Had to make a choice this morning — cash in a 35% two-day profit or go for the gold. BAC opened at 9.97, gapping down from Friday’s 10.13 close. The August 11 puts I bought last Thursday for .90 traded at 1.25. Tempting…

But, I couldn’t ignore the fact that BAC was one of the most active stocks on the NYSE today, and traded off 1.18% when the broader XLF was off only .72%. As I mentioned to someone, in somewhat technical terms… this is a suckish stock in a suckish sector in a suckish market. Yet, the premium to intrinsic value is still only a very modest 25 cents. Can’t ignore that, right?

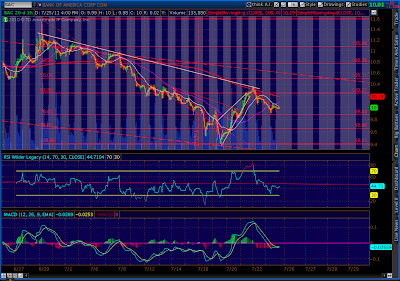

Although it looks like the histogram is considering a return to positive territory, the stock still trades below all of its moving averages. MACD is possibly indicating a bounce back, while RSI continues to look bearish. But, with no compelling contrary indicators, I’ll go with my gut that a weak overall market will continue to hurt BAC’s relative performance.

In the end, I compromised. I sold about 1/3 of my position at the 1.22 level for a 35% profit and am sitting with the rest. Tomorrow should be interesting.