ORIGINAL POST: 10:30 AM

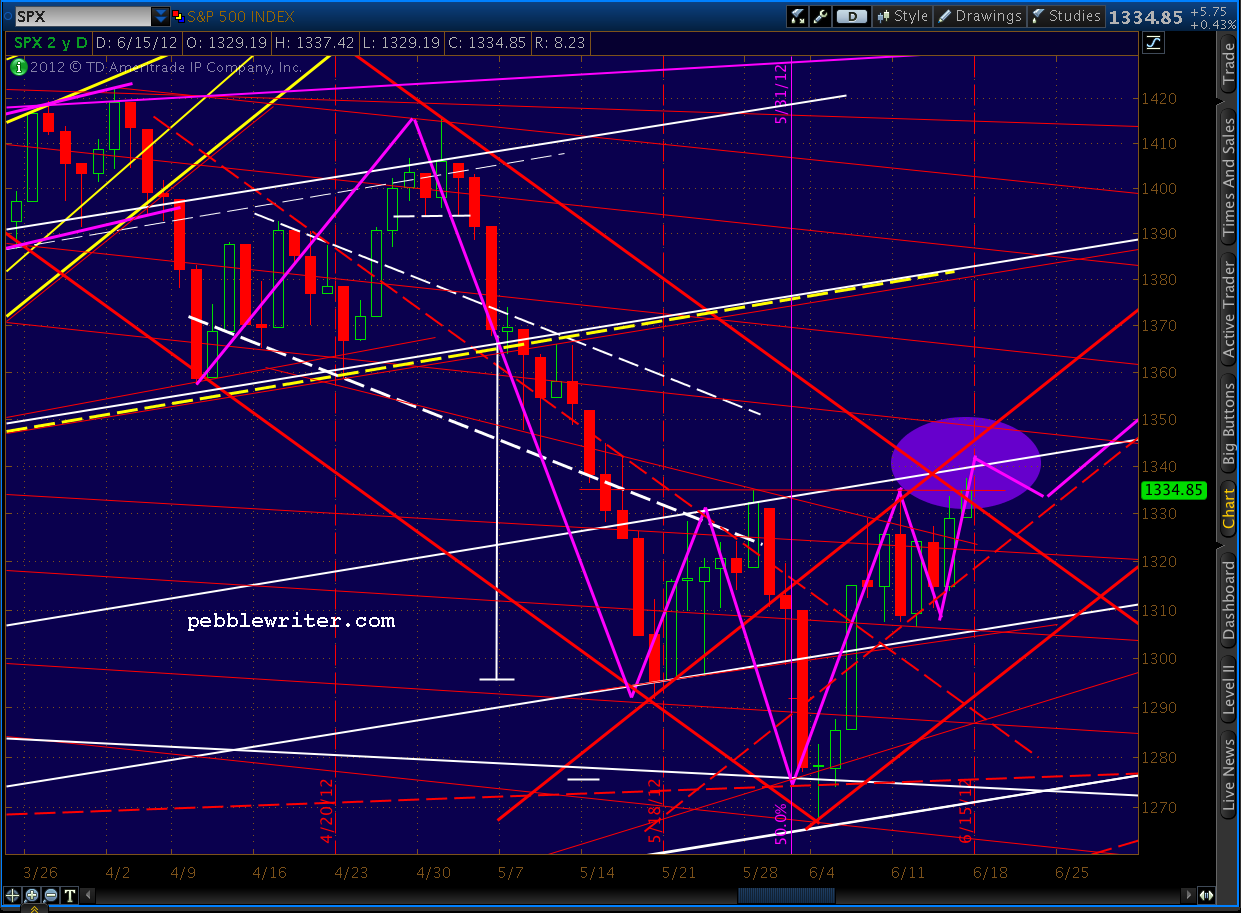

Back on June 1, I drew the following forecast, but was so uncertain about it I didn’t post it until June 11 [see: Mixed Signals.]

On the 11th, I adjusted the timing a bit, but then basically set it aside. Other than helping me forecast a dip to 1303-1308 (which occurred a few hours later) I expected it was just a little too “cute.” In other words, it seemed a bit too obvious for it to play out.

