ORIGINAL POST:

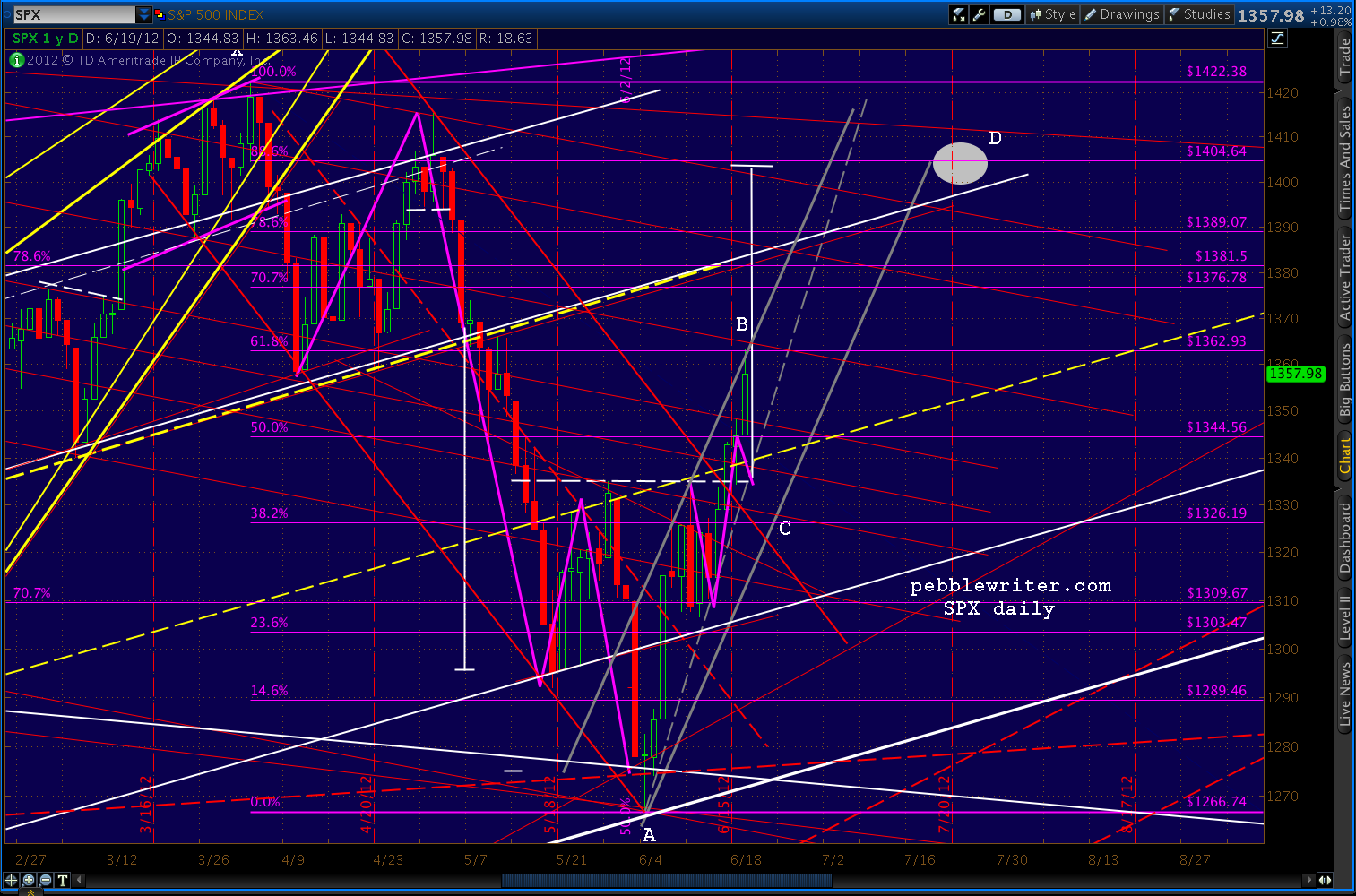

I got stopped out of my shorts in the first few minutes this morning. Apparently we’re going to test the .618 retracement instead of the .500 before any serious back test occurs. There’s one .618 at 1358.56 (from 1415) and another at 1362.93 (from 1422.) I’ll take a fresh look at re-shorting there, though this is a pretty powerful push.

