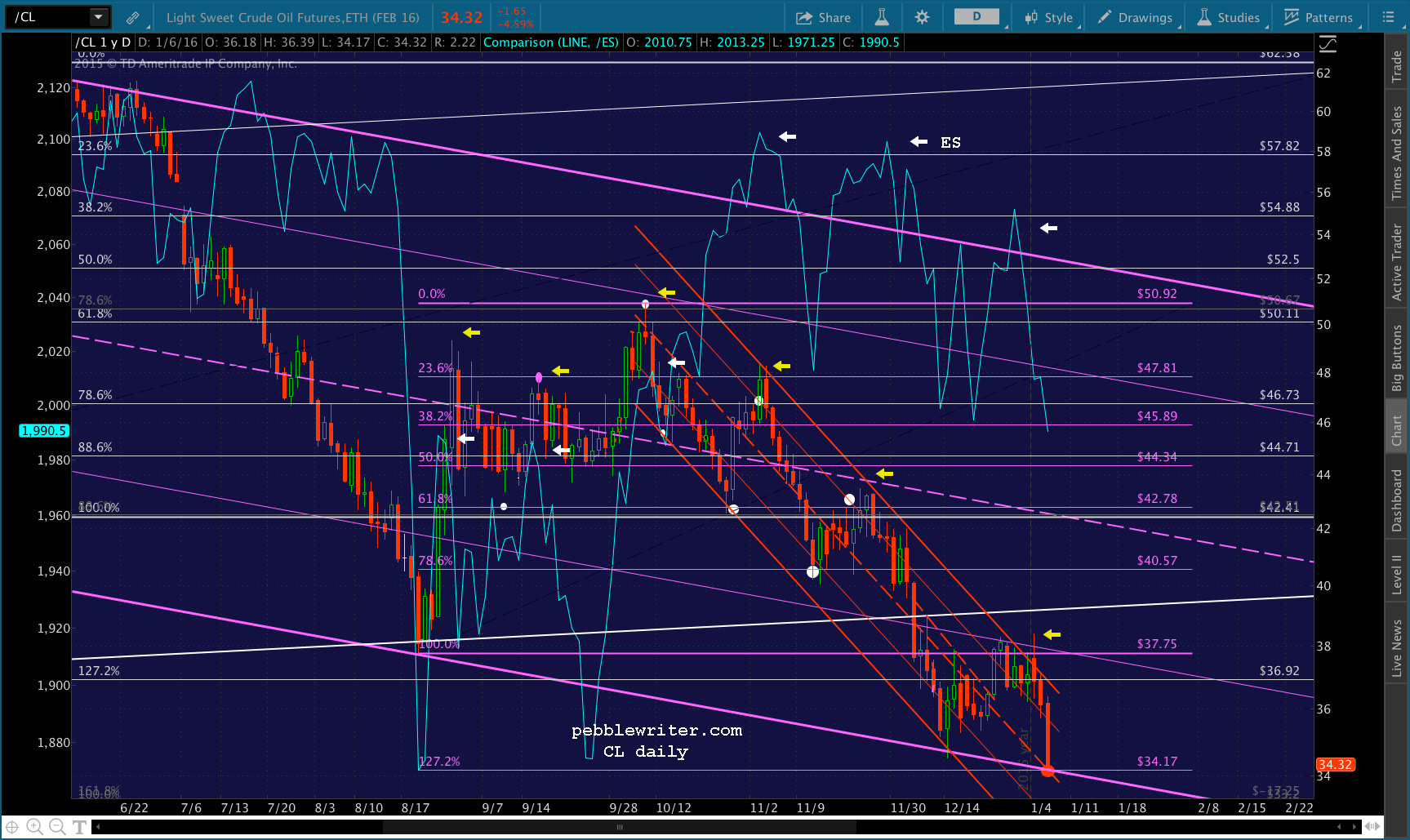

A few weeks ago, it seemed that CL’s tag of our 34.17 downside target was imminent. It had recently broken down below the critical channel bottom we charted on Dec 2 [see: CL Tests Support.] So, we posted this chart on December 14 [see: Dec 14 CIW.] Of course, it was the last two weeks of the year. And, the bullish contingent was working feverishly to get SPX back to even on the year. They failed, of course, but it wasn’t for lack of trying.

Of course, it was the last two weeks of the year. And, the bullish contingent was working feverishly to get SPX back to even on the year. They failed, of course, but it wasn’t for lack of trying.

Now that we’re into a new year, and the widening gap between the press releases and reality is becoming clearer, guess where CL just tagged?

continued for members…

It’s an even better tag than it might have been before, only because it nailed the bottom of the falling purple channel. In an unrigged market, it would suggest a possible bounce to the purple midline and .618 Fib at around 42.78 — a very playable 25% move. But, the noose of USDJPY is still hanging around CL’s neck, and could easily drag it lower.

In an unrigged market, it would suggest a possible bounce to the purple midline and .618 Fib at around 42.78 — a very playable 25% move. But, the noose of USDJPY is still hanging around CL’s neck, and could easily drag it lower.