On the 11th, I adjusted the timing a bit, but then basically set it aside. Other than helping me forecast a dip to 1303-1308 (which occurred a few hours later) I expected it was just a little too “cute.” In other words, it seemed a bit too obvious for it to play out.

Well, here we are — just a couple of points away. Despite my best efforts to disown it, the forecast is proving correct…and, right on schedule.

I don’t recall making any deals with an otherworldly spirit or otherwise pledging my soul in exchange for eerily accurate forecasts. No, I think there’s something much more sinister at work here.

I don’t recall making any deals with an otherworldly spirit or otherwise pledging my soul in exchange for eerily accurate forecasts. No, I think there’s something much more sinister at work here.

continued…

I think the folks whose job it is to keep this whole card game afloat are simply mapping out the most positive path to higher prices they can and then doing their part to make it happen.

Remember when we completed the initial H&S targeting more downside back on April 23? TPTB built another shoulder — delaying the inevitable another 10 days. When it finally played out amid a parade of bad news, they built an inverse H&S pattern out of it (now complete.)

Our “Bad News is Good News for QE” mantra is even being repeated on CNBS, of all places. And the path is cleared for more massive injections of central bank go-juice beginning Monday — after the Greek election results might otherwise decimate the markets.

More in a few.

UPDATE: 3:45 PM

Lots of discussion today — very cool. There are some very smart people on this site, and there’s no corner on the market for market savvy.

Everyone’s wondering about the IHS completion, which looks like it’ll close to the good. And, lots of speculation about this weekend and the Greek situation.

FWIW, here’s my take. Please feel free to disagree, but I think the conventional wisdom is right this time. I think the election will go either EU positive or neutral (which is positive for equities) or EU negative — which will result in the already “announced” stabilization efforts on the part of central planners — including the Fed if need be.

As has been much discussed elsewhere, each iteration of QE, LTRO, etc. has boosted stocks. IMHO, it has nothing to do with fixing things or a fundamental improvement in the outlook, but simply the impact of additional liquidity being pumped into the system.

When liquidity floods the system, big investors have to figure out a place to put it. Some of it goes into t-bills and the like, but a portion of it finds its way into stocks. Most days, there is a fairly even balance between bulls and bears. So, all it takes is for a few of the undecided’s in the middle to throw a percentage or two into equities for it to tip the balance and send prices up.

The point of this morning’s post is that everything’s happened pretty much as you might script it. I’m not that good an analyst that I could nail the highs and lows as consistently as I have the past 3 months. It’s pretty much unheard of. So, either I’ve become much, much smarter in the past 3 months (my wife assures me this is not the case) or the central planners have laid out a very simple and easy to understand plan and are sticking to it.

Will it last forever? Of course not. I doubt the July-August 2011 plunge, for instance, was part of the plan. But, for now, I think the old adage “don’t fight the Fed” makes sense. The trick is knowing where it might end, or at least make a significant turn.

