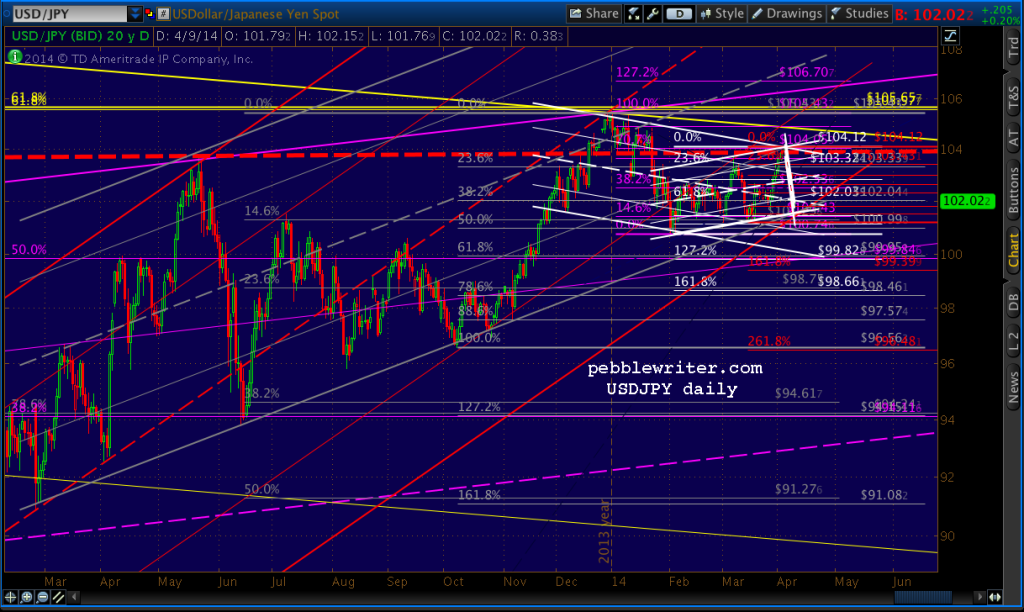

USDJPY plunged to 101.54 yesterday — very close to our 101.50 target. It bounced at the red .886 retracement, a legitimate spot. So, we could be in for a bounce, or we could see another small wave down first.

Such a drop to the white target would, IMO, better flesh out the rising red channel — but, it’s already close enough that investors might consider the move done. Interestingly, though, the bounce we’ve seen so far is having trouble rising back above the white channel midline.

Such a drop to the white target would, IMO, better flesh out the rising red channel — but, it’s already close enough that investors might consider the move done. Interestingly, though, the bounce we’ve seen so far is having trouble rising back above the white channel midline.

So, we’re left with a fight between rising channel bottoms (red, gray and white) and the falling white channel midline.

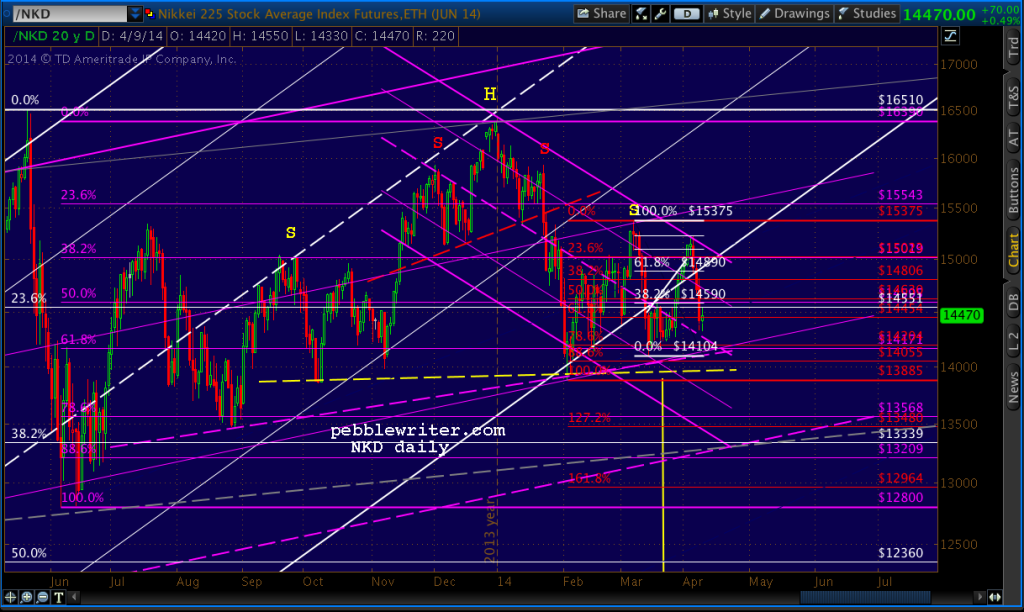

I’m keeping an eye on the Nikkei, as it’s back below channel support and appears likely to continue dropping to at least the H&S neckline.

I’m keeping an eye on the Nikkei, as it’s back below channel support and appears likely to continue dropping to at least the H&S neckline.

