A lot of folks get that wrong. They talk about Japan’s “deflation trap”, as though everything would be just great if only Japan could just manage to get inflation back above 2%.

In Japan, as in the US and the eurozone, inflation has been defined into non-existence. We accept terms like “core inflation, without the volatile food and energy component” as though it actually meant something. Sounds official…even sounds legitimate. It’s not.

There’s plenty of inflation. Just ask the person who does the shopping or pays the bills in most households. Even with the recent oil crash that was engineered to protect the yen carry trade, real inflation at the consumer level is more like 7-8% (for more, check out John Williams’ excellent website.)

No, the real trap that could drop kick Japan’s economy into the Pacific is the outrageous amount of stocks they’ve bought on margin over the past year. I consider it an equity trap.

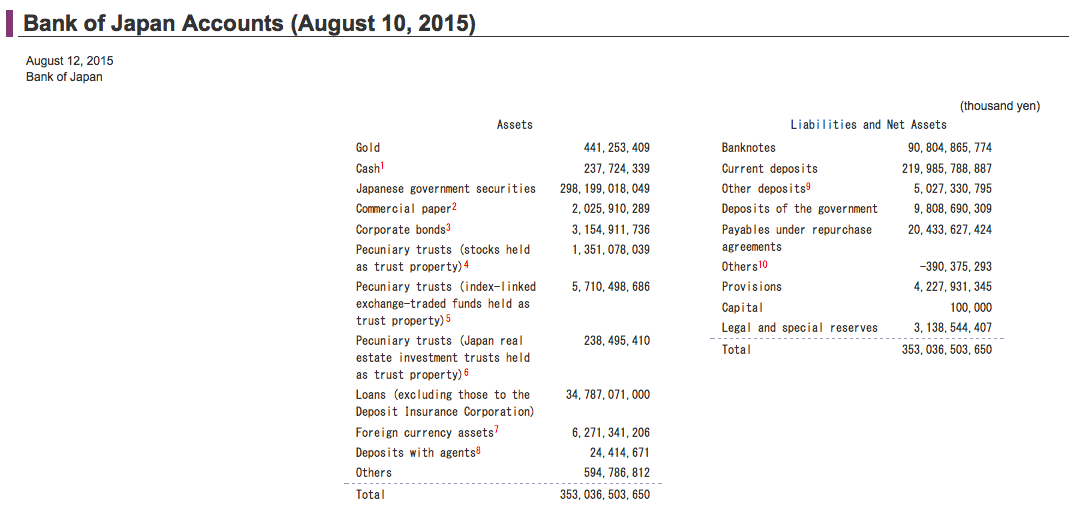

The most recent data show the BOJ owns almost ¥7 trillion in stocks outright. I understand they’re not buying stocks on margin at the local Schwab office. But, when your stocks are 70X your capital, you’re heavily margined.

Not only that, the ¥140 trillion Government Pension Investment Fund has allocated 50% of its assets to stocks.

Not only that, the ¥140 trillion Government Pension Investment Fund has allocated 50% of its assets to stocks.

Let’s round it off and say the bank/government of Japan has an equity position of ¥80 trillion ($666 billion at 120 yen/USD.)

First, note that this almost exactly the amount of annual easing that was announced in last October’s QQE expansion.

More ominously, it leaves Japan in a do-or-die situation. At its lows yesterday, August 24, the Nikkei 225 was off 9.5% from Friday’s close. Not that you’ll hear this on the news, but it’s off a full 18% in less than 2 weeks. I know, I know, it’s China’s fault…

If all of that $666 billion were in the Nikkei, the last two weeks’ exposure to equities would have cost Japan $120 billion — 2.4% of GDP!

Sure, some of it’s on the books of a long-term pension plan, and the rest is presumably not going to be realized anytime soon. But, the data illustrate just how vulnerable Japan is since it: (1) put that much money into stocks; and, (2) is doing so in such a leveraged fashion.

At the end of the day, taking on this much risk smacks of desperation. It’s probably because Japan is desperate. With over 40% (and growing) of Japan’s borrowings going to pay interest on existing debt — which is already over 250% of its (shrinking) GDP — don’t expect things to change anytime soon.

At the end of the day, taking on this much risk smacks of desperation. It’s probably because Japan is desperate. With over 40% (and growing) of Japan’s borrowings going to pay interest on existing debt — which is already over 250% of its (shrinking) GDP — don’t expect things to change anytime soon.

And, don’t expect the BOJ to sit idly by and allow the equity trap expand out of control. They have no choice but to increase QQE and/or devalue the yen again, and soon.

For more on the yen carry trade and why central banks are working to protect it at all costs, check out: The Yen Carry Trade Explained (Why the Rally Won’t Die.)

* * * * *

Enjoy this article? Take advantage of our current membership promotion. Over half off, and your rate is guaranteed to never increase. Now through Aug 29. For more details, see: Sign Me Up!