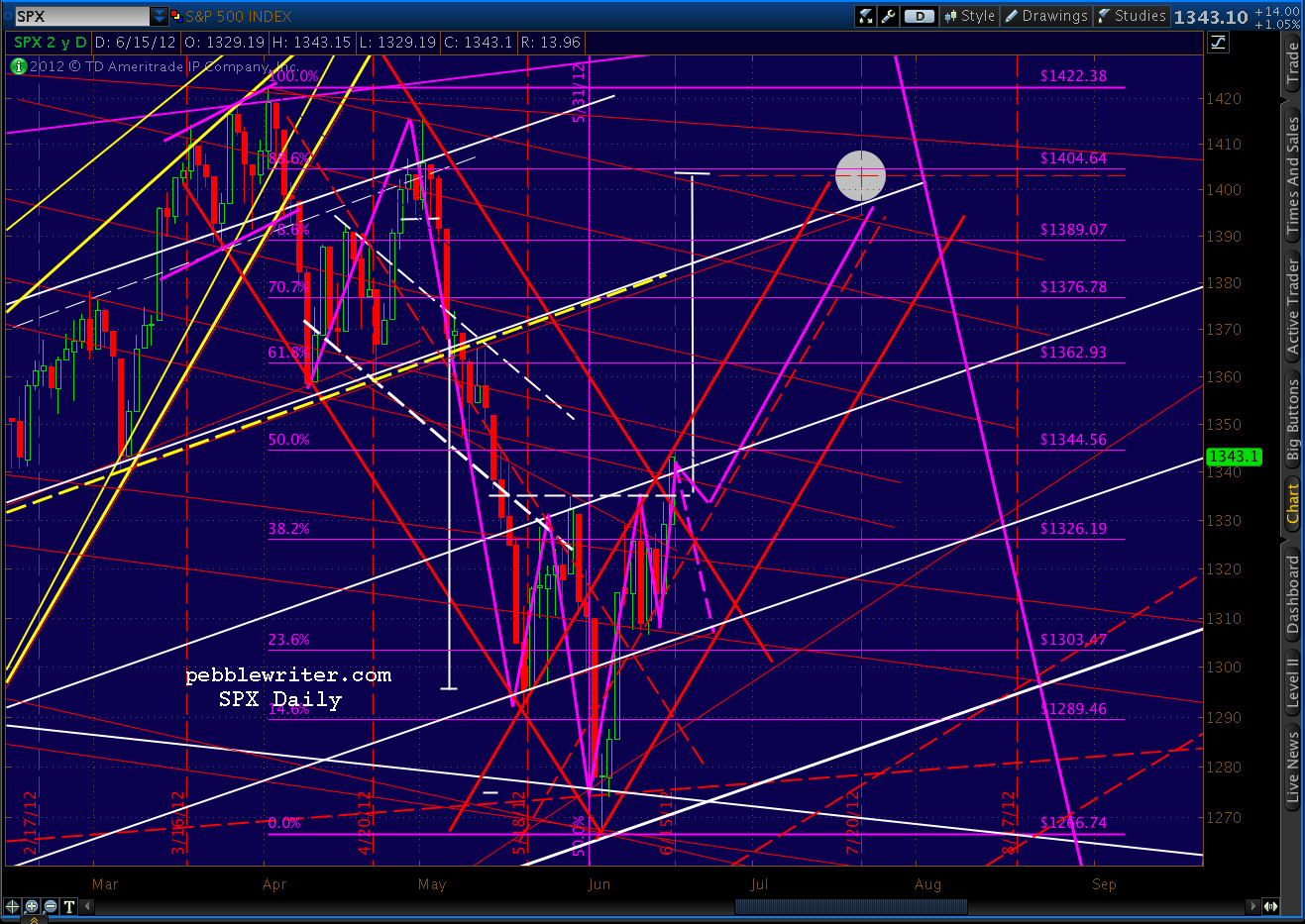

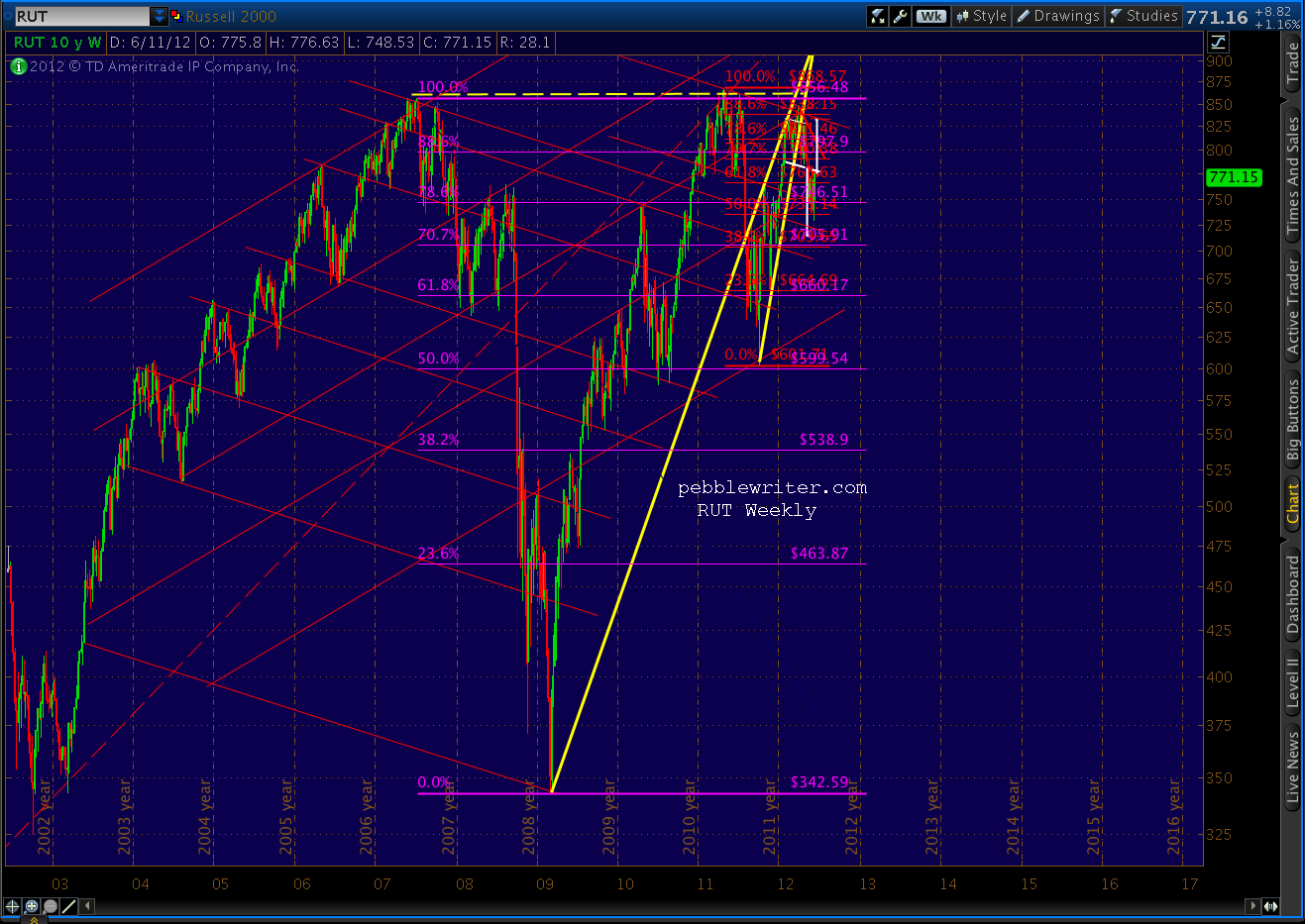

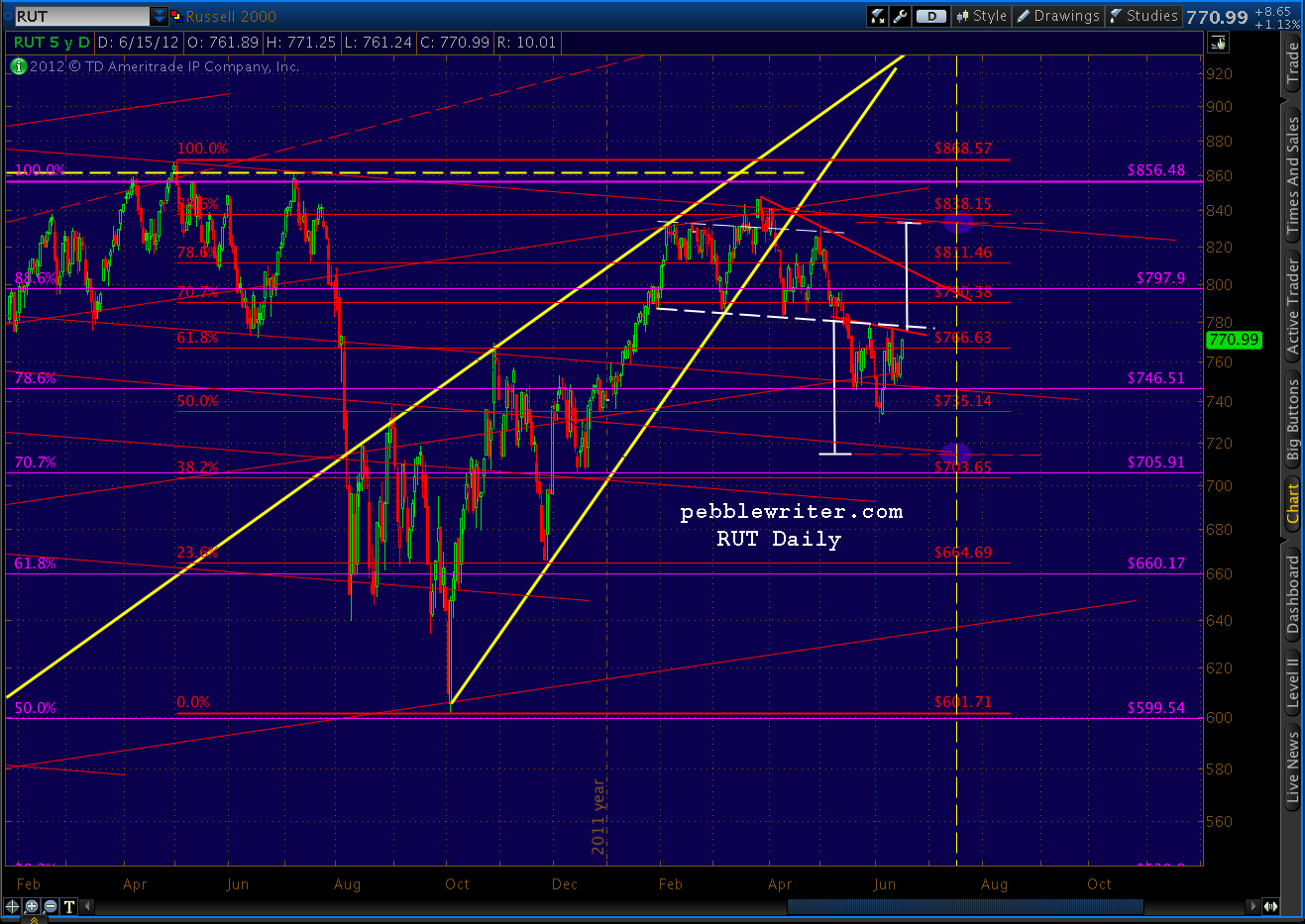

Here’s what the IH&S patterns indicate in the near-term for SPX, NYA and RUT. There’s a good possibility we’ll get a reaction/pullback off the current necklines, but I think we’ll make at least a significant lower high on all the major indices in the next month or so — if nothing else, a solid point C for the eventual downturn.

SPX:

