ORIGINAL POST: 11:00 AM

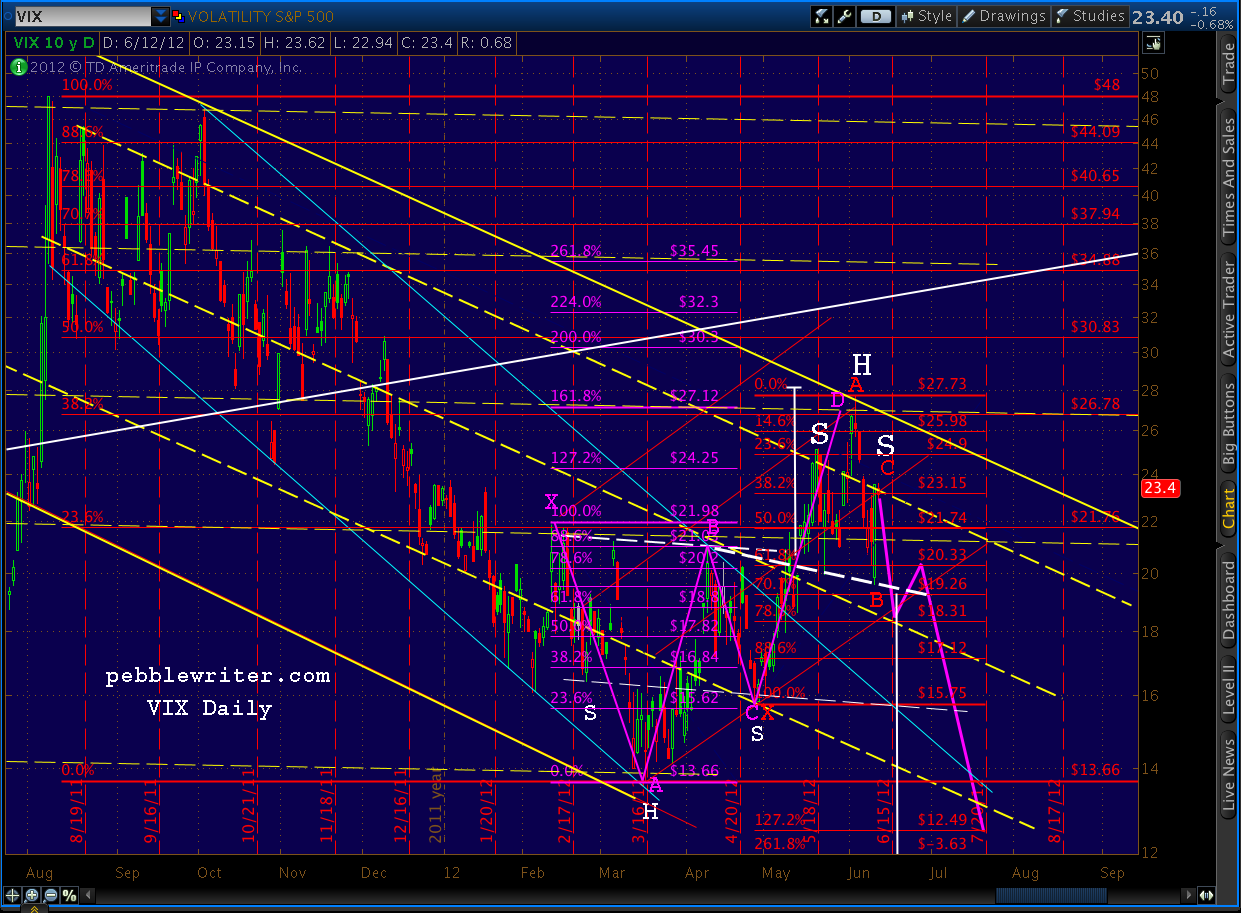

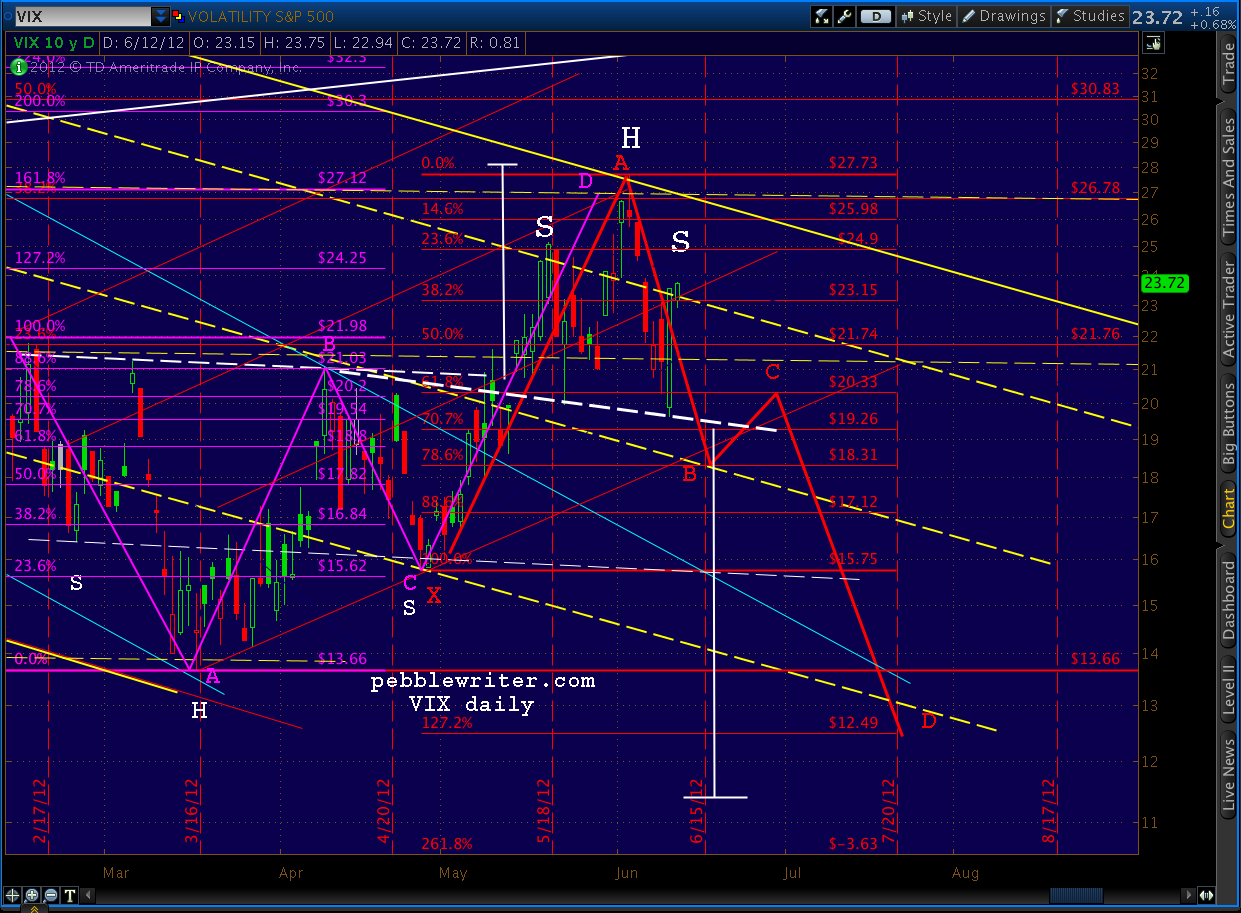

With all the volatility these past few days, VIX has put on a spectacular show — gaining 3.69 yesterday alone (18.6%). The weeks ahead promise to be just as exciting, but not for the reasons most expect.

As discussed back on June 2 [see: Channeling VIX] the “fear index” was on track to complete a Crab Pattern (in purple below) and fulfill its Inverse Head & Shoulder pattern target. These were targets originally set back on April 18 [see: VIX at a Crossroads.] With VIX at 18.70, we forecast a high of 27.13.

It topped out at a nearly perfect 27.73 on the 4th and has been sliding ever since — with yesterday being the notable exception. Now, as many investors are wondering which way is up anymore, we’ll plot out what appears to be a very clear path forward.

It topped out at a nearly perfect 27.73 on the 4th and has been sliding ever since — with yesterday being the notable exception. Now, as many investors are wondering which way is up anymore, we’ll plot out what appears to be a very clear path forward.

continued…

VIX is in the process of forming a H&S topping pattern that should complete within the next few days around 19.50 — though it’ll probably dip a little lower, say 18.31, before back testing the pattern.

A tag of 18.31 will constitute a Point B in a Butterfly Pattern (in red above), the completion of which will be 12.49. This comes in reasonably close to the H&S target of 11.40 — which I don’t believe we’ll quite hit. Looking closely, there’s a channel line and a long-term TL that intersect right around 12.49 in the vicinity of July 20 — our target date for the next equity high.

A tag of 18.31 will constitute a Point B in a Butterfly Pattern (in red above), the completion of which will be 12.49. This comes in reasonably close to the H&S target of 11.40 — which I don’t believe we’ll quite hit. Looking closely, there’s a channel line and a long-term TL that intersect right around 12.49 in the vicinity of July 20 — our target date for the next equity high.

Recall that the SPX forecast floated yesterday [see: SPX Big Picture] envisions a double top of around 1422 on July 20 (though I think we’ll likely hit 1433.) We’ll keep an eye on SPX, of course, but VIX trending towards 18.31 as the week progresses will be a good sign that our overall forecast is still on track.

Stay tuned.