UPDATE: EOD

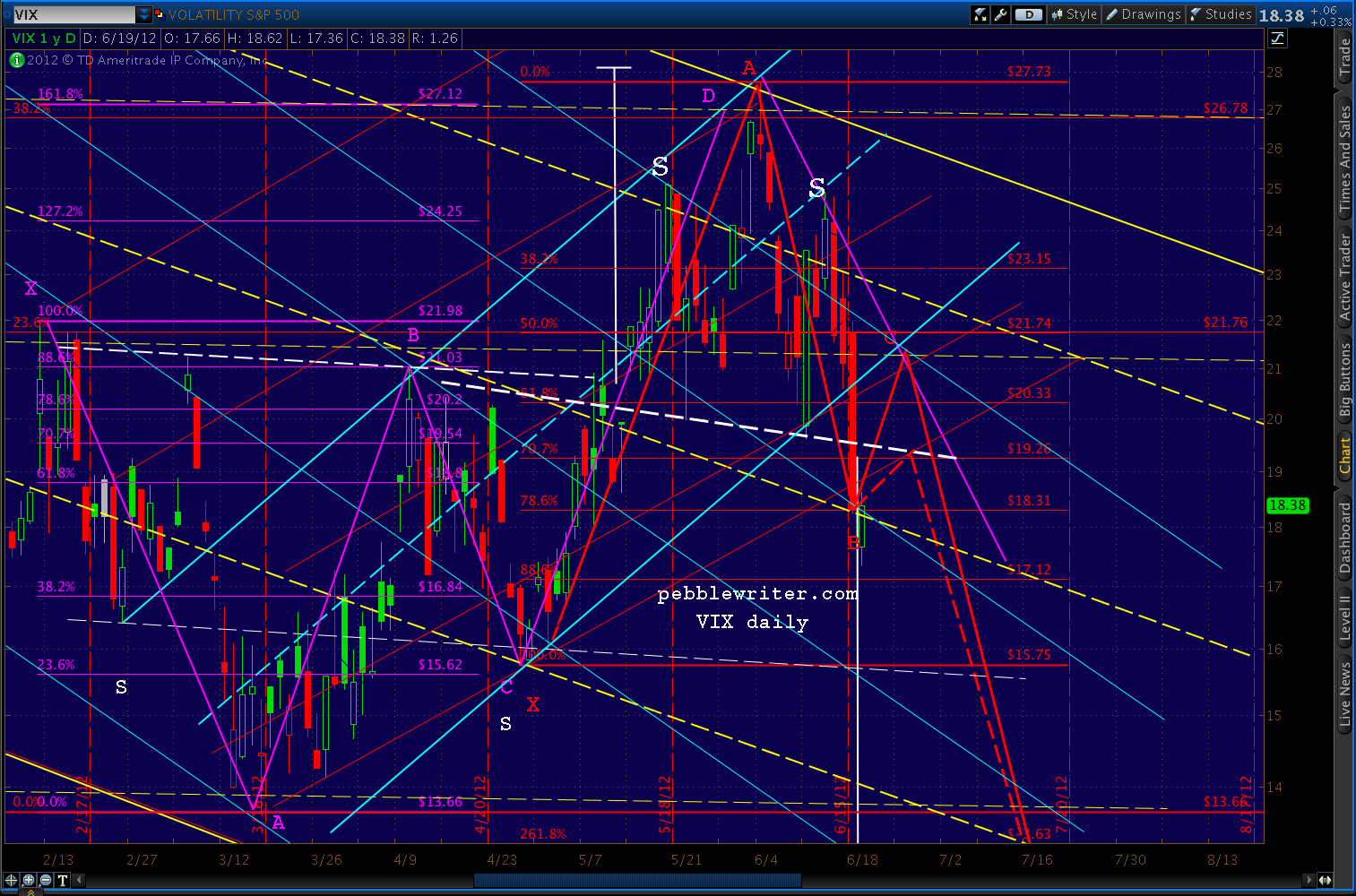

SPX nearly stopped on a dime earlier today, putting in a high of 1363.46 versus the .618 retracement (from 1422-1266) of 1362.93.

