It has come to my attention that last night’s post was too obtuse. Apparently, the sarcasm was a little too thick for the message to get through. In an effort to be as clear as possible…

Tomorrow is Christmas Eve 2007. If you’ve been following this blog, you know what that means and what to do.

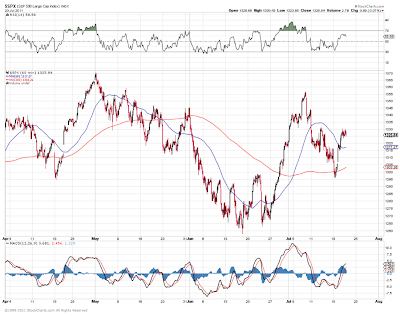

We have maybe 20 points at the most to the upside, with 1340-1344 a reasonable target.

My initial target on the downside is 1280 or so by the first week of August (our channel bottom). Prices should bounce there, then resume a descent to 1160 by the end of August.

I’m 99% sure about the price moves, only 75% sure about the timing. The debt ceiling deal timing remains a wild card and could throw the timing off, much like the petroleum reserve release did to our big move up. I think, after all this, the relief rally will be muted.

The fundamental case is compelling: poor earnings, Euro Zone more problematic than ever, unemployment getting worse, housing still dead, etc. I expect either this or next Friday’s WLI from ECRI to go negative for the first time since last summer.

The only thing that can save this market is another round of QE, which will likely be announced somewhere around SPX 1200. But, we’ll deal with that when the time comes.

Good luck, everyone.

Re earnings, I don't mean they're uniformly bad. Just some big cracks here and there, and gimmicks in a lot of cases.

No worries re the sarcasm. Just want to make sure that everyone who's taken the time to follow what I'm doing here has a clear understanding of what to expect. Don't want anyone asking "why didn't you warn us!?"

Re your charts, yes, that's what I've been posting since May 31 [Why P3 is My Top Count] when I said "I've also noticed significant similarities between the past few months and the tops in 2007 and 2000. More posts on that to follow."

And, that's why I've been beating that drum ever since in at least 20 different posts [OMG, WTF…].

I notice that EWI and Daneric (at least as an alternate) have finally adopted the EW count I proposed over a month ago, so I guess that's progress LOL.

Are you sure earnings are pure so far? I thought the earnings are pretty positive.

With love for AAPL, GOOG, IBM, even CMG with a miss was only down 1%, I don't think we are at an imminent sell off, despite my agreement that the macro economic environment is getting worse every day.