It’s de rigueur in movies nowadays. Something scary almost befalls our hero. He narrowly escapes, saying something like “wow, that was a close one!” Half a beat later, the really bad thing happens that he was too busy thanking his lucky stars to notice or prevent. The Final Destination franchise has made a mint off this device alone.

This is that moment in the “markets.” While a big CL and USDJPY inspired after-hours ramp job gives the impression that the danger is past, it’s not. On the other hand, the bad thing that’s coming probably isn’t as bad as some would have you believe.

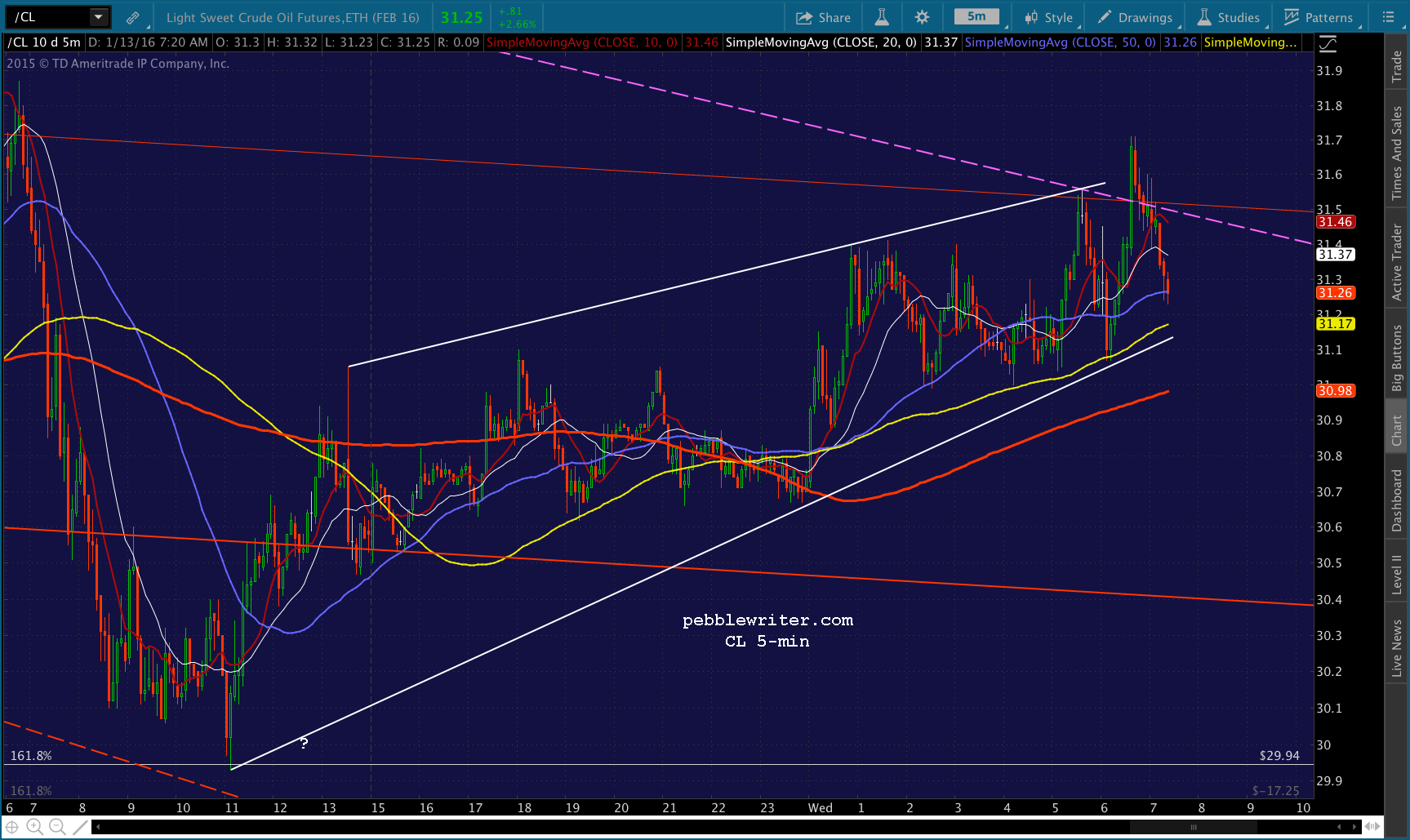

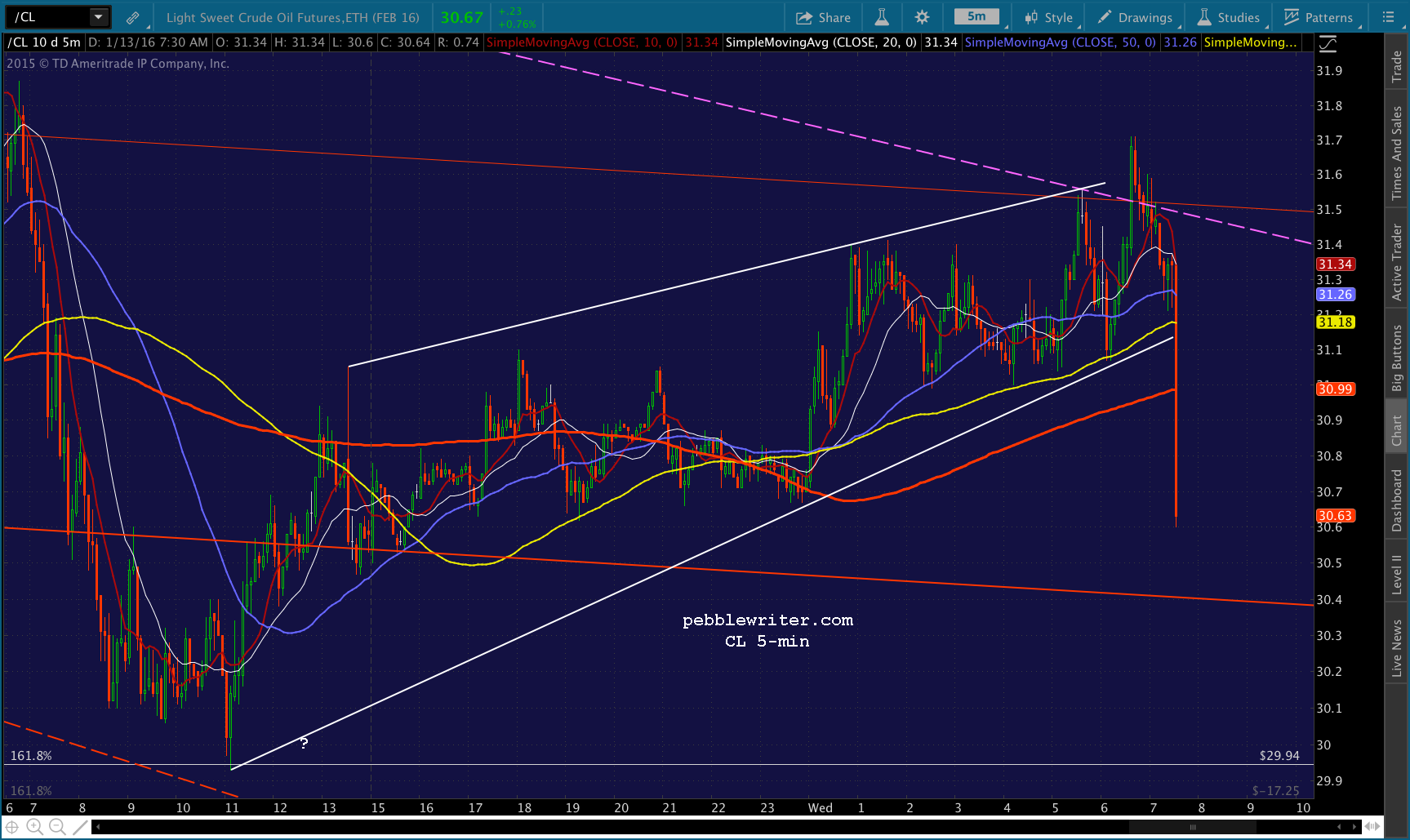

We’ll start with CL’s big bounce off our downside target yesterday. It’s currently up 2.2%, which is mildly impressive. But, it hasn’t yet cleared the purple TL connecting the tops formed over the last week. Not exactly an all-clear sign. Likewise, USDJPY’s bounce off the .886 Fib is reassuring. But, wouldn’t it be more so if it could clear the midline of the falling white channel it’s been in since late November?

Likewise, USDJPY’s bounce off the .886 Fib is reassuring. But, wouldn’t it be more so if it could clear the midline of the falling white channel it’s been in since late November? Then, there’s stocks themselves. We nailed most of yesterday’s ebbs and flows, racking up a nice 3.35% gain on the day. But, ES is currently only back to the channel bottom that started the dramatic intraday swoon.

