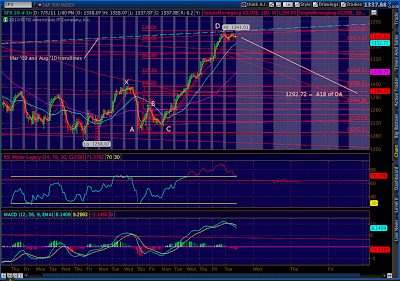

Back on June 27th, with SPX at1279, I suggested an upside target of 1322 [Patterns, Patterns and More Patterns.] At that price, I noted, we would have completed a bearish Crab Pattern at the 3.14 extension of the BC leg.

At the recent high of 1341, we’ve completed a nearly perfectly formed Crab Pattern at a whopping 4.237 extension of the BC leg (an unusual Fib number — inverse of the .236 level.)

The initial target of a Crab Pattern is the .618 retrace of the AD leg. Here, that translates into 1292.72. Subsequent targets include a 1.272 retracement of AD at 1242 and a 1.618 retracement at 1214. (As I mentioned in this weekend’s post, I suspect the initial drop will stall by 1299 in order keep alive the hopes of a wave 5 up.)

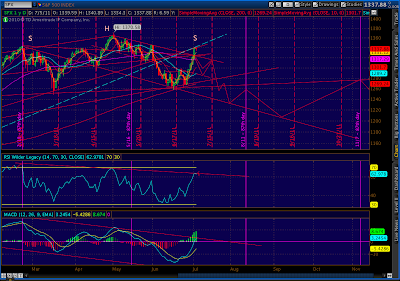

These targets dovetails perfectly with my “same as 2007” way of thinking in the near-term, and the resolution of the head and shoulder pattern developing longer-term. Note the H&S; pattern target indicates 1146, close to the 2.618 AD retracement.

Looking at the hourly chart above, I think we’re about to start that next leg down. Let’s call it a 3 of (1) of P[2]. We’ve got plenty of possible catalysts: Greece, the Portugal downgrade, coming employment data, the debt limit, etc.

I expect this move down to be fast and powerful. I added to short positions in SPX and XLF near today’s high and long positions in VIX. It’s still possible we go up and kiss 1345 for a proper double top, but I don’t think it’s necessary in order for the DT or H&S; pattern to be valid.

Good luck to all.

Thanks Pebble. Do you watch breadth? The MCO hit levels not seen since mid July last year. The indexes backed off for three days (about 40 RUT points), then rose again into early August.