Back in the saddle today, but lots of catching up to do. Here’s the basic situation:

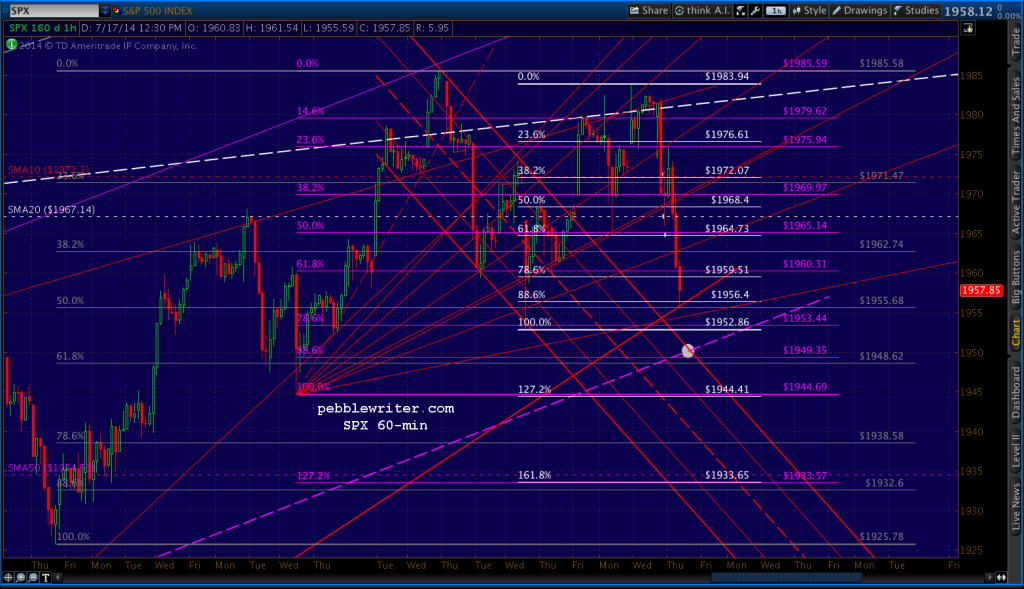

SPX fell to a TL and Fib that could legitimately serve as a bottom for this move. On the other hand, a drop to the purple .886 — also a channel midline — would be more definitive.

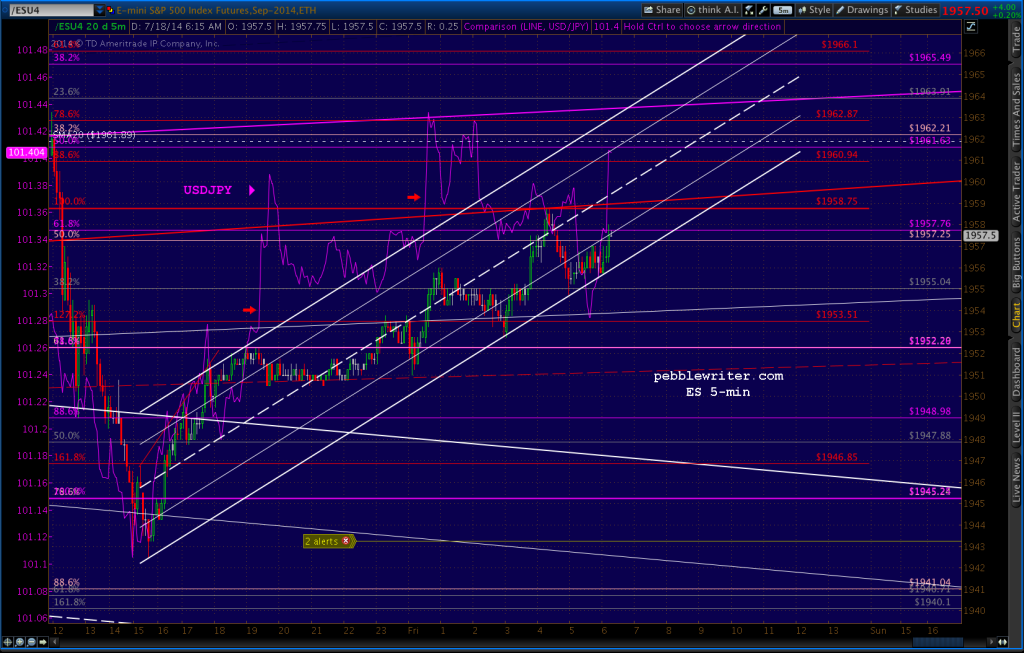

We got the usual ramp job overnight, though it started very early in the afternoon this time. It was good for a 16-pt bounce off yesterday’s bottom — completely based on USDJPY manipulation. ES has almost reached the SMA20 at 1961. SPX’s is at 1967.

The bottom, BTW, would have been more appropriate at 1940-1941 — a trio of Fib levels. But, the algos don’t much care about Fibs… If you’re a cash market trader who stayed short into the close based on the huge geopolitical events going on, you have HFT/algos to thank for screwing you over yet again. It’s a big reason for why the “market” is broken, and volume has disappeared. Write your congressman. Seriously.

No POMO today, but it is OPEX. More later if there’s time. GLTA.