Then, there’s stocks themselves. We nailed most of yesterday’s ebbs and flows, racking up a nice 3.35% gain on the day. But, ES is currently only back to the channel bottom that started the dramatic intraday swoon.

continued for members…

The way the futures are backing off their overnight highs, we could see a replay — a pop and drop. SPX would reach the purple channel bottom at around 1948ish — a 10-pt gain from yesterday’s close.

The way the futures are backing off their overnight highs, we could see a replay — a pop and drop. SPX would reach the purple channel bottom at around 1948ish — a 10-pt gain from yesterday’s close. It currently looks capable of breaking that with ease on the open. But, I’d be cautious about remaining long if ES, CL or USDJPY start to back off from the resistance in front of them.

It currently looks capable of breaking that with ease on the open. But, I’d be cautious about remaining long if ES, CL or USDJPY start to back off from the resistance in front of them.

UPDATE: 9:32 AM

SPX reached our 1948 target in the opening two minutes. I’d take a short position here at 1948.04 and see what develops. The initial target is the broken channel top around 1940-41, followed by the SMA cluster around 1927. USDJPY is breaking down through the channel midline…

USDJPY is breaking down through the channel midline… …but, CL is ramping to try and compensate. So far, it’s a standoff.

…but, CL is ramping to try and compensate. So far, it’s a standoff.  SPX is nudging higher on CL’s push, but ES hasn’t broken out or down — meaning it could go either way.

SPX is nudging higher on CL’s push, but ES hasn’t broken out or down — meaning it could go either way. UPDATE: 9:54 AM

UPDATE: 9:54 AM

Just reached our initial goal. I’d take profits here at 1941.43 and go to cash while we wait to see whether or not it pushes through or bounces. UPDATE: 10:04 AM

UPDATE: 10:04 AM

Looks like the bounce might be over… I’d short if it pushes through the channel top…

…or ES through the neckline of a little H&S targeting 1918.

…or ES through the neckline of a little H&S targeting 1918. UPDATE: 10:15 AM

UPDATE: 10:15 AM

Could be a headfake, but ES is pushing below the neckline as SPX dips below the SMA5 20. I’d hazard a short position with tight stops here at 1939.63. UPDATE: 10:20 AM

UPDATE: 10:20 AM

Now, it’s USDJPY coming to the rescue, trying to prevent SPX from dipping into negative territory. If it pops through the purple midline, it might be able to. CL is slipping down toward rising wedge support.

CL is slipping down toward rising wedge support. UPDATE: 10:31 AM

UPDATE: 10:31 AM

Oops! According to Zerohedge, it’s the biggest 2-week gas inventory build on record.

