We should get the follow through to Friday’s downside target today. Beyond that, it depends on how much CL and USDJPY are ramped as the “market” opens.

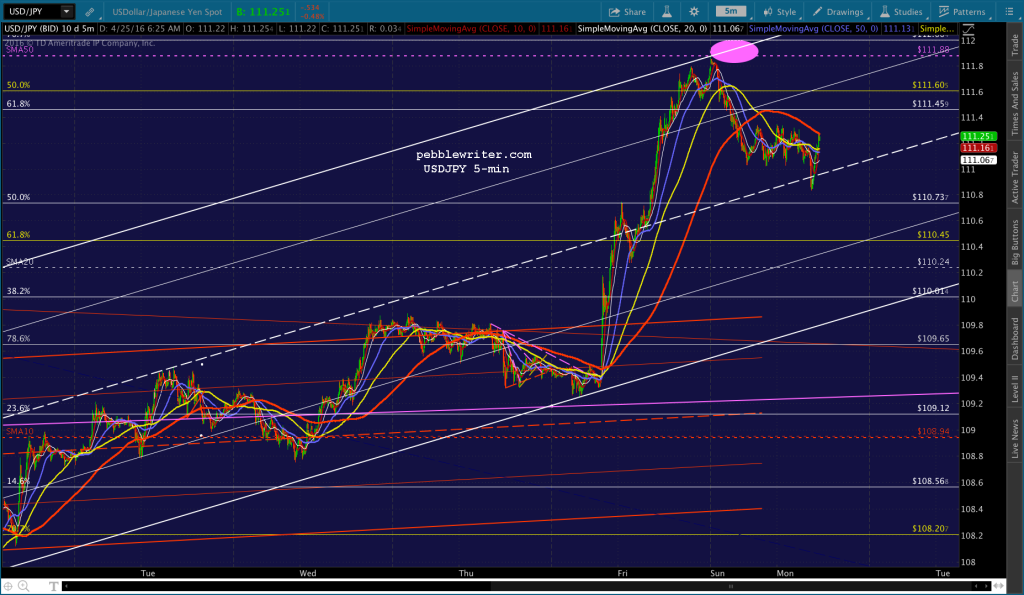

USDJPY hit our upside target on Sunday, then tested the waters on a reversal until the eminis began to sell off in earnest before rebounding to its SMA5 200. Interpretation: more downside.

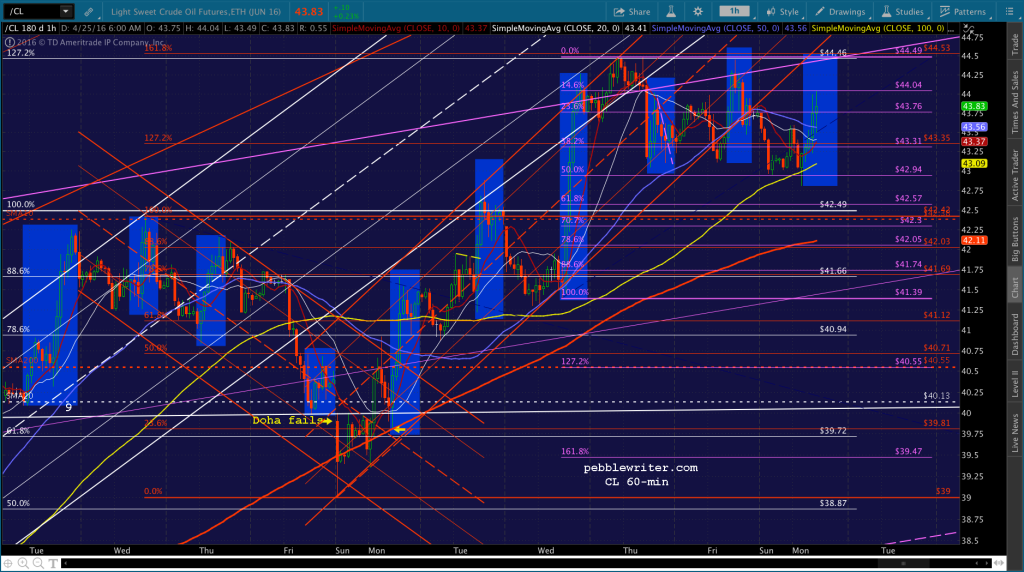

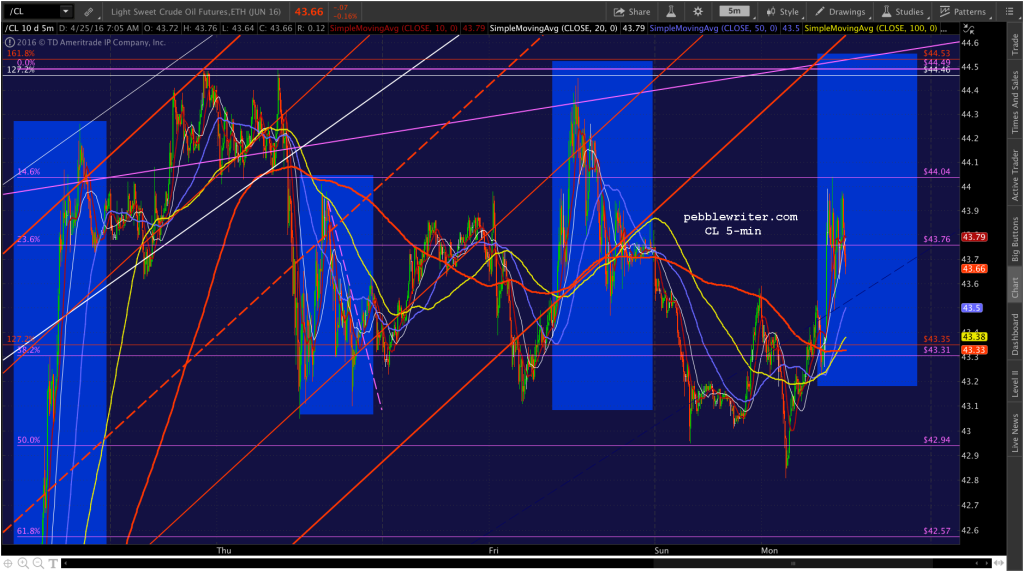

While CL continues to conveniently ramp just as the daily session opens, giving stocks a boost until, conveniently again, the “market” closes.

While CL continues to conveniently ramp just as the daily session opens, giving stocks a boost until, conveniently again, the “market” closes. The past few days illustrate how CL is being recycled to provide its timely daily boost, then reset overnight.

The past few days illustrate how CL is being recycled to provide its timely daily boost, then reset overnight.

Anyone who has read any of our many articles on BoJ intervention, or yesterday’s Bloomberg article on how the BoJ has become a top-10 owner of 90% of the Nikkei 225, should have no trouble putting two and two together. A good primer:

Bottom line: these daily CL ramps are without doubt the handiwork of the BoJ, probably in concert with other central banks. Of course, we’ll potentially get another dose of central bank reality with both the Fed and BoJ meeting this week.

continued for members...

Sorry, this content is for members only.Click here to get access.

Already a member? Login below… |