Final day for our membership sale on Annual and Charter Annual memberships to celebrate another successful month. Sign up for an Annual Membership at a 62% discount the first year or, for only $100 more, a Charter Annual Membership, where your rate is guaranteed to never increase for the life of the site.

CLICK HERE for more details and to sign up now.

* * * * *

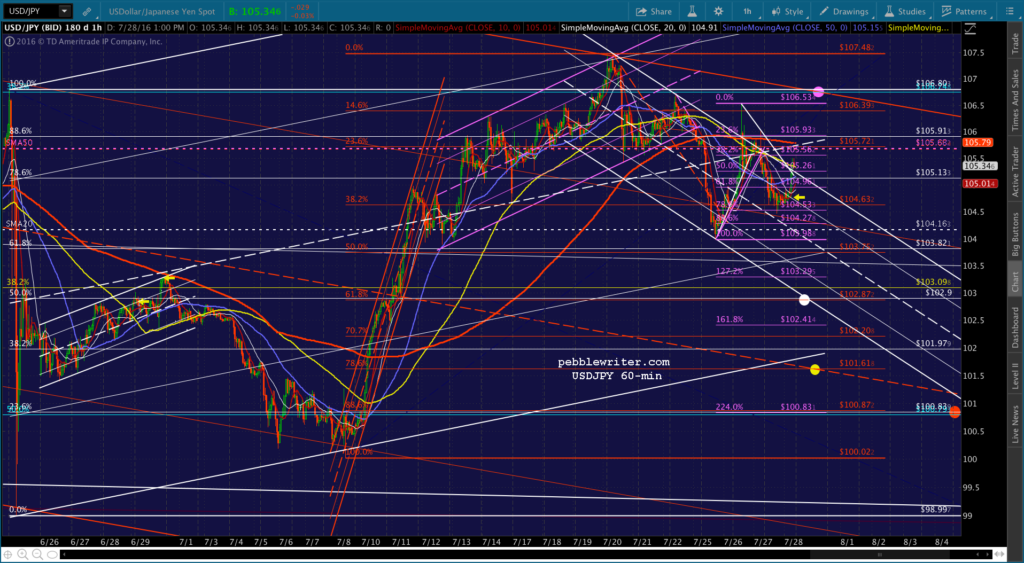

Last Thursday, with the BoJ up to bat in central banks’ favorite game of Keep Equities Afloat, I suggested that not only would they whiff the ball, there would be some fallout. With USDJPY at 105.34 and spiking higher into the US equity close, I posted this half-hearted trade advice:

If you’re a glutton for punishment and want to take a flyer on Kuroda disappointing, here’s your entry point. My gut tells me this is the right move, but of course it’s insanely risky. And, I’ve been wrong more than right today. So, do the smart thing and stay on the sidelines.

(If you intend to ignore that last remark, keep an eye on VIX and CL. FWIW, I think VIX makes a recovery here and CL heads for 40.92.)

This was my best guess at the fallout to come:

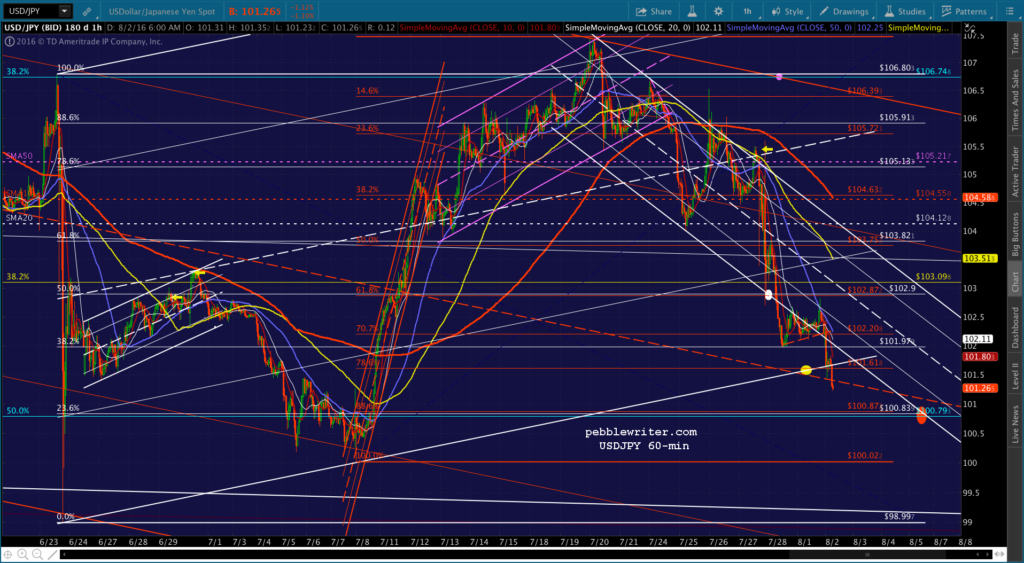

USDJPY plunged to the first target (the white dot) later that evening. This morning, five days later, we’ve been rewarded with the second target — bringing the total gains for those who shorted to 4.1% in 3 days.

USDJPY plunged to the first target (the white dot) later that evening. This morning, five days later, we’ve been rewarded with the second target — bringing the total gains for those who shorted to 4.1% in 3 days.

It’s a day late, but that’s okay. It just means the BoJ “cares.”

The delay helped stocks avoid a worse sell-off than would otherwise have been the case (so did the fact that CL spiked over 3% off its lows and VIX, which has managed to make new highs since then, was first smacked down rather forcefully.)

The delay helped stocks avoid a worse sell-off than would otherwise have been the case (so did the fact that CL spiked over 3% off its lows and VIX, which has managed to make new highs since then, was first smacked down rather forcefully.)

But, that was then. This is now.

continued for members…

Sorry, this content is for members only.Click here to get access.

Already a member? Login below… |