There’s SMA5 support at 1930.77 and 1926.59. But, the better target is ES 1918 (about SPX 1925 — where nothing special is happening anytime soon.) To reach any of those, USDJPY will probably need to break back through the white midline support.

There’s SMA5 support at 1930.77 and 1926.59. But, the better target is ES 1918 (about SPX 1925 — where nothing special is happening anytime soon.) To reach any of those, USDJPY will probably need to break back through the white midline support.

UPDATE: 10:37 AM

Getting there, but USDJPY bounced on that midline mentioned above.

Note that CL is back below the red channel bottom at the moment — even backtested it.

Note that CL is back below the red channel bottom at the moment — even backtested it.

UPDATE: 10:57 AM

Do you think maybe they’re trying to prop this sucker up? Someone sure hit the panic button. ES isn’t due to tag 1918 until closer to 11:30, so we’re probably going to get more backtesting before that final drop.

Well, they got it back to green for the euro close. But, ES and CL have backtested some pretty good resistance. So, ideally, the rest of the drop should commence pretty soon. The one possible hitch is that SPX is back above the SMA5 10 and 20, which can be a powerful algo crutch. For now, I’m still looking for ES 1918 — about SPX 1924-25.

UPDATE: 11:35 AM

The one handy thing about this delay is that SPX 1924 can now more easily align with the rising white TL off Monday’s lows. Depending on when it happens, it could range from 1922 (12:00) to 1925 (1:55, at the red SMA5 200.)

They got a little out of sync. But ES just tagged the red TL at 1918 exactly, while SPX reached the SMA5 200. It could obviously go lower, but I think I’ll take profits here at 1926.32 and wait and see. It should be safe to go long here, but USDJPY isn’t bouncing at all, and we’ve got important Fibs just below. Besides, the falling SMA5’s will catch down with SPX at 1930ish, which IMO isn’t enough upside to justify a trade.

UPDATE: 12:45 PM

UPDATE: 12:45 PM

SPX didn’t stop at the white TL, and ES didn’t stop at the red .786. USDJPY is bouncing somewhat, but not very aggressively. And, CL looks confused — as am I. I’d try a long position here at 1921.97, but be very cautious. Lots of overhead resistance if the bounce isn’t strong. UPDATE: 12:50 PM

UPDATE: 12:50 PM

Don’t like the way this is shaking out. I think we’re in for more at least a few more points downside. Shorting here at 1922.03 on ES’ weakness. Be cautious, as ES could be aiming for its .886 at 1910.4, which doesn’t offer much downside.

UPDATE: 1:00 PM

UPDATE: 1:00 PM

SPX just reached its .886, which should produce a bounce of some sort. But, it hasn’t quite reached a backtest of the broken white channel, so it could drop to 1908.25ish. If it doesn’t stop at the backtest, SPX is aiming for the falling red channel midline next.

USDJPY suggesting the downside isn’t done.

USDJPY suggesting the downside isn’t done. Ditto for NKD.

Ditto for NKD. UPDATE: 1:13 PM

UPDATE: 1:13 PM

I think we’re going to bounce up to the SMA5 10 or even 200. I’d close the short here at 1920.19 and go to cash. If ES is heading for 1908.25, then I’m giving up 3.75 or so (SPX 2016ish). But, if it breaks out, we’d be underwater pretty quickly.

UPDATE: 1:24 PM

UPDATE: 1:24 PM

ES just backtested the broken white channel, so I’d try a long position here if USDJPY were bouncing. But, it’s dropping, so I can only assume they’re aiming for SPX 1914.35, to run some stops, or lower. Back to short with tight stops.

UPDATE: 1:30 PM

UPDATE: 1:30 PM

NKD just reached that white TL of support. Would be neat if it just dropped through. But, will probably bounce — perhaps after SPX breaches 1914.35?