Emboldened by the chart below, I was pretty sure yesterday’s high would begin a decent back test, and positioned accordingly — hoping to capture a few points on the downside before the rally got going in earnest.

Didn’t happen. The housing news (permits up, starts down) didn’t justify a rally, but along came fresh rumors about yet another euro-fix (since denied by Germany.) But, by then, another low-volume rally was in the books.

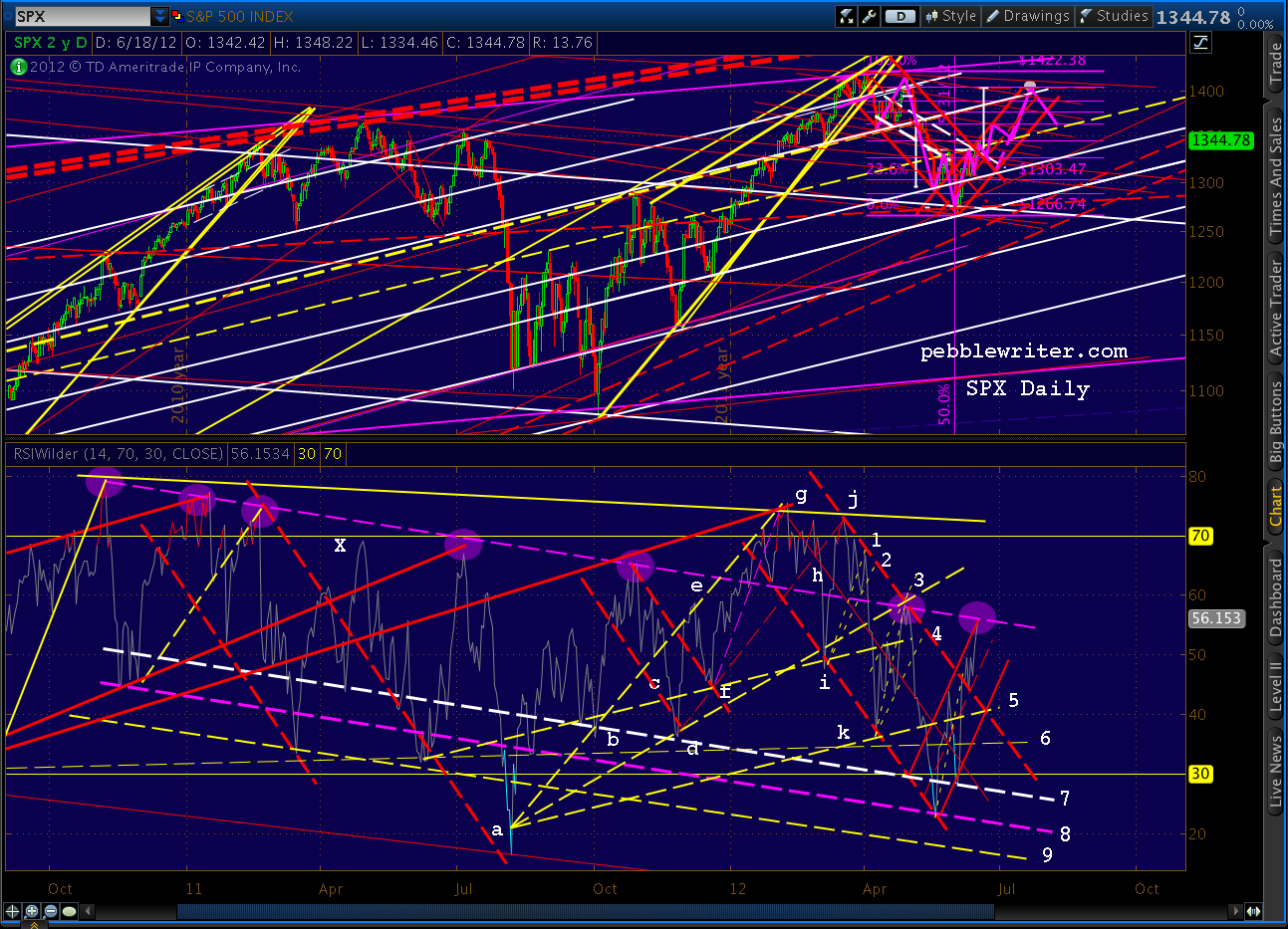

I’ve studied the charts all day folks, and there’s virtually no technical reason for the markets to have climbed today. This is another QE driven ramp job. Although, the price action on both gold and the US dollar imply that QE will be, at best, an extension of Operation Twist.

I tend to agree, as I think the Fed will save the big guns for an emergency — such as a falling market right before the elections. It would be very hard to justify such an announcement with the market up 100 points off its recent lows, and down only 13% from its all-time highs. In other words, the ramp we’ve seen in anticipation of QE might be the very thing to ruin its chances of happening.

Call me stubborn, but I’m willing to bet that the bond/currency/metals markets have a better grip on reality than the stock market. I have little doubt that the market’s going higher, but we really should get more of a dip first. Which is another way of saying I shorted again today at 1363.

I know, I know. But, we’re up about 30% in the past quarter (on a cash basis) and I think the risk is justified, and I’ll flip long at the first sign of the ramp continuing. Nervous types, pretend you never read this.

Gotta run out for a bit. I’ll try to post more later tonight.

Gotta run out for a bit. I’ll try to post more later tonight.

Comments

8 responses to “Stopped Out”

Hello PW, as you shorted at 1363, what is your target? In your post yesterday, when SPX reached 1348, you expected a pullback to “1326-1329 over the next several days before starting up.” Meanwhile, if BB disappoints the market and there is a pullback, what is reasonable level to watch for you to switch side? Thanks! The past 4 trading days were very unnatural and favorable to the bulls. June 14: Rumor about global central banks to save the world if Greece election disappoints. June 15: Opex. June 18: Greece stays in Euro (for now). The world is saved. June 19: Rumor about German agreed to buy bonds. And QE expection.