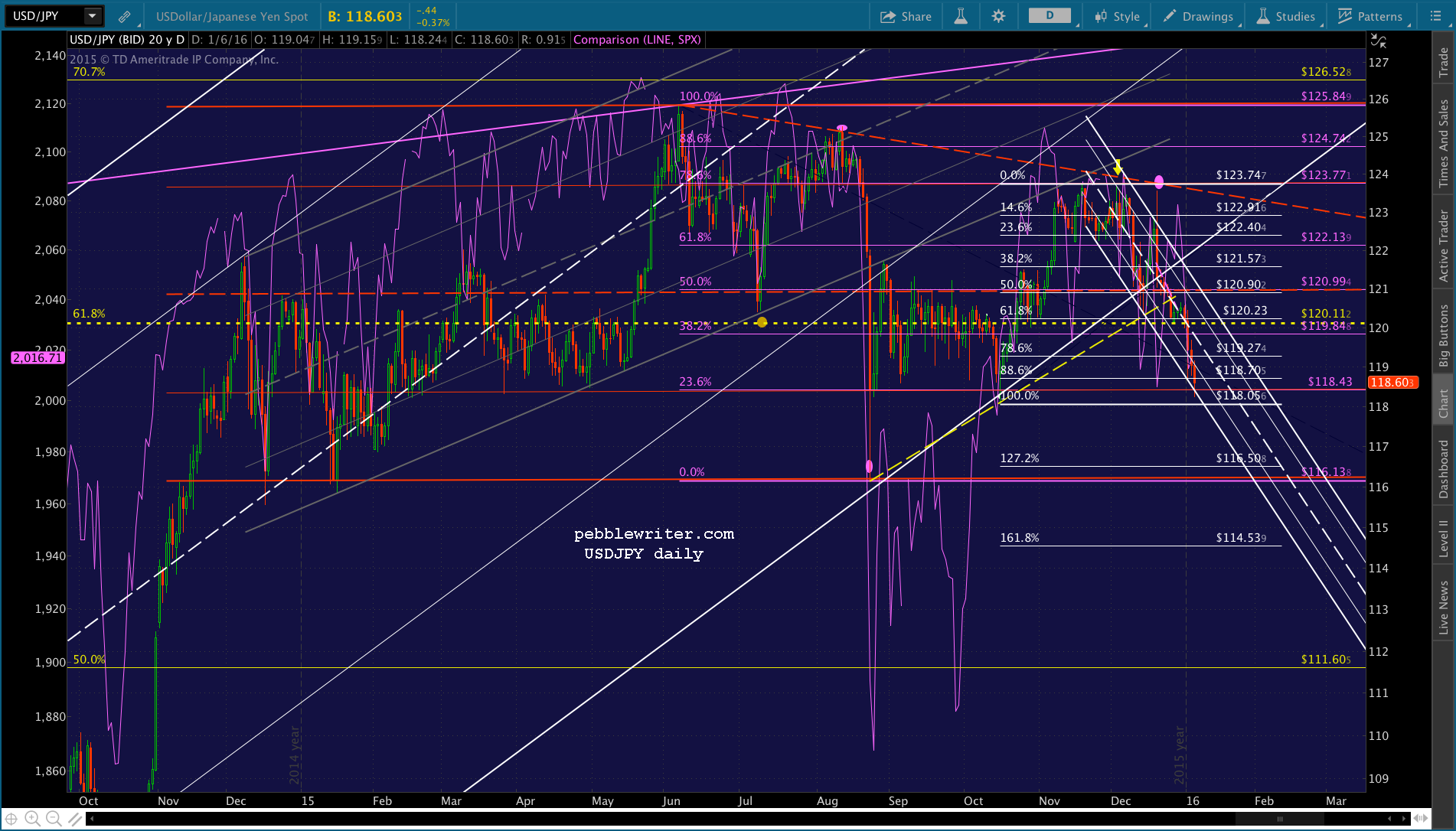

Quick review for our new members: USDJPY can’t move higher (yen lower) unless TPTB accommodate Japan with lower oil prices to compensate for the hit of higher imports (chiefly oil — which is priced in USD.)

And, if USDJPY doesn’t start moving higher soon, we’re going to see a lot more days like today, with sub-2000 SPX [see: Yen Carry Trade.] Remember what happened the last time USDJPY explored new lows after falling below the critical 120.11 Fib level in August?

The only caveat to that admittedly tin-foil-hat sounding theory is the fact that CL, in itself, has become a pretty effective algo tool. That is, when USDJPY isn’t available for ramping duty, a strong spike in CL almost always works.

The only caveat to that admittedly tin-foil-hat sounding theory is the fact that CL, in itself, has become a pretty effective algo tool. That is, when USDJPY isn’t available for ramping duty, a strong spike in CL almost always works.

Note the effect on ES (the white arrows) whenever CL spikes (yellow arrows.) It hasn’t produced new highs, but it certainly keeps stocks on track.