If SPX does dip below 1914.35, keep a close eye on NKD. If it starts spiking like crazy, this was just a stop run. If it drops further, then there’s more downside to 1911.64, 1906.71 or 1900.

If SPX does dip below 1914.35, keep a close eye on NKD. If it starts spiking like crazy, this was just a stop run. If it drops further, then there’s more downside to 1911.64, 1906.71 or 1900.

UPDATE: 1:40 PM

Just reached the .786 at 1911.64. first bounce opportunity. But, I think USDJPY is going to test the purple channel bottom.

UPDATE: 1:46 PM

UPDATE: 1:46 PM

I don’t expect it to happen today, but note that we’re no longer all that far from our 1882-1887 target as posted Monday in The Century in Review. UPDATE: 1:51 PM

UPDATE: 1:51 PM

Next downside target – the .886 at 1906.71. It’s also the .886 of the purple ES chart. Should get a bounce here – perhaps up to SMA5 10 now at 1914. Worth a shot at a long position here at 1906.69 for those 8+ points. I don’t see it as anything more than a potential bounce, and fully expect to test 1900 before the session’s done.

I don’t see it as anything more than a potential bounce, and fully expect to test 1900 before the session’s done.

UPDATE: 1:59 PM

Bounce isn’t going anywhere. Back to short at 1907.45 for 1900. UPDATE: 2:19 PM

UPDATE: 2:19 PM

Next target down. If it doesn’t bounce here at 1900 (another stop run opportunity) then we should get our 1887 target by the close. I’ll try a long position here at 1901.03, but with tight stops.

UPDATE: 2:31 PM

UPDATE: 2:31 PM

Looks like we’re heading lower. Back to short here at 1901.95. Looks like we’re going for all the marbles. Next stop should be 1887.71.

UPDATE: 2:37 PM

UPDATE: 2:37 PM

Here’s another one of those potentially big bounces that shouldn’t amount to much, but could here at the red 1.618. Should still target 1887.71, but I’d go to cash with very tight stops here at 1891.34. It could go as high as a backtest of the red midline at around 1898.25ish.

It could go as high as a backtest of the red midline at around 1898.25ish.

UPDATE: 2:40 PM

Thanks to USDJPY, getting another crack at 1887. Back to short at 1893.8.

UPDATE: 2:45 PM

UPDATE: 2:45 PM

Reached 1887.71. I show the actual channel bottom at 1883.4, but this is definitely close enough. Back to cash here at 1887.21. I would expect a nice rebound here, but that last 4 points could prove problematic in the very near term. If you go long, which is probably okay, just use tight stops.

I would expect a nice rebound here, but that last 4 points could prove problematic in the very near term. If you go long, which is probably okay, just use tight stops.

If the past few weeks is any indication, it’ll bounce around like crazy for the next hour, closing at or near the low for the day, which I’m assuming is 1880-1883. We’ve had a nice day, so I’m going to stretch my legs.

UPDATE: 2:58 PM

Final stretch. If it’s going to reverse down to 1883, this is the place. I’d try a short position here with tight stops, but call it quits if it pushes above the midline.

Note that NKD is bouncing pretty nicely off a .886, and USDJPY is backtesting its channel bottom. Watch both of these like a hawk if you try shorting here.

No dice. Back to cash for the day. Turning off my monitors till the close so I’m not tempted to spoil a perfect day!

more…

Comments

6 responses to “That Was a Close One”

Is the 12:09 time going to change the tides again today?

Glad you pointed that out, Wade. Good catch! Enjoyed speaking with you earlier.

lolll just figured out you are on different time zone

Not sure what you mean. I try to post everything using EST. Did I screw up somewhere?

You mentioned 8:30 in your 10:57 post when you obviously meant 11:30. No worries, I think most know that you are on the West coast.

So I did! Probably not the biggest mistake I’ll make today.

I am on the Left Coast, which means the fog sometimes doesn’t clear until after copious amounts of caffeine.