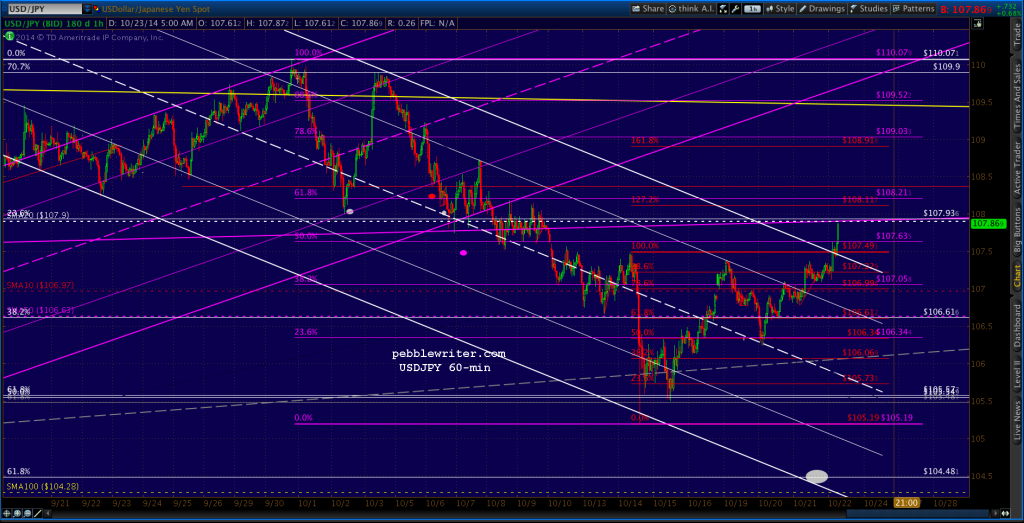

USDJPY provided the lift last night, making a bid to break out of the falling white channel. The key is whether it can break through the SMA20.

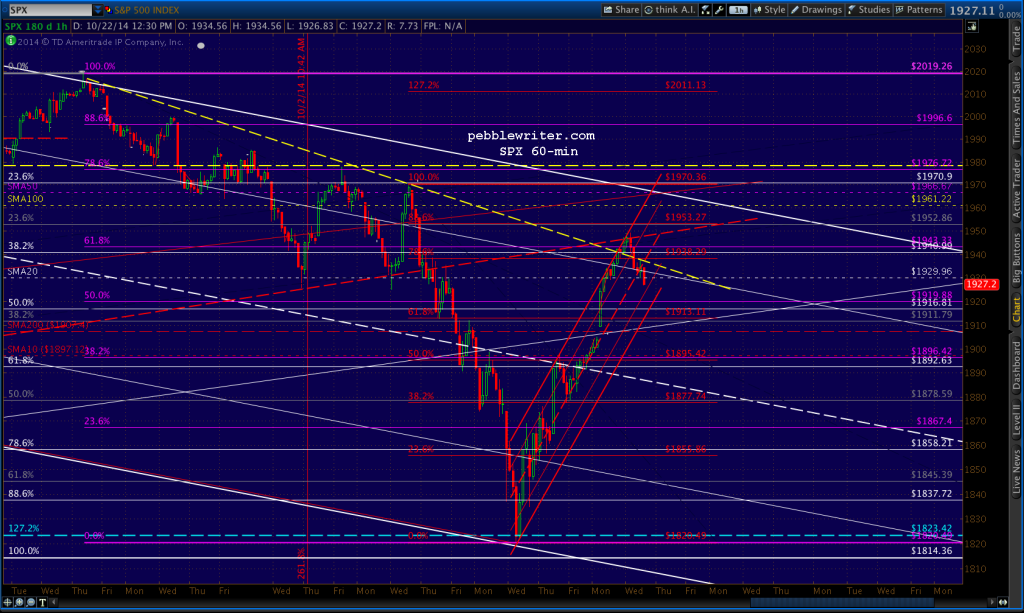

SPX reacted, belatedly, at the purple .618 (1943.33) as expected. The futures indicate a bounce to backtest it. From there, we’ll have to see whether the yen and Nikkei can provide the usual boost.

Ordinarily, we’d look for a minimum reaction at a major .618 to at least the .500 – usually lower. So, a backtest of 1943 and then a continuation lower would make sense in an unrigged market. But, this rally — being completely manufactured by central bankers and the carry trade algos — might have other plans.

UPDATE: 1:45 PM

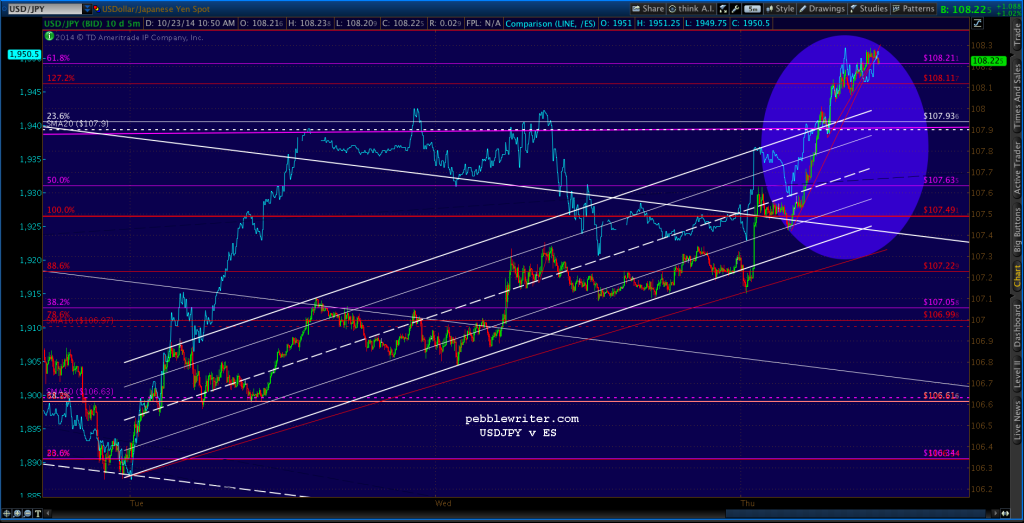

This is really getting old. Today’s rally has nothing to do with CAT, MMM, OXY or anything even remotely related to the economy. The reason stocks have vomited higher is, as usual, the yen carry trade which is fueling the algos. Note how USDJPY spurts higher every time SPX even thinks about digesting its gains. The pair blew though its .618 and 20-day moving average, and the rising white channel in order to prevent SPX from experiencing any pullbacks of any consequence.

Watch USDJPY spurt higher when SPX reaches its SMA100 at 1961.22.

GLTA.