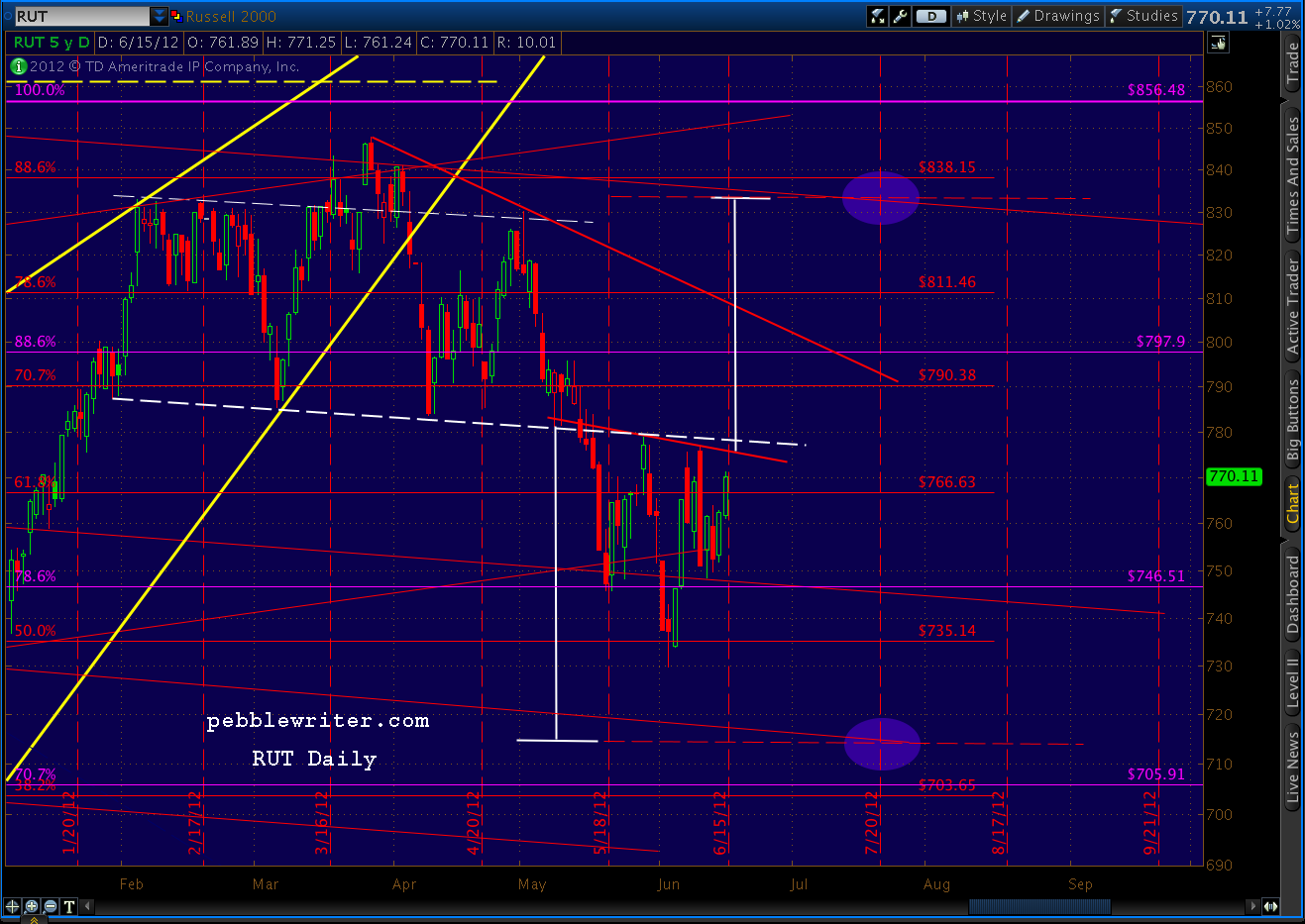

RUT:

