June 10, 2012

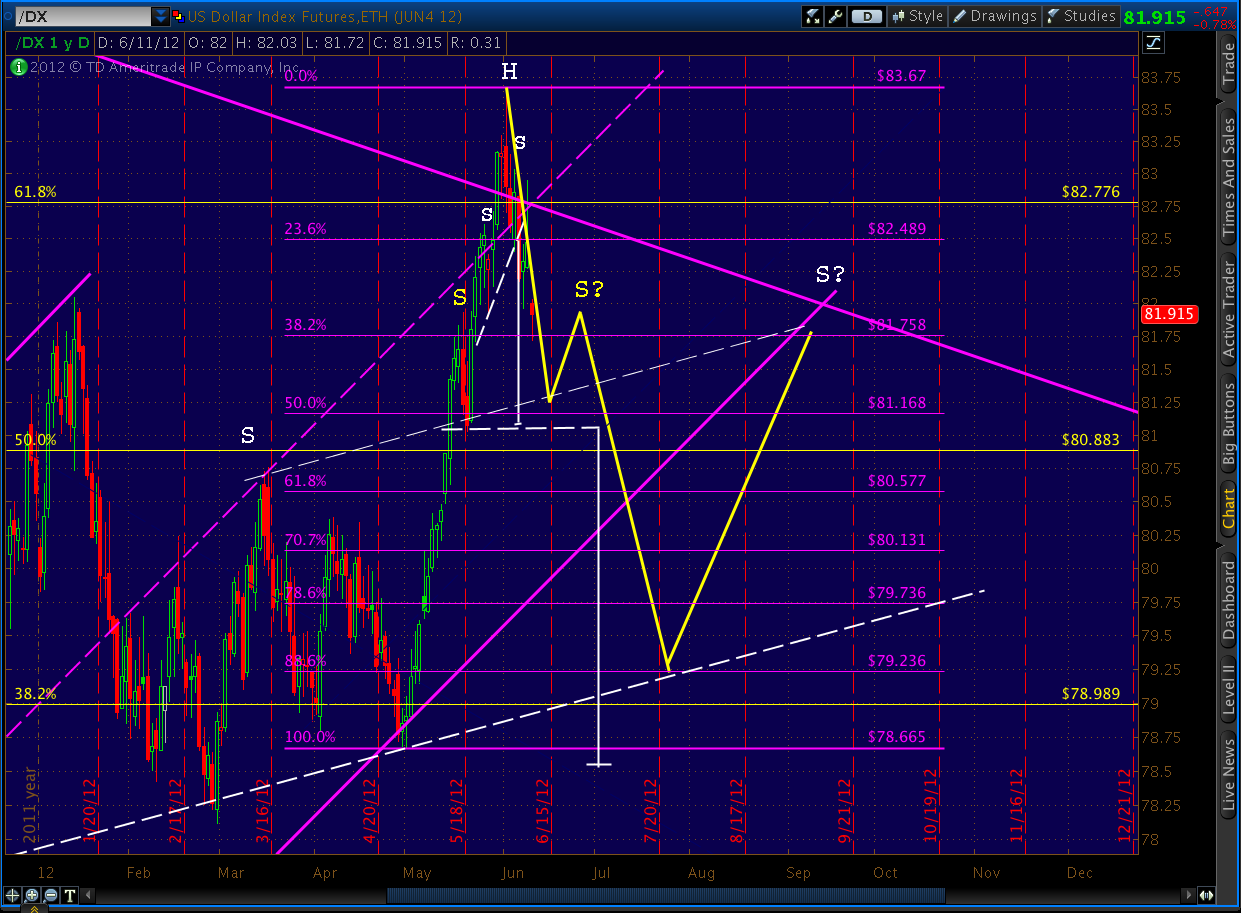

DX flirted with breaking the big purple channel dating back to 1999, but in the end backed off as we expected.

It’s clear from even a casual glance that DX has to choose between the big purple channel and the smaller one (yellow, dashed) cutting across its mid-section.

It’s clear from even a casual glance that DX has to choose between the big purple channel and the smaller one (yellow, dashed) cutting across its mid-section.

Since reversing as expected on June 1 [see: Why I’m Buying] DX has done a great job of following our forecast very precisely. Recall that we were watching for a H&S top at the .618, followed by a series of additional H&S patterns in a cascading effect.

Since reversing as expected on June 1 [see: Why I’m Buying] DX has done a great job of following our forecast very precisely. Recall that we were watching for a H&S top at the .618, followed by a series of additional H&S patterns in a cascading effect.

continued…

Following this first one that played out right on schedule, the next should establish a neckline parallel to the lower TL already established (below), hitting bottom around June 15th before putting in a lower high and forming another right shoulder that sets up another, much bigger plunge.

