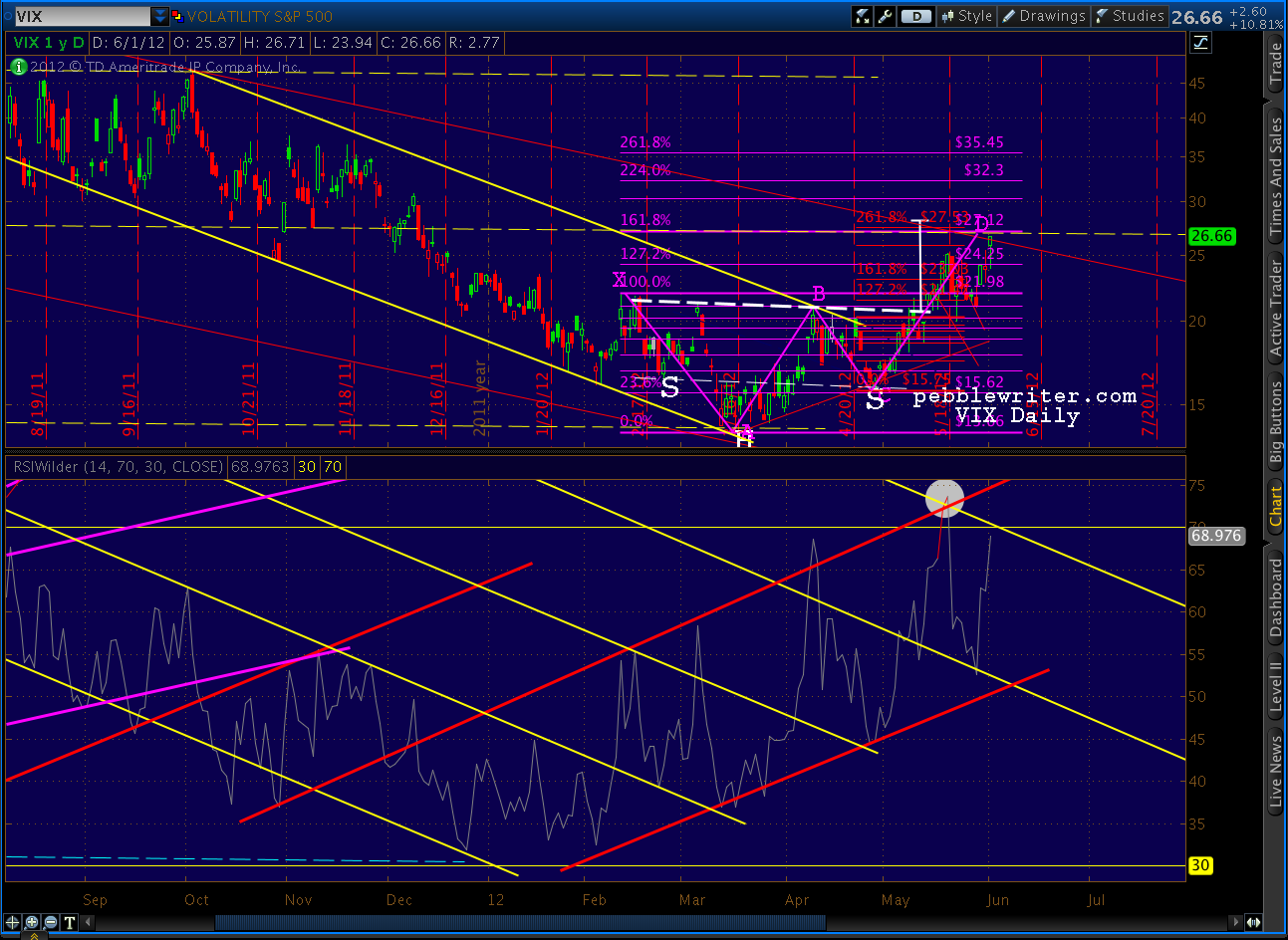

VIX has very nearly reached the channel mid-line, Inverse H&S and Crab pattern targets I posted back on April 18 [see: VIX at a Crossroads], though we’re 2 days behind schedule.

Our IHS target was 28.10 and the Crab pattern target was 27.12, expected to occur on May 30.) Friday’s high was a very close 26.71. It’s close enough to be considered complete, but a little follow through Monday morning would tie things up in a nice neat bow.

Our IHS target was 28.10 and the Crab pattern target was 27.12, expected to occur on May 30.) Friday’s high was a very close 26.71. It’s close enough to be considered complete, but a little follow through Monday morning would tie things up in a nice neat bow.

continued below…

Note the red, dashed RSI trend line on the weekly chart above which, along with the channels drawn on the VIX itself (first chart above), also suggest a reversal.

BTW, Friday’s high of 26.71 was only a few pennies away from the .382 retracement of the 48 to 13.66 drop since last August. We’ll keep an eye on it as a possible Point B for a future Bat or Crab pattern. Remember, a Bat completes at the .886, which would be 44.09.

The upper channel line crosses 44 sometime around May 2013, though it’s speculative that we’ll tag it at all let alone exactly on time. First things first — meaning a reversal right about here.

The daily RSI, which has done a stellar job at keeping us right on track, tagged the little pink circle right on time, and could be tracing out a new channel to the downside if stocks are, indeed, bottoming. The alternative is another tag of the red TL at a higher level before turning down — though the current negative divergence is more in keeping with my other forecasts.

An ideal .618 retracement of the difference between A and D indicates a downside of 16.84, realistic if stock market takes off again. I’ll be watching the thin red channel line to see if prices stay contained within it. The previous tags within the big red, dashed channel have left unconventional harmonic patterns — where Points C came in lower than corresponding Points A. A repeat would take us back below 13.66, but that’s getting ahead of ourselves.

BTW, there’s an excellent post on the McClellan website that graphs out the spike in treasury bond futures which has prices up against the upper bound of a channel going back to 1960. Very worth your time heading over there and checking it out.

Comments

One response to “Channeling VIX”

Hello PW, two or three days ago, you mentioned that you’ll have to say goodbye to the analog, as SPX dropped below 1291. (the March 2011 SPX had a bounce after hitting a low point, while May 2012 did not behave the same. The May 2012 drop is still searching for a bottom. After hitting1292, it tested1277. It might go even lower)

Does it mean the target 1472 is no longer achievable?