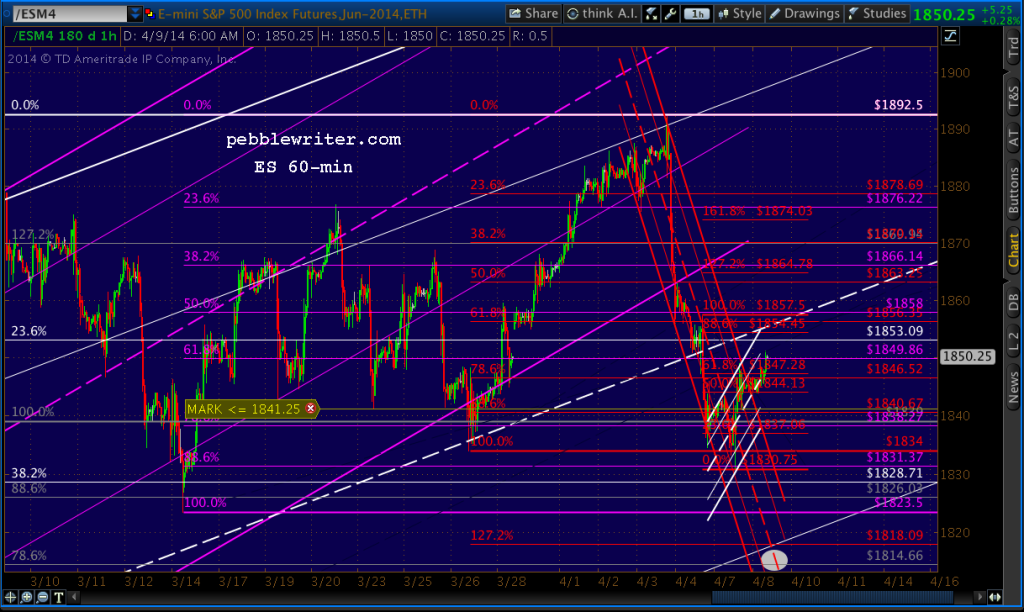

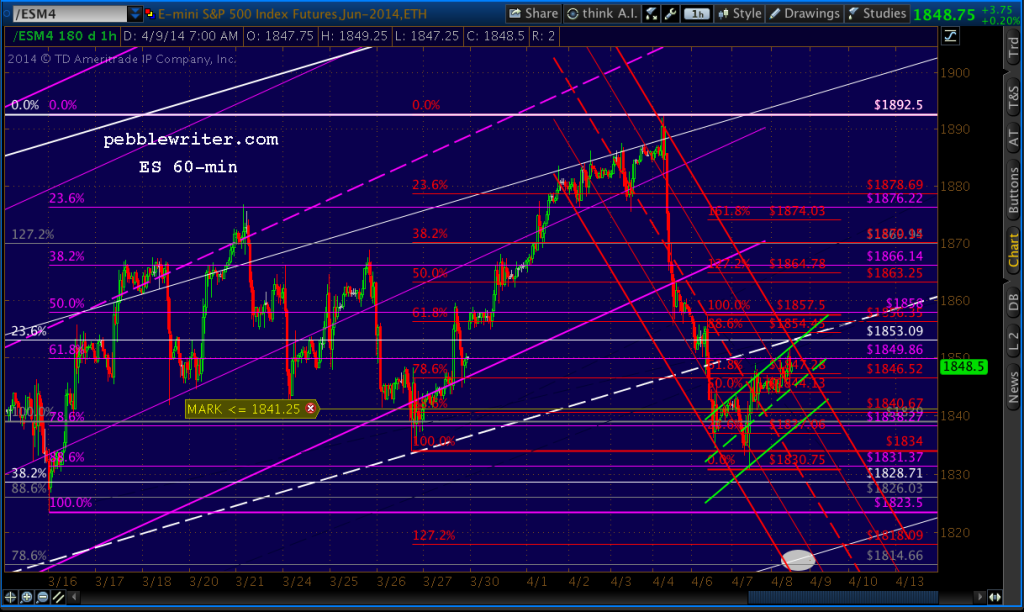

ES is up 5 pts after bouncing, as expected, at the SMA50. Ordinarily, I’d say the bounce should reach at least the broken white channel midline. But, the USDJPY might keep a lid on things. We’ll find out shortly.

ES is up 5 pts after bouncing, as expected, at the SMA50. Ordinarily, I’d say the bounce should reach at least the broken white channel midline. But, the USDJPY might keep a lid on things. We’ll find out shortly.

The white midline held so far. So, we’ll set our sights on a deeper retrace or a last wave lower for a more meaningful bounce.

One caveat: as we’ve discussed for months, the yen carry trade is huge. If enough players rush the exits all at once, forget about all those channels holding. It’s a long way down — for USDJPY and for equities.

This is our medium-term thesis, and I suspect it to play out sooner rather than later. In other words, a bounce is by no means assured. It all boils down to how well TPTB can keep things under control.

ES is building a nice little flag pattern — and sputtering near the backtest of the rising white midline.

ES is building a nice little flag pattern — and sputtering near the backtest of the rising white midline.

USDJPY just backtested the latest fib fan line at the .382.

The Fed minutes aren’t due out until 2pm EDT, so the pair has some time to kill. ES is stuck right at the midline — about .382 of the drop from 1892.5 to 1830.75.

The Fed minutes aren’t due out until 2pm EDT, so the pair has some time to kill. ES is stuck right at the midline — about .382 of the drop from 1892.5 to 1830.75.

My best guess is the market will react negatively — based on the fact that the initial reaction to the Fed statement [READ IT] back on Mar 19 was a 25-pt drop. But, that drop was erased by a massive Plunge Protection Team effort, and a ramp job that carried into the following morning when the press trumpeted a bevy of mixed (at best) economic news.

Here’s an updated forecast. (continued for members)

Sorry, this content is for members only.Click here to get access.

Already a member? Login below… |