Following this first one that played out right on schedule, the next should establish a neckline parallel to the lower TL already established (below), hitting bottom around June 15th before putting in a lower high and forming another right shoulder that sets up another, much bigger plunge.

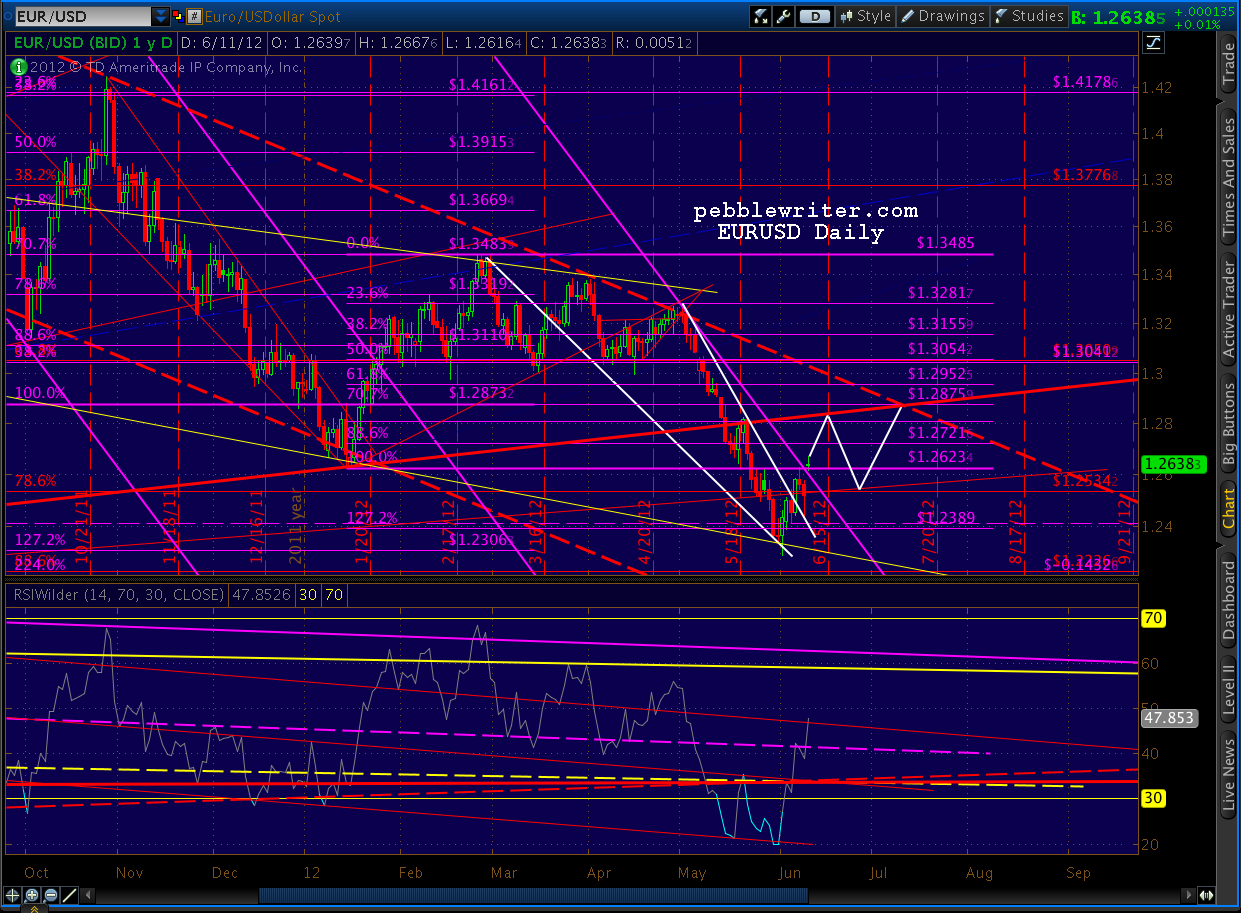

This pattern works nicely with the fan lines already in place, as well as the RSI channels, etc. And, it works very nicely with the EURUSD forecast.

This pattern works nicely with the fan lines already in place, as well as the RSI channels, etc. And, it works very nicely with the EURUSD forecast.

I suspect the euphoria over the Spanish bailout will be relatively short-lived. After all, putting the rest of the eurozone in harm’s way seems like a better way to get them downgraded than it does Spain upgraded.

I suspect the euphoria over the Spanish bailout will be relatively short-lived. After all, putting the rest of the eurozone in harm’s way seems like a better way to get them downgraded than it does Spain upgraded.

In the weeks ahead, I’m expecting a decent sell-off in DX — bottoming out around the 15th, and again in mid-July.