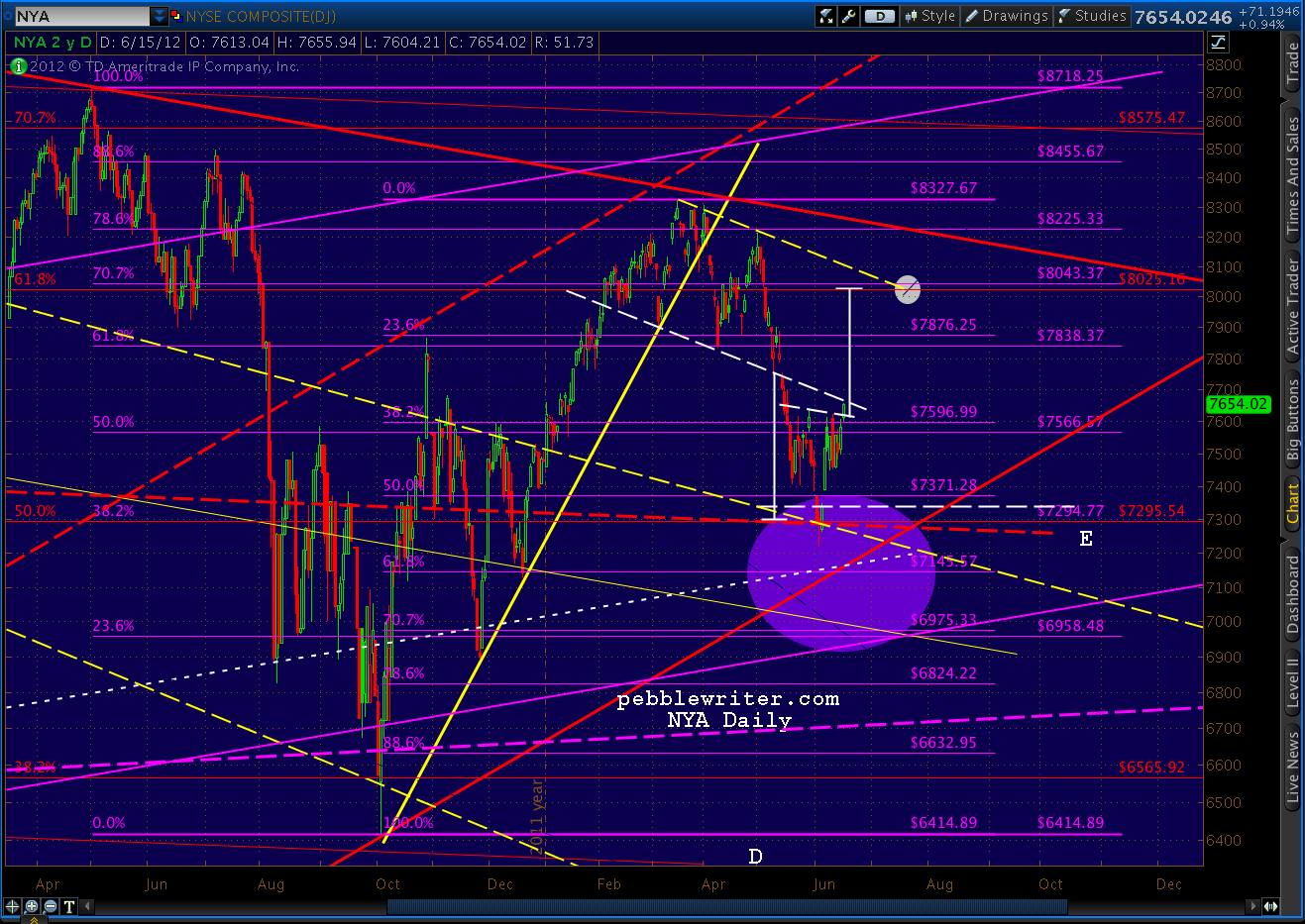

NYSE:

Comments

10 responses to “Forecasts, Darts and Ouija Boards”

I have a question on gold. As a total novice when it comes to harmonic patterns, it looks to me as though on the hourly gold futures we have a bullish crab pattern. The move from ~$1530 to $1640 retraced 61.8% to ~$1575. Now the move up from $1575 has retraced 88.6% of the previous move. Is there actually something here or am I trying to find a harmonic that does not exist? Thanks as always.

For some reason I can post the image via Disqus. It just pauses and “just a moment”

looks like the image posted after all

My amateur eyes would say it could be a Gartley as well. One of the things I have the most trouble with is knowing how close is close enough. For example, a Crab B point should be 61% or less and a Gartley should be exactly 61%. By those rules, said pattern is nothing, but if you fudge it just a bit, they are both possibilities!

Agree with Fred AND it is not complete on the futures charts due to the big spike that didn’t survive into cash.

well, the day is not over yet, so I do not consider it complete yet.

true that.

Hi PW, I have a naive question. Is this a signal for the bull to go all in? (it is for discussion, not an investment advise). Consider (1) The inverse H&S pattern is now complete. It implies SPX to go up. (2) Central banks are ready for more massive injections. (3) If Greek election is favorable to EU, market goes up. If Greek election is not favorable, Central Banks would step in. Market goes up.

We’ve had very few major IHS patterns not pay off in the past 5 years. I’m not comfortable with the notion of “going all in” because: (1) it sounds synonymous with “betting the house” which is against sound trade management practices; (2) we need confirmation of the pattern — meaning a close above the neckline; and, (3) almost all H&S patterns back test the neckline, so there’s likely another opportunity to get in at around these prices if it does play out.

With trading issues out of the way… yes, I agree with the injection of money = market higher premise. The question is, as always, “how high?”

Assuming that IHS pattern is on track and a person is holding cash, what is the reasonable level of SPX and RUT to watch for before jumping in? You mention about “a reaction/pullback off the current necklines”. Also, all major indices are highly correlated. With the IHS pattern in SPX, if a person invests (speculates) in DIA, MDY (mid cap index), USO (oil fund), or XLE, wouldn’t the return similar when the IHS pattern in SPX plays out? Thanks!

hi Michael – great stuff you have going on here. got a quick question about the VIX – any

change in thoughts since your musings a couple weeks ago citing a potential

target in the high 16’s? i hear ya on

the “managed” aspect of this market so i could definitely see the

potential in this level (especially if we do follow the projected trend to the

1380-1400 level; at the same time it is on the completely opposite level of

Citi’s target range given their perspective of fundamental macro risk:

http://www.zerohedge.com/news/citi-matrix-outcomes-if-disordely-grexit-then-vix-80

thoughts? conviction?