Yesterday, CL and USDJPY had already edged above technical resistance in the pre-market…

…when Fed president Kocherlakota added fuel to the fire by floating the idea of QE4. It was deft timing, as SPX needed help getting past bearishly aligned moving averages.

…when Fed president Kocherlakota added fuel to the fire by floating the idea of QE4. It was deft timing, as SPX needed help getting past bearishly aligned moving averages.

It nearly came undone a few hours later, however, when atrocious consumer credit numbers hit the tape.

Only a trading halt prevented a truly ugly close and a slip back below the moving averages. Funny how often that happens, and so rarely when stocks are rallying sharply…

Only a trading halt prevented a truly ugly close and a slip back below the moving averages. Funny how often that happens, and so rarely when stocks are rallying sharply…

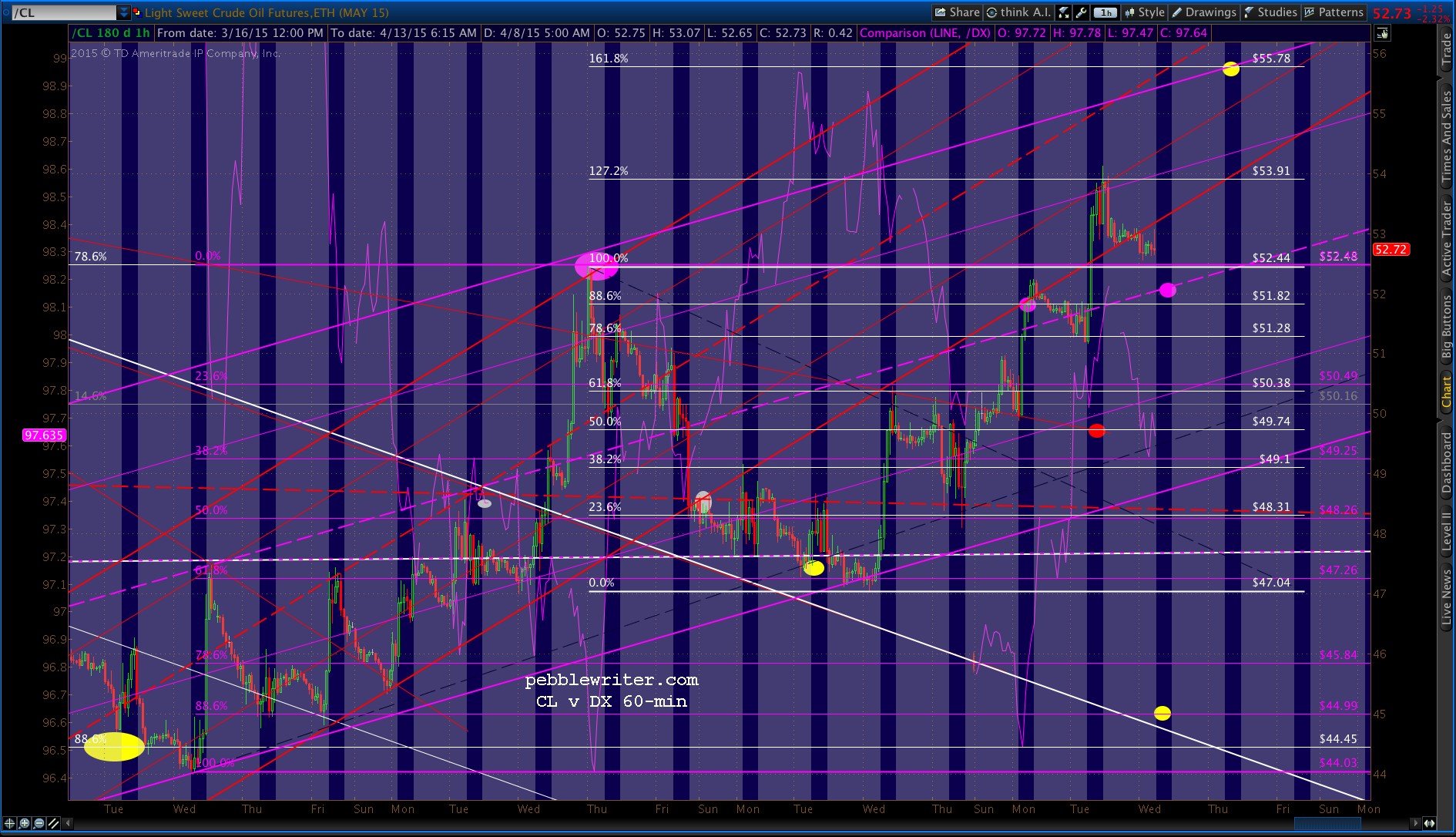

This morning, USDJPY remains above the falling red channel, CL remains above the white .786 Fib and SPX remains above its 10, 20 and 50-day moving averages. So, no harm done — yet.

This morning, USDJPY remains above the falling red channel, CL remains above the white .786 Fib and SPX remains above its 10, 20 and 50-day moving averages. So, no harm done — yet.

continued for members…

Sorry, this content is for members only.Click here to get access.

Already a member? Login below… |