Germans are now saying they won’t. So, who knows!? Can’t see BB shooting his wad now, especially with the market being up 100 pts. Why actually do it when you can simply hint at it? I’m working on targets, will try to post something in the morning.

Actually, I have a tough question. Take your time to think about it and reply when you get a chance later. My question is since you are short, would you sell your short position and switch side (go long) in the 1st chance you get in the pullback? Or you won’t do anything until the target is met, i.e. you will wait until the pullback reach your target and then you will sell your short position and go long? The hardest thing is timing. As far as last week and this week concern, I notice that when there a a pullback, it usually recovers at the end of day. Then, the next way, it would go higher. So, it seems like for those who short, they need to sell all position in the 1st chance we get.

Tommy, not to make it more complicated, but covering shorts and going long typically happen at different times (not simultaneously). Just as selling longs and initiating shorts don’t happen at the same time. Pebble can likely give a better answer than I.

I would be very carefull shorting, and if I do get out very quickly. weekly impulse is up ( 26 ema and macd hist up ) and daily just went to neutral (13 ema up and macd hist down). path of least resistance for now seems to be up.

it is said that Topping formations last longer than bottoms do; you’d take additional risk if you short too early

Hello PW, it takes courage to short this week. BB is going talk. (script: “Economy is moderately improving, although there are signs of trouble in Europe. There are tools available to handle a crisis, if necessary”)

Meanwhile, as stocks are expecting QE, Gold is not responding. Who is right? Stock or Gold.

All CB stimulus related. The ponzi continues–until it doesn’t. Seems like things are setting up for a BIG disappointment tomorrow afternoon when BB doesn’t shoot more heroin into the veins of Wall Street.