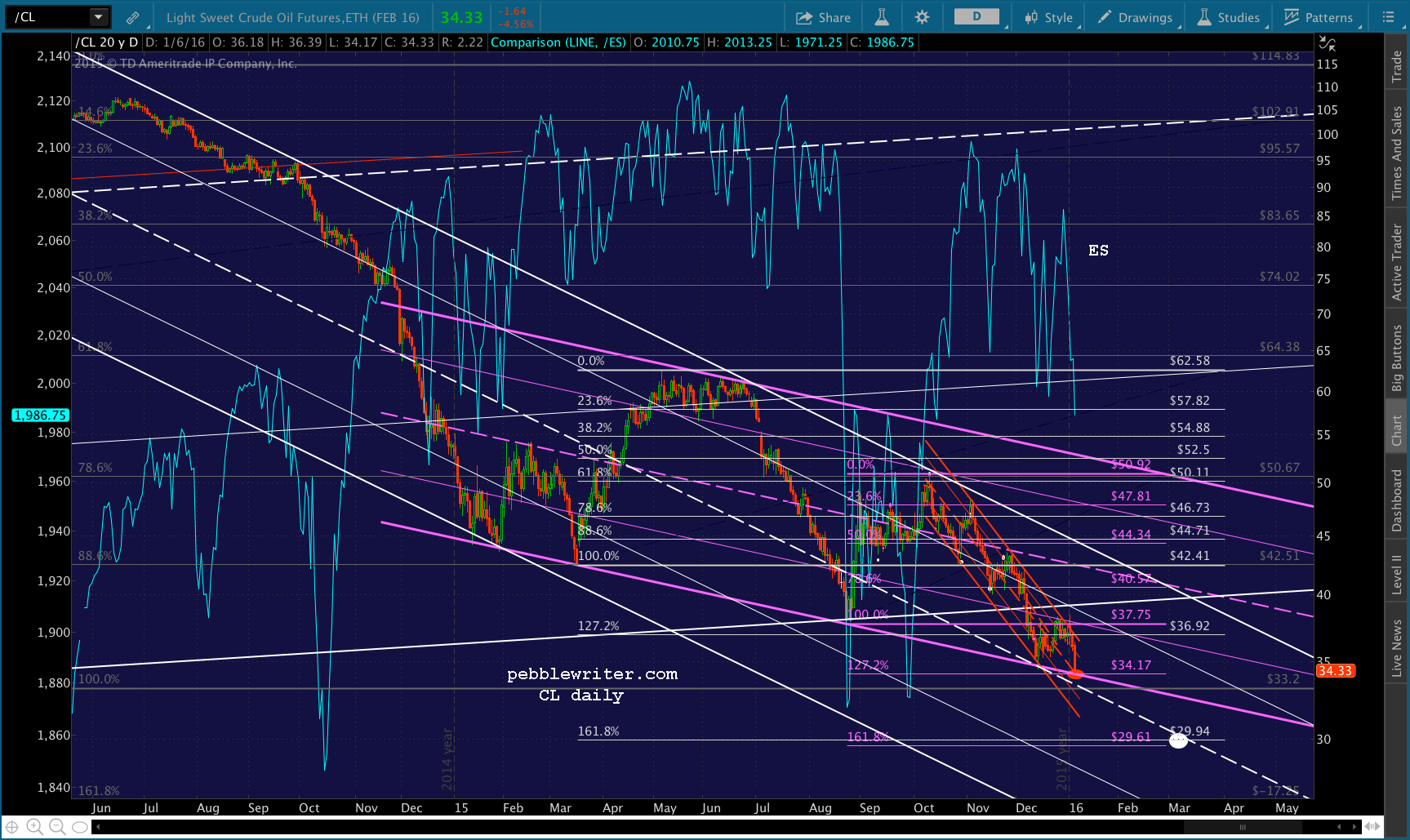

If the BoJ has given up on trying to drive stocks higher by bashing the yen, then the rest of the world has no incentive to keep the lid on oil prices. Sure, it’ll crush Japan’s finances. But, since when did that outweigh good old fashioned self-interest?

If the BoJ has given up on trying to drive stocks higher by bashing the yen, then the rest of the world has no incentive to keep the lid on oil prices. Sure, it’ll crush Japan’s finances. But, since when did that outweigh good old fashioned self-interest?

If, on the other hand, the BoJ is merely taking a break from manipulating SPX higher via yen bashing, CL’s next downside target is the Jan 15, 2009 lows (33.20), followed by the white .886 at 31.96 that was almost tagged in 2009 and the co-located 1.618 Fib extensions at 29.61-29.94. Beyond that, there are plenty of other targets, culminating in the yellow .886 at 26.22. Below that, things could get downright nasty. But, I suspect the go-for-broke-yen-carry-trade-on-the-back-of-cheaper-oil aproach would have normally compliant Japanese citizens rioting in the streets and oil companies rioting in the Congressional office buildings long before.

Beyond that, there are plenty of other targets, culminating in the yellow .886 at 26.22. Below that, things could get downright nasty. But, I suspect the go-for-broke-yen-carry-trade-on-the-back-of-cheaper-oil aproach would have normally compliant Japanese citizens rioting in the streets and oil companies rioting in the Congressional office buildings long before.